Overview

Futures has been one of the essential parts of the cryptocurrency trading since the rising of the crypto derivatives, yet, futures trading strategy seems like one of the under-discussed areas. With the increasing product selection in the market, traders of all levels could take advantage of these proven ways from the traditional FX/equities/commodities markets to balance their risks and rewards of their crypto portfolio.

With about 23000 BTC equivalent futures and 10000 BTC options are set to expire this Friday on CME, the market may experience short-term turbulence, and perhaps it’s a good time to review some of these strategies.

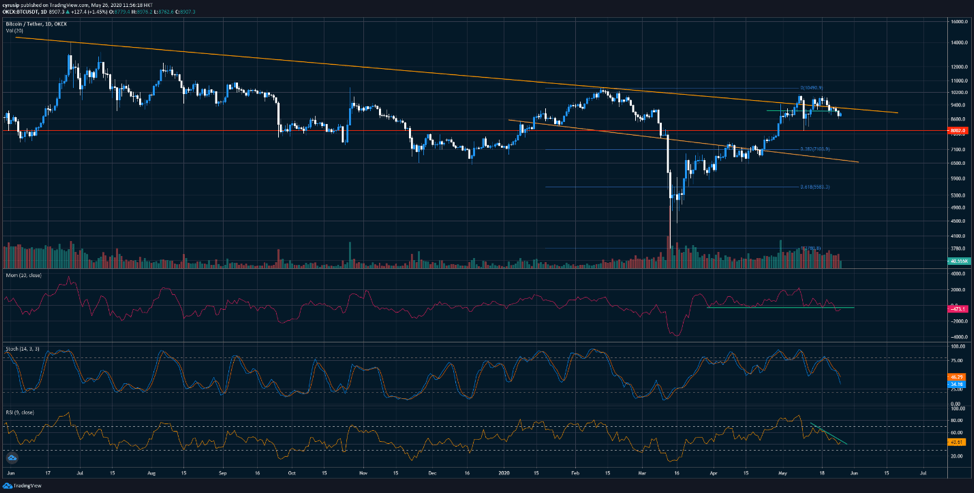

BTC’s unfruitful price actions

BTC has been mostly in sideways trading between 8700 to 8900 after failing to secure the 10000 levels earlier this month. Although the medium/long-term outlook of the leading crypto remained mostly positive after halving is delivered, OKEx Technicals believes that BTC prices may need to reconfirm the lower support in the area of 8000 to 8200 before starting a new trend.

Source: OKEx; Tradingview

Given the current market conditions that could be challenging for some traders, a future spread strategy may help traders strike a balance between risks and rewards.

What’s a futures spread strategy?

Futures spread involves buying a futures contract and selling another one at the same time. Generally, the spread acts as a hedge against price fluctuation, and profit from the changes in the price difference between two positions. Spread trades can be performed within the same market or cross markets. However, traders may want to look at related contracts for setting up spread trades because the closer relationship between the two contracts, the more synchronization they will be, and will usually lower the risk exposure.

Gold-platinum spread as an example.

Futures spreads have been widely adopted by commodities traders. For example, gold-platinum spread trade could be a hedge against macro uncertainties. That’s because the primary usage for platinum is for industrial purposes; its price usually benefits from rapid economic growth. On the other hand, gold is more like a safe-haven asset, and its price often benefits from economic uncertainties. So, an effective gold-platinum spread strategy could be an ideal set up for commodities traders.

That’s just one of the many examples of spread trades. The same strategy could be applied to other metal markets, FX, treasury, and equities markets. The same approach may also apply to bitcoin futures trading.

Current market conditions may favor BTC spread strategies

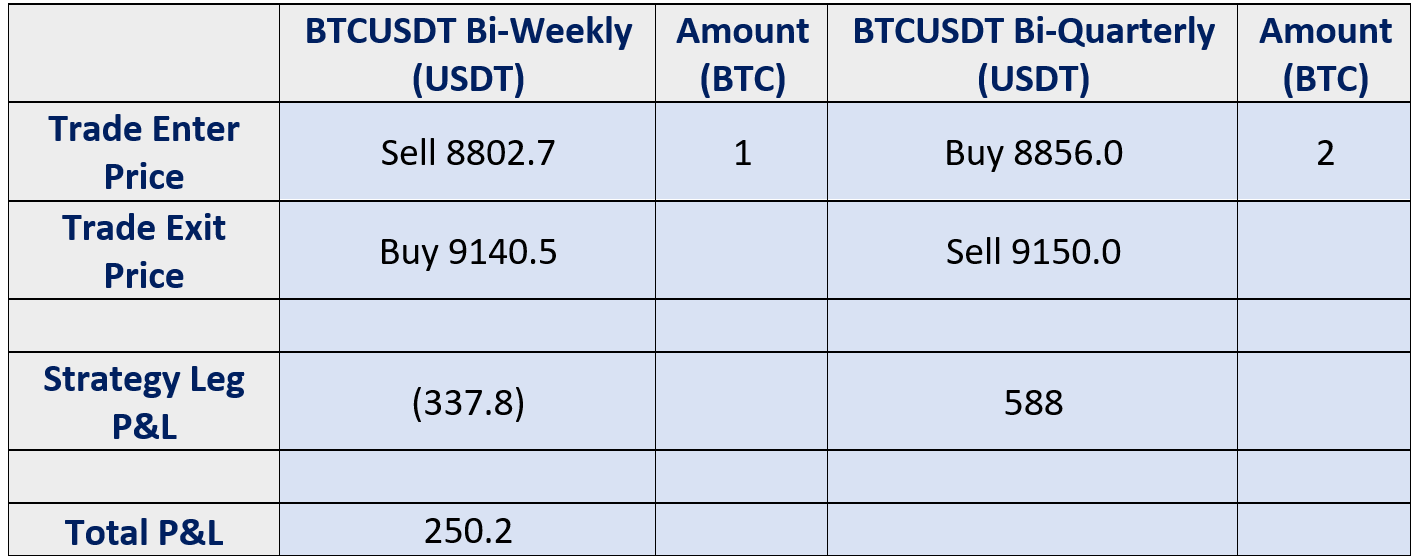

In the early part of this article, we explained the unproductiveness of recent BTC prices; however, the major narrative of the long-term outlook for BTC remains largely positive after the last halving. If a trader was long-term bullish on BTC while uncertain about the short-term volatility, he might consider selling a shorter-term contract while buying a longer-term contract. Below could be one of the examples of buying BTC futures on May 1 and close the positions on May 14. This period covers the halving event, as well as the mid-May selloff.

Source: OKEx

Bitcoin-Altcoin spread

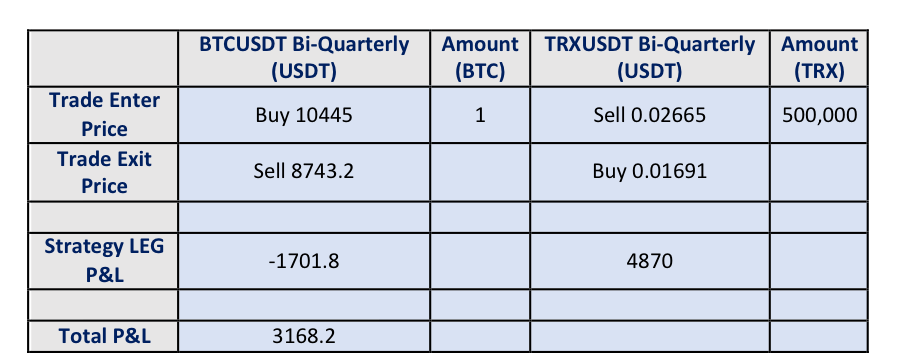

The idea of a bitcoin-altcoin spread strategy also borrows from commodity futures trading. If a trader is more bullish on corn prices than coffee bean prices, he could buy corn futures and sell coffee bean futures at the same time.

Again, if a trader is bullish on BTC and bearish on a specific altcoin, e.g., XRP, he may maximize the opportunities by buying in a BTC futures and selling XRP futures at the same time.

In mid-Feb to mid-Mar, major altcoins have experienced some significant price corrections, while BTC prices have been relatively stable. Below could be an example of a bitcoin-altcoin spread strategy between Feb 15 and closing the positions on Mar 1.

Source: OKEx

Limitations

Given spread strategies were widely used by traders in the traditional world of finance, these strategies could have more limitations on crypto assets. That is because the correlation between bitcoin and altcoins is comparatively high after all, the diversification effect may not be as obvious as other asset classes. For that, crypto traders may have to be very careful when it comes to determining their investment timeframe.

Additionally, some of the crypto assets' volatility could be unstable, and that could be another point that crypto futures traders should carefully consider.

Conclusion

The crypto derivatives markets are expected to continue its robust growth this year, thanks to the growing institutional interest. With more products in the pipeline, traders and investors could use all these instruments to construct strategies that are more suitable for their investment style. OKEx offers a wide range of futures contracts and perpetual swaps with different selections of underlying crypto assets.

This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?