Bitcoin’s price is starting to stabilize after a near-4% drop over the past week. The cryptocurrency was trading around $57,000 at press time and could go higher, initially toward $60,000-$63,000, according to technical indicators.

Analysts expect trading volumes to decline this week given the U.S. Thanksgiving holiday on Thursday. “The last three years we’ve had downward volatility every time around this holiday; could be due to end of month rotations, options/futures expiries and rebalancing,” CryptoQuant wrote in a blog post.

Bitcoin is up about 3% over the past 24 hours, compared with an 8% rise in ether. Alternative cryptocurrencies are gaining ground relative to bitcoin, suggesting that traders are taking on more risk as the recent sell-off stabilizes.

Latest prices

Bitcoin (BTC): $57,854, +3.83%.

Ether (ETH): $4,382, +8.32%.

S&P 500: $4,690, +0.17%.

Gold: $1,791, -0.99%.

10-year Treasury yield closed at 1.68%.

Increased market fear

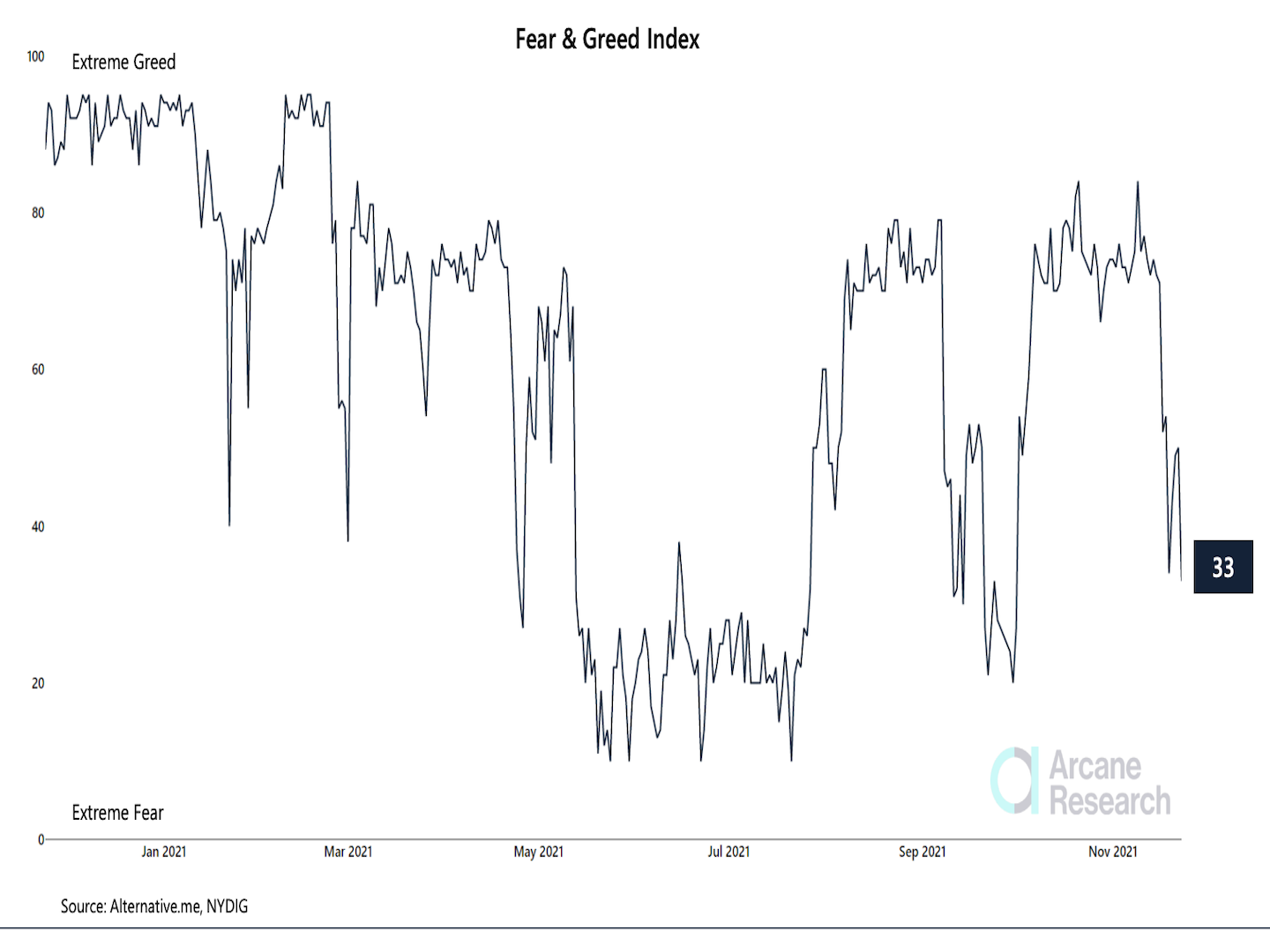

The bitcoin Fear & Greed index is at the lowest level since late September, which preceded a BTC price recovery. The index suggests market participants are in “fear” mode, which some analysts view as a contrarian signal as buyers gradually return to the market.

“Typically in bull markets, the index indicates ‘greed’ or ‘extreme greed’ for more extended periods with short periodical visits to the ‘fear’ area, just like we saw this spring,” Arcane Research wrote in a Tuesday report.

Bitcoin Fear & Greed Index (Arcane Research)

Bitcoin versus the dollar

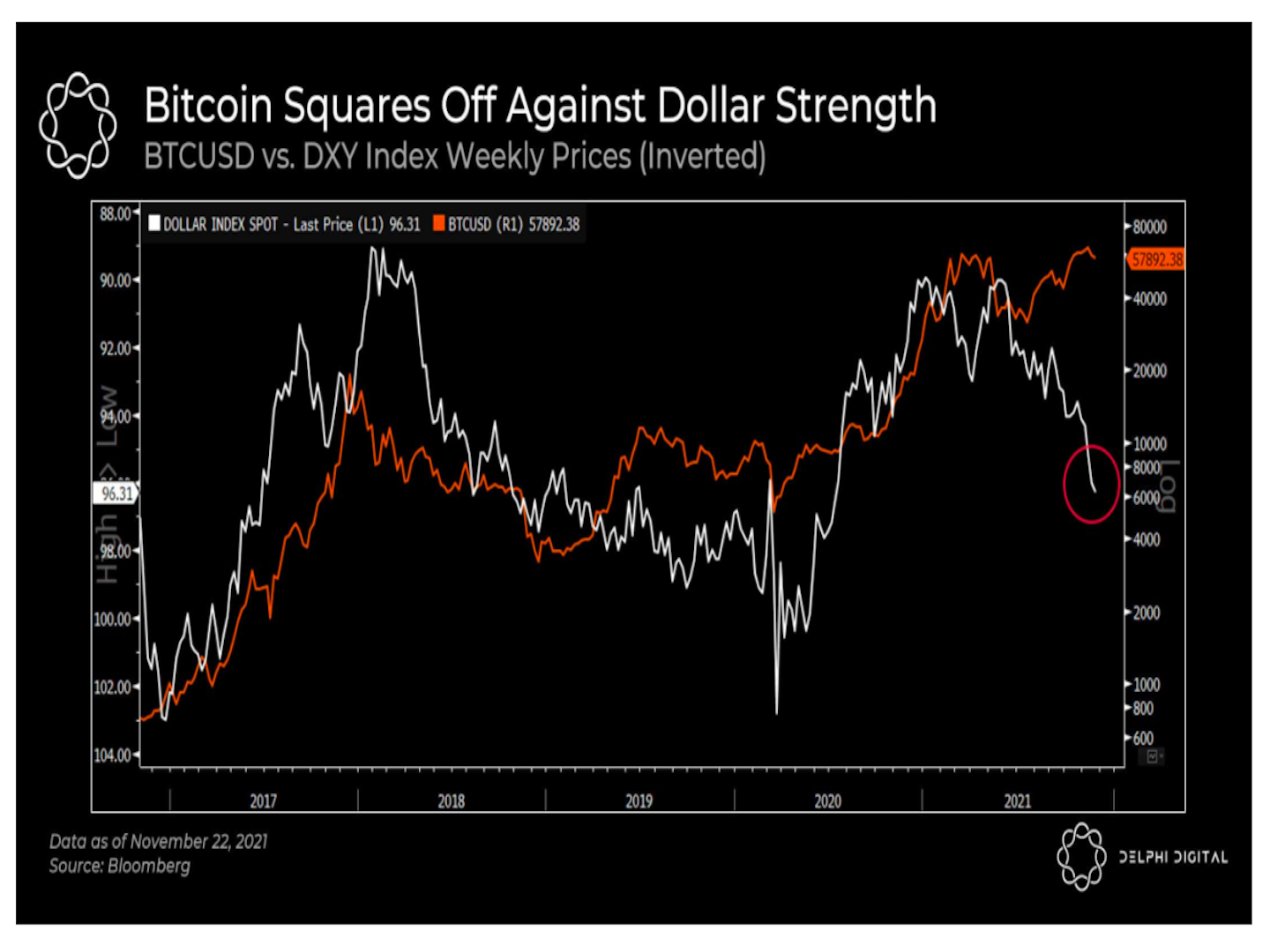

On the flip side, a rising U.S. dollar could be a headwind for bitcoin. The U.S. dollar has strengthened over the past few weeks as investors anticipate tighter monetary policy.

“We’ve seen a considerable run-up in the dollar alongside Fed funds rate futures, which now imply 100% chance of two rate hikes by end of 2022 and a nearly 40% chance of a third rate hike by next December,” Delphi Digital, a crypto research firm, wrote in a report Tuesday.

The chart below shows the recent rise in the dollar (inverted scale), which could signal further downside in bitcoin’s price. Generally, tighter monetary policy is negative for risk assets including stocks and cryptocurrencies.

Bitcoin vs. dollar (Delphi Digital)

Altcoin roundup

Crypto options traders turn to DeFi for altcoin bets: The Singapore-based firm QCP Capital now trades more than $1 billion of crypto options per month using decentralized financial applications, including $1 million worth of AAVE options recently with Ribbon Finance, CoinDesk’s Omkar Godbole reported.

Binance rebuilding DOGE wallet to deal with user account freeze: Users previously told CoinDesk their accounts were frozen by the exchange until they returned the DOGE, which was incorrectly transferred, back to the exchange. The incident led to Elon Musk starting a Twitter war with the exchange.

NFT marketplace Rarible launches messaging feature: The non-fungible token (NFT) marketplace Rarible.com has launched a direct messaging function that allows users and creators to communicate using crypto wallet addresses rather than social network usernames, CoinDesk’s Brandy Betz reported.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?