- LTC/USD needs to recover above $70.00 to resume the recovery.

- The strong short-term support is created on approach to $68.50.

Litecoin has resumed the decline and reached an intraday low at $68.41. The fifth-largest digital asset with the current market value of $4.3 has been losing ground both on a day-on-day basis and since the beginning of the day. At the time of writing, LTC/USD is changing hands at $68.92, down 2.5% in recent 24 hours.

Litecoin’s technical picture

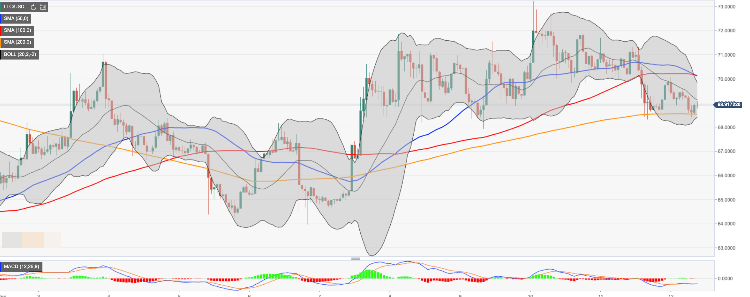

A sustainable move below $70.00 has darkened the technical picture. The next critical support is created by the lower line of one-hour Bollinger Band and SMA200 (Simple Moving Average) and the middle line of one-day Bollinger Band on approach to $68.50. If it is cleared the sell-off may be extended towards psychological $68.00 closely followed by SMA100 four-hour. The next support awaits LTC on approach to $64.66 (the lowest level since September 7).

On the upside, we will need to see a recovery above $70.00 to improve the technical picture and get Litecoin back on the recovery track. However, this area is strengthened by SMA100 and SMA50 on the one-hour chart. Once it is out of the way, the upside is likely to gain traction with the next focus on $72.00 (the upper line of four-hour Bollinger Band) and $72.70 (SMA200 four-hour).

LTC/USD, one-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle (PENDLE) price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Ethereum shows signs of a potential rally as suspected Justin Sun wallet buys heavily

Ethereum's (ETH) recent price movement hints at a potential rally despite ETH ETPs recording outflows. The recent price improvement follows the fourth Bitcoin halving and a suspected Justin Sun wallet purchasing large numbers of ETH.

Floki poised for growth after listing on Revolut

Floki's (FLOKI) team announced in an X post on Monday that the meme coin would be listed on the popular neobank and Fintech platform Revolut. Floki could rise further following key partnerships to boost retail usage.

Jupiter DEX second Launchpad vote concludes, JUP price rises 5%

Jupiter, a Solana-based decentralized exchange (DEX) has completed the second launchpad (LFG) vote to identify the two projects that will debut on its platform. On March 30, the aggregator network had unveiled its Core Working Group (CWG) budget proposal voting.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?