- Parking garage owners can now digitize their asset and monetize it using the Trive.Park app.

- IOTA has been deemed the best fit because it can process microtransactions with virtually no fee.

- IOT/USD responded by going up from $0.24 to $0.261 this Thursday.

To facilitate easy booking and payment of parking spaces, German company Trive.Me has launched a new app Trive.Park. Motorists can now book and reserve parking spaces in advance. According to an EDAG Engineering report, users will have to pay for parking space and communicate with the garage over the Tangle, making the whole transaction quick. Through an online reservation system, the Trive. Park app will allow parking garage owners to digitize and monetize their asset.

Alexander Süssemilch, Trive's Head of Product, thinks that IOTA is the best fit for the platform because the network can process the required microtransactions with virtually no fee. The firm stated that technology like IOTA can significantly disrupt the mobility industry, allowing users to experience a new level of efficiency for a lesser cost.

IOTA is headed towards eliminating their centralized validator node. This is a big step towards their vision of decentralized micropayments. However, network security can be comprised if the move is not executed at the right time.

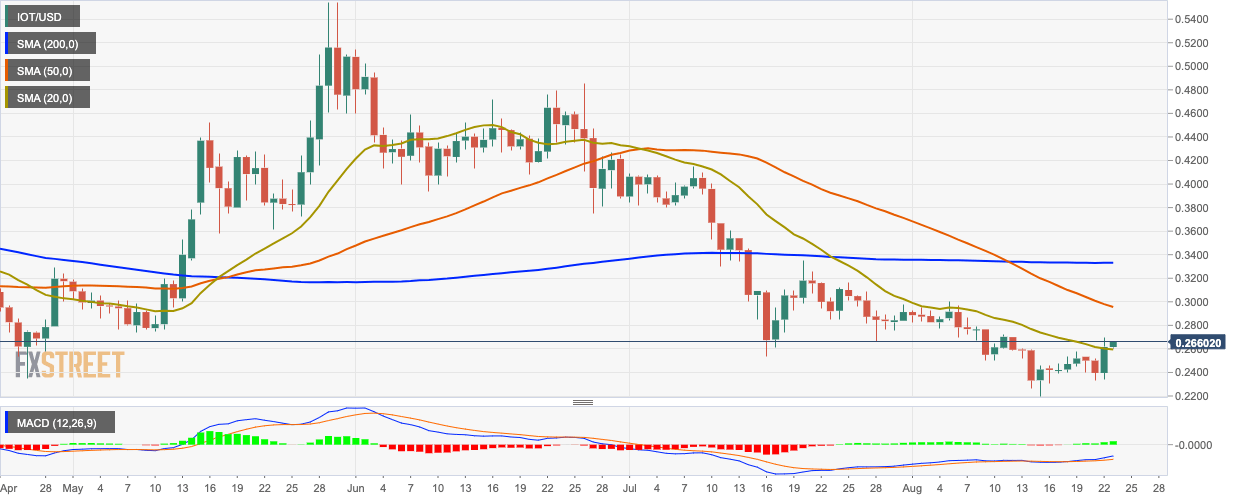

IOT/USD daily chart

IOT/USD flew up on the back of this news and went up from $0.24 to $0.261 this Thursday. The bullish momentum continued this Friday and went up further to $0.266. The price broke past resistance offered by the 20-day simple moving average (SMA 20) and is trending below the SMA 200 and SMA 50 curves. The moving average convergence/divergence (MACD) indicator shows increasing bullish momentum.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?