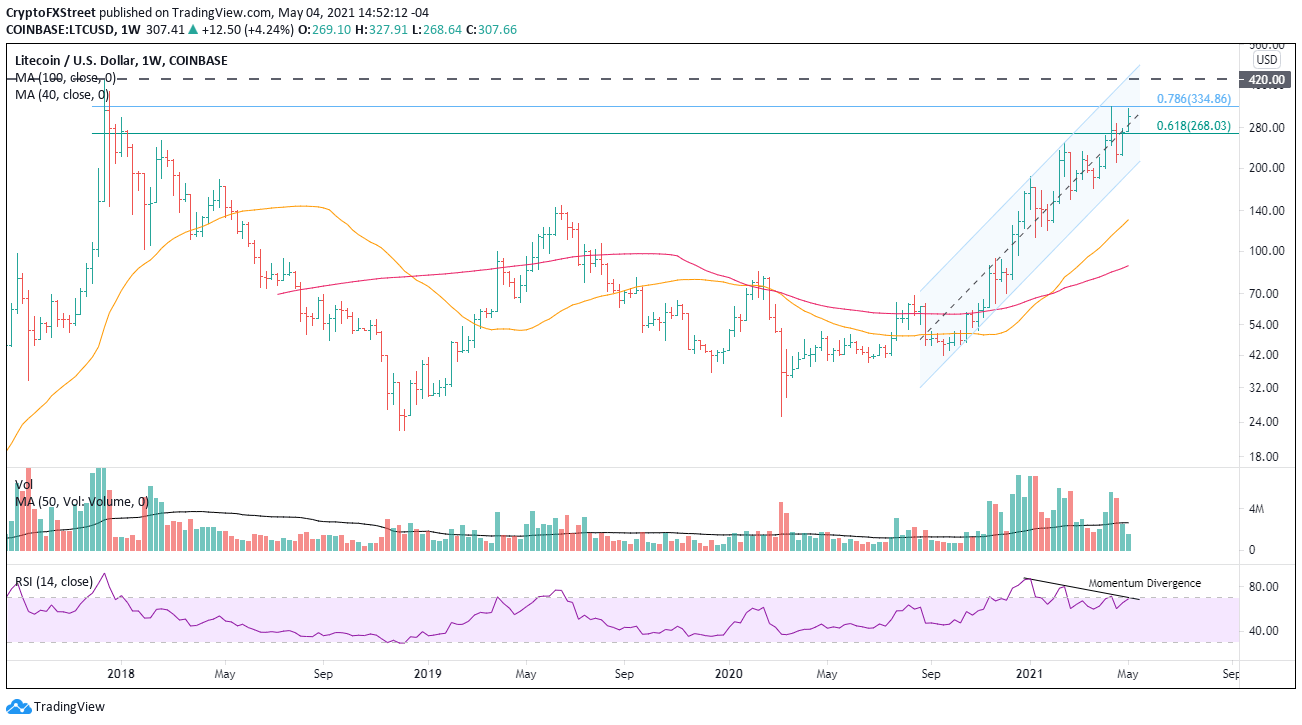

- Litecoin price stalls again at the 78.6% Fibonacci retracement of the 2017-2018 bear market.

- Ascending Channel governing Litecoin price action since the fall of 2020.

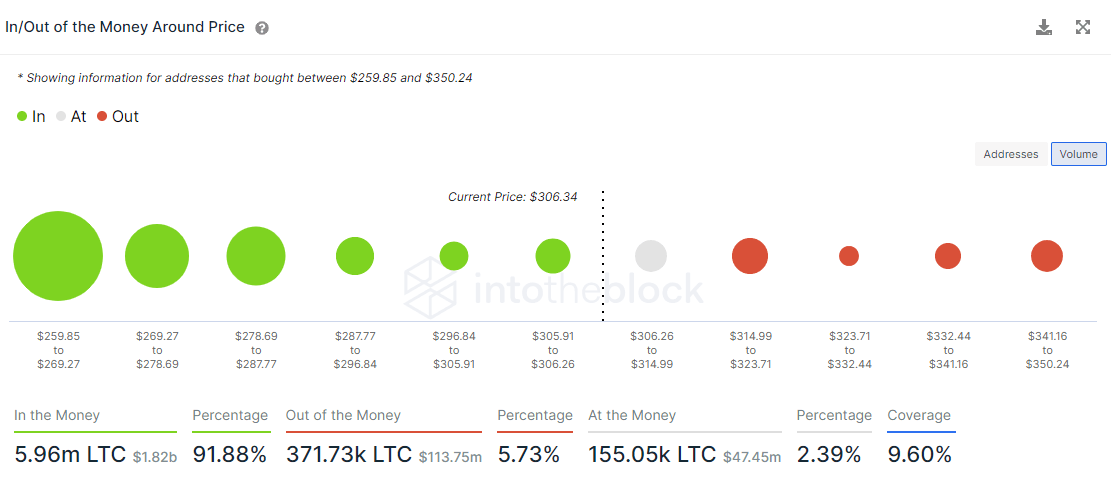

- IOMAP data displays minimal resistance until $350.00.

Litecoin price failure today at the critical Fibonacci level is the second time since mid-April and lowers the odds that LTC can overcome the resistance and launch a substantive test of the all-time high at $420.00.

Litecoin price in need of a dominant catalyst

The IntoTheBlock In/Out of the Money Around Price (IOMAP) data shows almost no resistance from the current Litecoin price until $350.24, which is slightly beyond the 78.6% retracement level mentioned above.

Likewise, Litecoin shows limited support until a cluster between $259.85 to $269.27. A total of 103.49k addresses bought 3.39 million LTC at an average price of $265.07, which is slightly below the 61.8% retracement of the 2017-2018 bear market at $268.03.

LTC IOMAP data

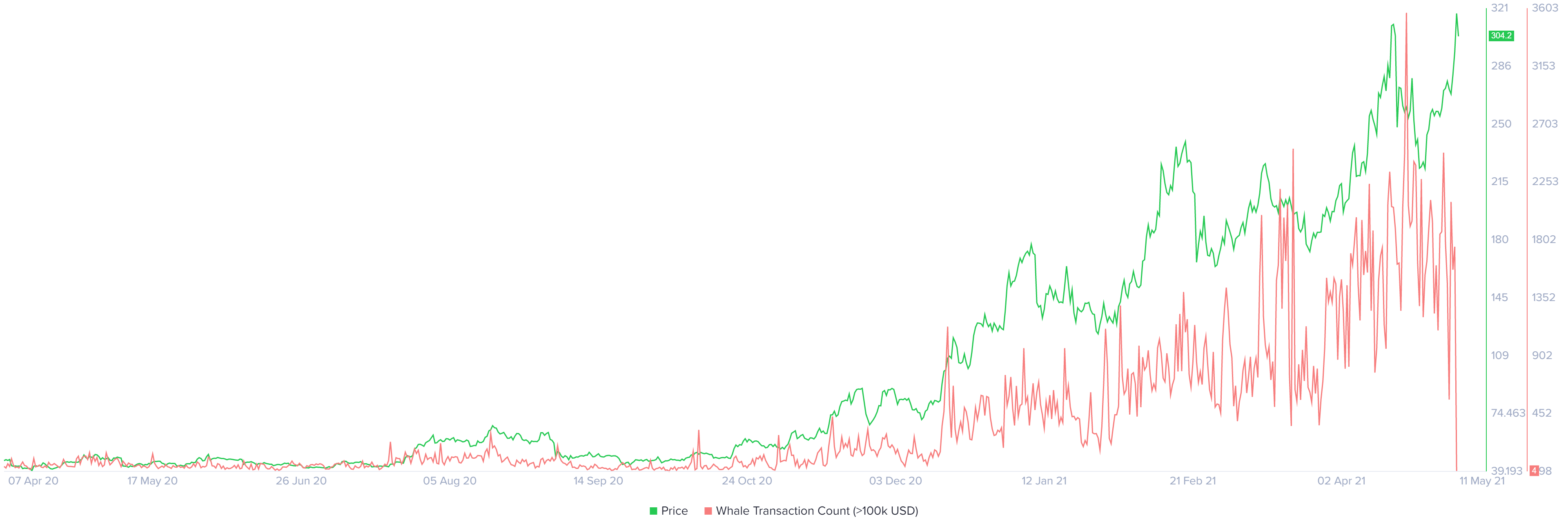

On the other hand, the whale transaction count has fallen from the peak of 2.501 to 4 as of yesterday. The reading is similar to what preceded the long rally that began in October 2020.

The minimum level of whales (transaction count > 100k USD) points to a new source of buying power moving forward if Litecoin price can get off the mat.

LTC Whale Transaction Count (>100K USD)

The on-chain metrics offer a positive outlook for Litecoin price, but the resilience of the 78.6% retracement at $334.86 is a significant obstacle to overcome before the all-time high at $420.00.

A failure to hold the 61.8% retracement at $268.03 will assure a test of the 10-week SMA at $ 231.47 and potentially project a decline to the channel’s lower trend line at $189.65.

Adding to the bearish outlook is the negative momentum divergence between the weekly RSI and price since the mid-February high. If a new rally high is printed, it needs to be confirmed by the momentum index.

LTC/USD weekly chart

Only a weekly close above 78.6% retracement level will encourage a re-evaluation of the bearish outlook and boost the probability of a successful breakout into new highs in the coming days or weeks.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?