The BTCUSD longs were sold well before the $20,000 peak was hit last year on a trend line break. See here. However, there was a number of questions about BTCUSD. Some people have bought in at very low prices and are deep in profit. That sounds great, but strangely it can be quite stressful to know what to do with a trade deep in profit. Furthermore, when markets behave like BTCUSD you can see large profits evaporate nearly as quickly as they appear. So having a plan is important. This article will give you some ideas how to manage you profit.

Techniques for managing your profit

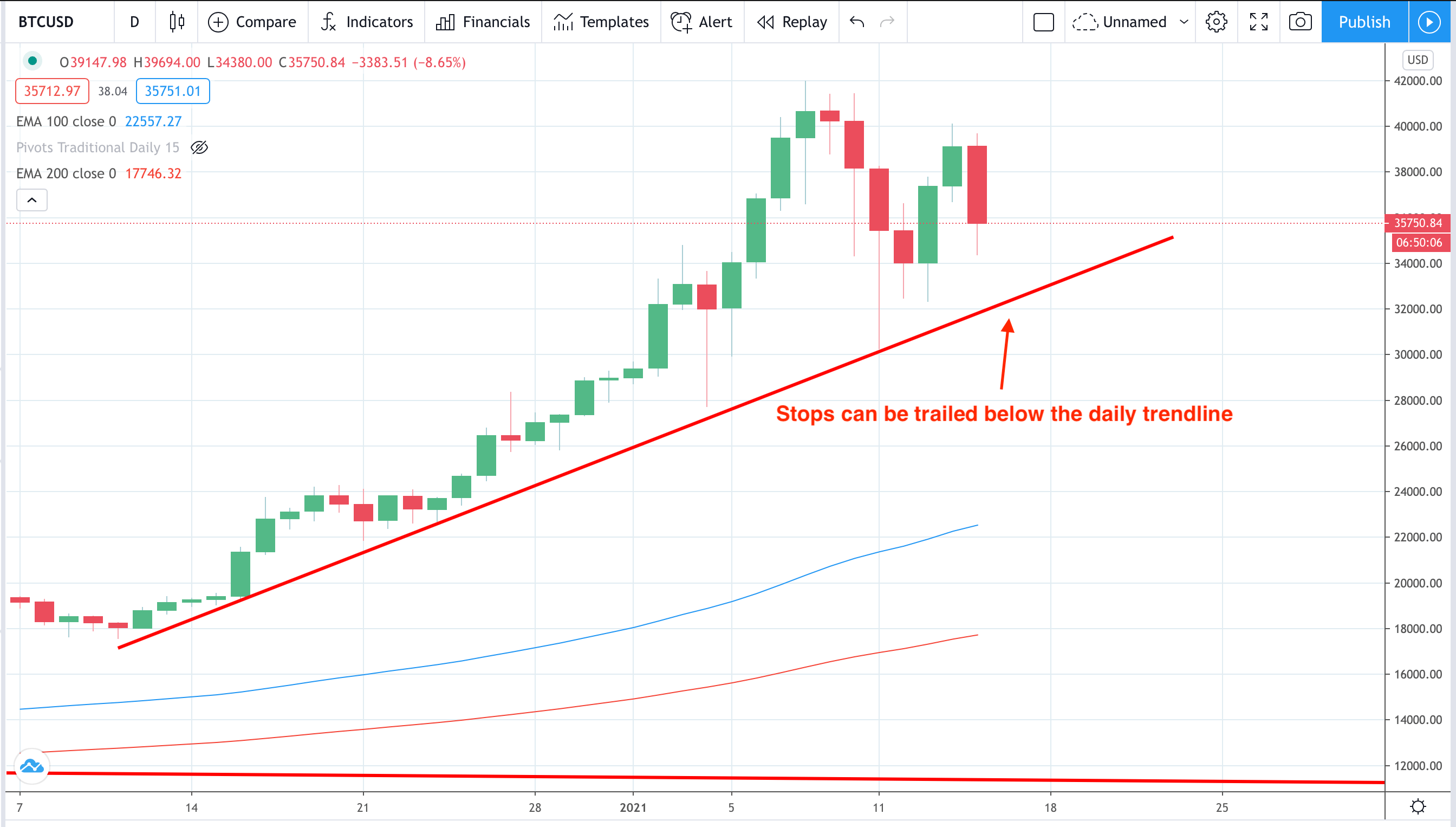

1. Trail your stop beneath the daily chart trend line

Take a look at the chart below. You will see the daily trend line.

This is an obvious technical place to trail your stops.

Advantages: If the trend carries on you are in and stops can be trailed to reflect higher prices.

Disadvantages: The stop beneath the trend line is around $30,000 which is considerably below current prices.

2. Take profit now

This would have been a great trade and you need to book those large profits when they come.

Advantages: Remember that markets don’t double every day of the week, so take those gains.

Disadvantages: If price rallies to $100,000 you may wish you had held on. However, you could argue there is more to lose by holding than there is to gain by closing the trade.

3. Take profit at retest of recent highs

Advantages: This seems a good compromise and a decent level.

Disadvantages: If BTCUSD is a new digital currency then get in early. That won’t help you if you have closed your positions. The other disadvantage is if price does not go back to recent highs.

4. Trail stops underneath weekly lows

Advantages: You will be in for a large price shift higher if it comes.

Disadvantages: You will get taken out on the eventual pullback whenever it does come.

Whatever you do it is best to commit to one approach. Also realise there is no perfect answer to the question on when to take profits, as no-one has a crystal ball to see future prices. So, if you do take a profit that turns out to be too early, don’t be hard on yourself. Picking tops and bottoms is often more about chance than skill.

Also remember if you are in the UK that once you close your position you will be unable to open it again due the FCA regulation change. So, think carefully.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.