The 1-hour chart shows that there is still room for growth.

Ethereum must step above $150 and focus on $160 for a sustainable recoil to higher levels.

ETH/USD embarked on another upside move above $130 following the declines on Monday. A high was formed around $139 on Tuesday. While the bullish momentum seems to be losing steam short of $140, the 1-hour chart shows that there is still room for growth. However, traders must wait for a confirmation that is likely to be signaled by ETH/USD breaking above $140.

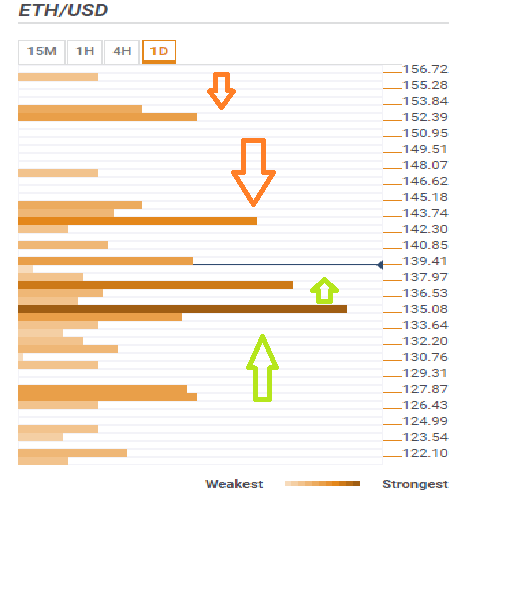

ETH/USD daily Confluence Detector levels

The first support is seen slightly below Ethereum’s current market value at $139.74 and extends to the level at $135.08. If this level caves in, then we expect ETH/USD support to reach the level highlighted by $126.31. The confluence of indicators at these levels include:

100 SMA 1-hour

Previous low 1-hour

Bollinger Band Middle curve 15-minutes

5 SMA 1-hour

Previous low 4-hour

200 SMA 1-hour

50 SMA 4-hour

Bollinger Band 1-hour Lower curve

200 SMA 4-hour

Previous week low

61.8% Fib retracement 1-minute

Marginally above the current price, the bulls will come face to face with the resistance at $140.85 highlighted by the Bollinger Band 4-hour upper and the 100 SMA 4-hour confluence of indicators. Once this level is cleared, expect the upside to remained without significant barriers until the price hits $143.74; resistance shown by the 38.2% Fib retracement 1-minute chart, the Pivot point 1-day R1 and the 38.2% Fib level 1-week chart confluence of indicators.

Further movement to the north will be marked by a correction above $150 and the critical resistance at $152.39; the 23.6% Fib retracement level on the 1-minute chart. Essentially Ethereum must step above $150 and focus on $160 for a sustainable recoil to higher levels.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?