- The losses mostly driven by Bitcoin saw IOTA trim gains towards last week’s major support at $0.22.

- IOTA’s recovery follows in the footsteps of the defiant Ethereum Classic’s 12% surge.

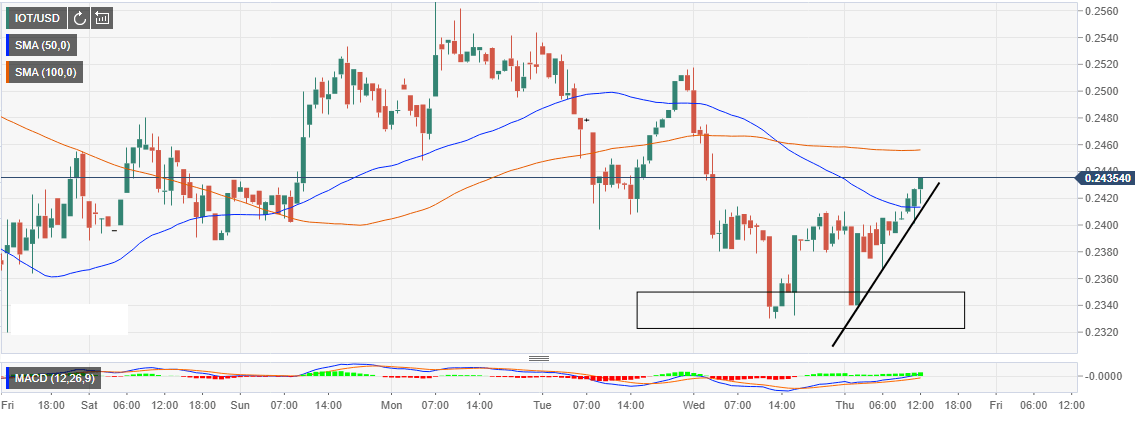

IOTA price is back in the green alongside several other cryptocurrencies. The grandparent cryptocurrencies Bitcoin is still nursing wounds after the bear’s mauling. $0.2325 - $0.2350 is coming up as an incredible support area. The losses mostly driven by Bitcoin saw IOTA trim gains towards last week’s major support at $0.22.

However, a low was formed at $0.2330 on Wednesday allowing the bulls to regain control. The rebound from this level initially stepped above $0.24 before extending the price action above the 50 Simple Moving Average 1-hour.

Read also: Cryptocurrency market update: Bitcoin real market dominance is 90% leaving altcoins with a mere 10%

At the time of writing, IOTA market value stands at $0.2428. The buyers intend to push the 1.32% gains higher on Thursday. Glancing ahead, $0.24 is the immediate hurdle. If IOTA manages to clear the resistance at this level, we are likely to witness a surge above the 100 SMA currently at $0.2456 towards the supply zone at $0.2520.

IOTA is following in the footsteps of the defiant Ethereum Classic. ETC continues to shake the ground in the market with gains over 12% on the day. After breaking the barrier at $6.4, the bulls are throwing jabs at $7.0 hurdle. The crypto’s technicals are still positive as discussed in this price analysis.

MIOTA/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Google, Apple could remove Binance from their app store on Philippines SEC request

The Philippines SEC has requested Google and Apple to remove applications controlled by Binance from their App stores. The exchange’s Philippines-based users are finding the exchange inaccessible to remove their funds.

XRP rallies as Ripple slams SEC for penalties, asks regulator to establish likelihood of future violations

Ripple filed its response to the SEC lawsuit on Monday, arguing that XRP institutional sales before and after the court ruling show no disregard for the law. The firm asks for a civil penalty of no more than $10 million against the $2 billion requested by the SEC.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?