- Vitalik reckons that scalability and simplicity are key to the development of new technology.

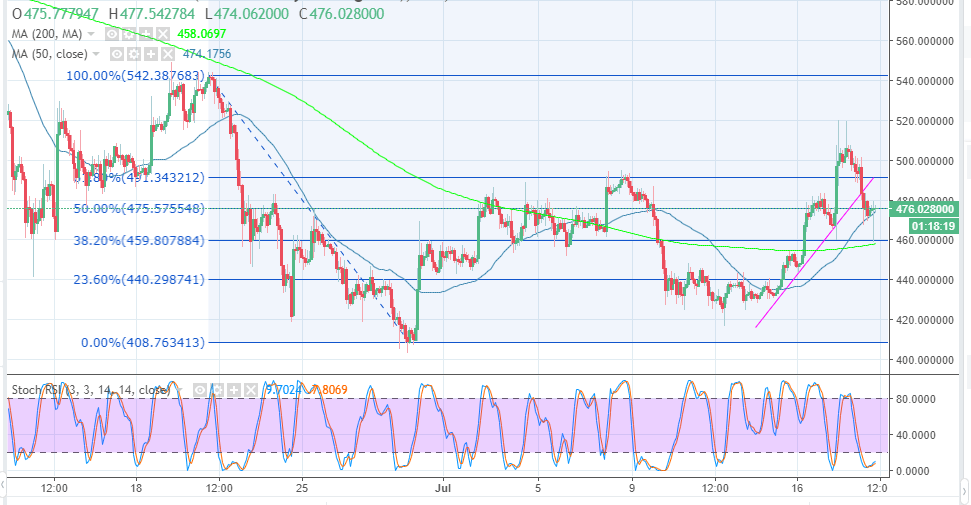

- Ethereum price is supported by the 50 SMA while immediate resistance is limiting recoil at $480.

Ethereum tested the waters upstream above $500 but it lacked the momentum to maintain the tempo. It has slipped back below the trendline, although it is supported slightly above $470. The trend is generally bearish on Thursday but the price seems to have found a balance after bouncing from the short-term support.

In other news, Ethereum co-founder Vitalik Buterin while in an interview with Tyler Cowen, reckoned that scalability and simplicity are key to the development of new technology. He also talked about the user experience an essential part of creating technologies for the mainstream market.

"Another big one is user experience – both user experience in terms of using the blockchain, not being as clunky as it is today, but also user experience of security."

Consequently, Vitalik went on to explain how cryptocurrencies get their value. His opinions can also be used by users to judge the value of digital assets. He continued:

“I’ve thought about this a lot, and I’m still not sure what the best answer is because, ultimately, it depends a lot on the way the cryptocurrency goes. One way to measure this is to treat a cryptocurrency as being a kind of corporation that collects revenue through transaction fees, particularly in the case where the transaction fees either are burned or get redistributed to the cryptocurrency’s own proof-of-stake validators.”

Ethereum price analysis

The price is currently flirting with the 50% Fibonacci level between the highs of $542.38 and lows of $408.7 slightly below $480. The crypto is also supported by the 50 SMA on the 2-hour timeframe chart. On the upside, $480 is an immediate resistance and hurdle in the short-term towards $500. The stochastic is at 10% but pointing north, which means that there is buying pressure building at the moment. Therefore, ETH/USD is likely to continue retracing upwards in the short-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.