- Grayscale manages $1.5 billion in digital assets for its clients, $1.38 billion of that is in BTC while $90 million is in ETC.

- The 23.6% Fib level support has to hold but if it gives in, ETC/USD will still be in danger of retesting $14.20 support.

Grayscale Investments is a company that manages cryptocurrency investments on behalf of its clients. It gives investors a way to enter the cryptocurrency space and particularly digital assets investments. The website explains:

“At Grayscale, we believe investors deserve an established, trusted, and accountable partner that can help them navigate digital currency investing. That’s why we are building transparent, familiar investment products that facilitate access to this burgeoning asset class, and provide the springboard to investing in the new digital currency-powered internet of money.”

The investments company said in a recent report that it currently holds at least $90 million investment in Ethereum Classic; the 13th largest crypto with a market capitalization of $1.5 billion according to CoinMarketCap. The firm currently manages at $1.5 billion, all in digital assets for its clients. At least $1.38 of the total holdings is in Bitcoin (BTC).

Ethereum Classic price analysis

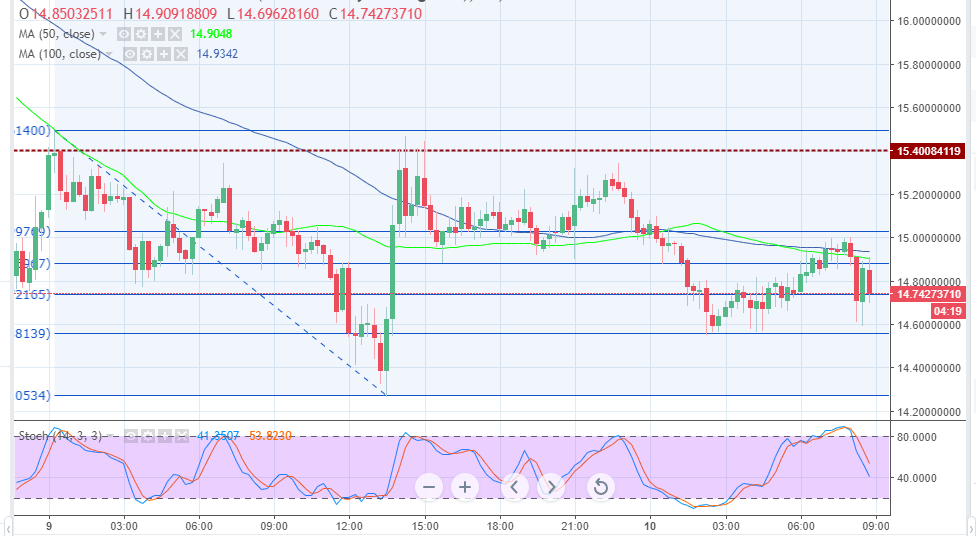

Ethereum Classic corrected higher at the beginning of the week due to the hype surrounding the listing on Coinbase Pro and Coinbase Prime. However, the widespread selloff in the market did not spare the digital asset. It plunged from trading highs above $20.00 only to find a support at $14.20. On Thursday, a slight recovery gave it a boost from the pits but the upside remained capped at $15.40 as indicated on the chart.

Fresh subtle declines continued on Friday morning (Asian trading hours) but the support at the 23.6% Fib level taken between the highs of $15.49 and lows $14.81 at $14.56 prevented further declines. The price bounced back up from the support but has been unable to clear the $15.00 resistance. At the time of press, the trend is highly bearish with the stochastic making advances south. Moreover, the short-term 50 SMA has crossed below the longer-term 100 SMA to show that the sellers are regaining control. The above 23.6% Fib level support has to hold but if it gives in ETC/USD is in danger of retesting $14.20 support and slide below $14.00. On the upside, the price must find support above $15.00 before it can comfortably attack $15.40 again.

ETC/USD 15-minutes chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?