- XMR/USD corrects from fresh half-yearly highs hit on Saturday.

- Technical outlook across the time frames favor the bulls.

- Coin ditches its other crypto peers, trades in the green.

Monero (XMR), the 14th largest cryptocurrency with the current market capitalization of $ 1.68 billion and an average trading volume of $167 million, is leading the pack of top 20 widely traded cryptocurrencies this Saturday. The coin has gained almost 2% over the last 24 hours, bucking the bearish momentum seen across the crypto space. At the time of writing, XMR/USD trades near the 95.25 region, having hit the highest levels in six months at 96.78 in the last hour.

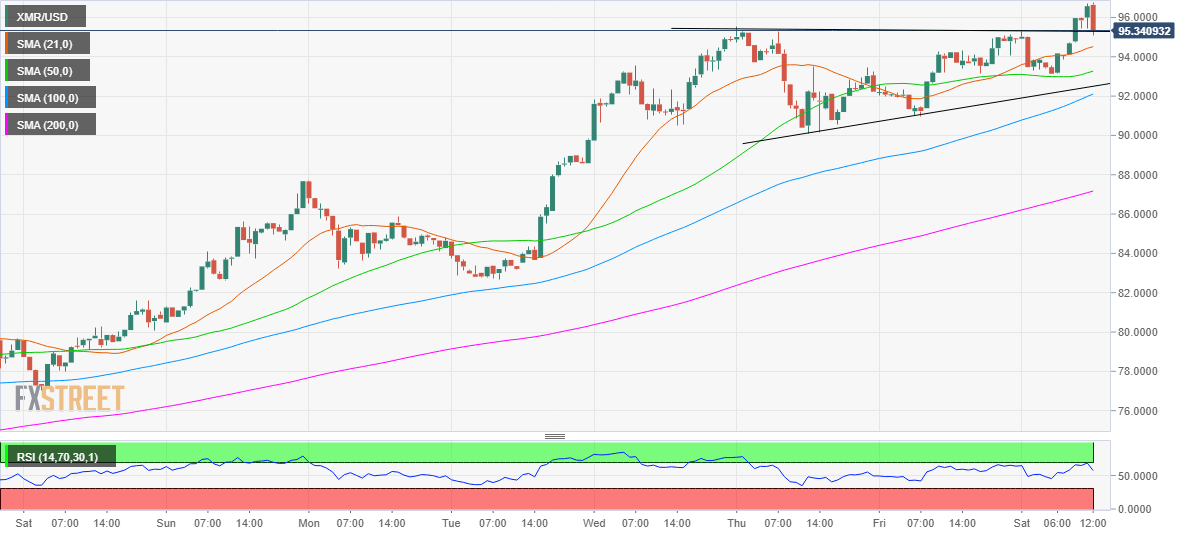

XMR/USD, 1-hour chart

- An ascending triangle breakout was confirmed earlier today, pattern target lies at 100.49.

- Hourly Relative Strength Index (RSI) takes a U-turn for just beneath the overbought territory, looking to test the mid-line at 50.0.

- Correction from multi-month tops likely to extend in the near-term.

- Bullish 21-HMA offers immediate support at 94.50 while the next support awaits at 50-HMA of 93.25.

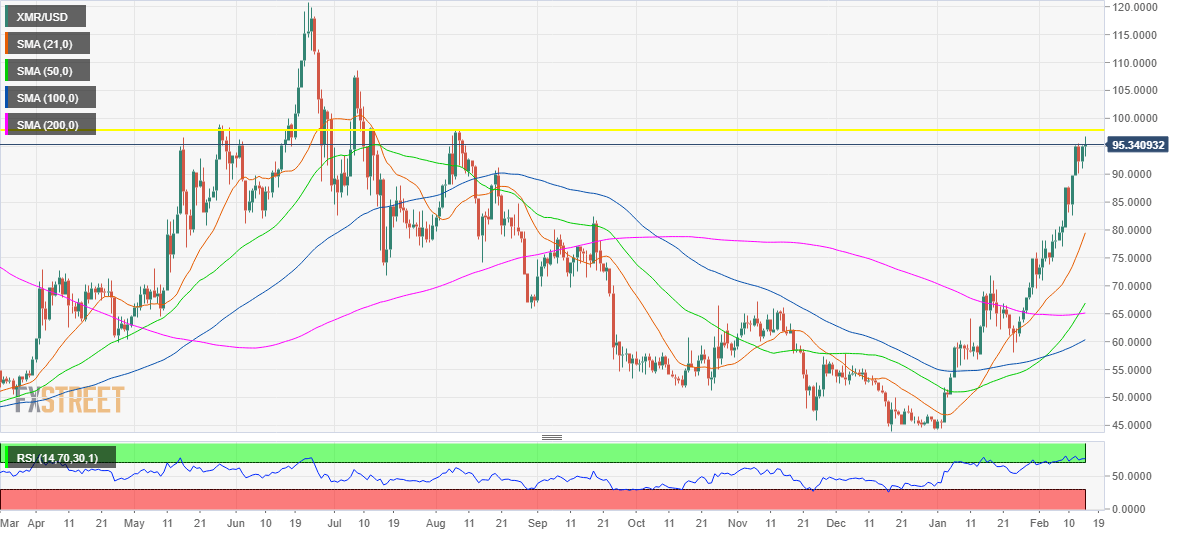

XMR/USD, daily chart

- No. 14 coin portrays a potential rounding bottom formation.

- A break above 97.91 needed to validate the pattern, with the target seen at 151.83 over the next six months.

- The spot trades above all the key Daily Simple Moving Averages (DMA).

- Daily Relative Strength Index (RSI) consolidates in the overbought territory, with further room for upside.

- All in all, any corrective downside in a bargain-buying opportunity for the XMR bulls.

XMR/USD technical levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?