- This Tuesday and Wednesday’s price action has brought the price above the $5 level.

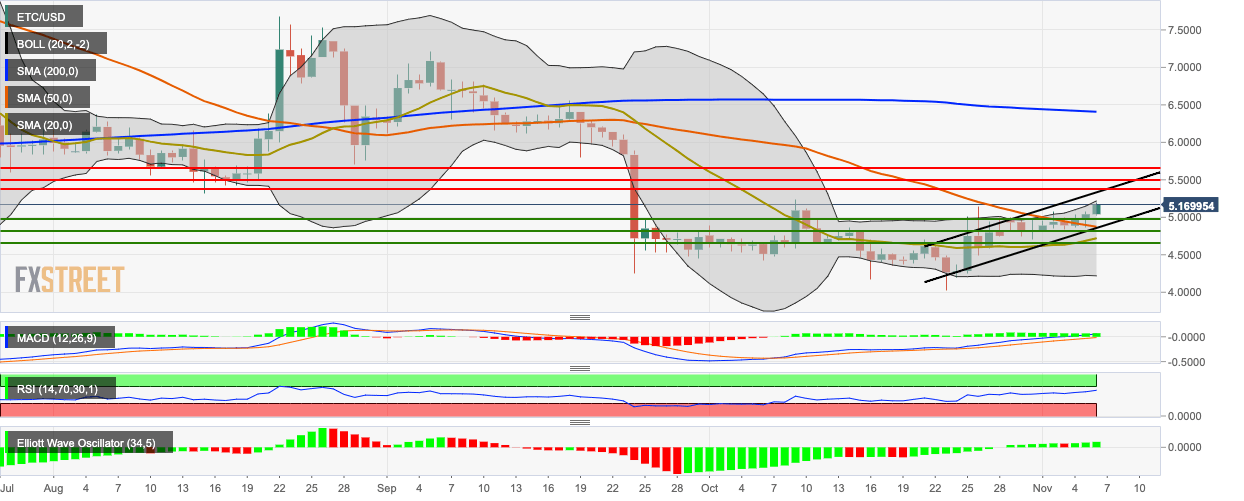

- ETC/USD is presently trending in an upward channel pattern.

ETC/USD is on course for charting three consecutive bullish days. This Wednesday, the price of the asset has gone up from $5.04 to $5.16. From Monday to Wednesday, ETC/USD has gone up from $4.88 to $5.16, charting a 5.75% growth in price in the process. Let’s look at the hourly breakdown for Tuesday and Wednesday. ETC/USD initially dropped to $4.89, where it found intraday support and flew up to $5.07. The price then dropped to $5.02 and trended around that territory for a bit before spiking from $5.05 to $5.17 in just one hour.

ETC/USD daily chart

ETC/USD is trending in an upward channel formation and has climbed above both the 20-day and 50-day Simple Moving Average (SMA 20 and SMA 50) curves. The latest session is looking to peek above the 20-day Bollinger Band. The 20-day Bollinger jaw has widened, which indicates increasing price volatility. The Moving Average Convergence/Divergence (MACD) indicates sustained bullish momentum, while the Elliott Oscillator has had three straight green sessions. The Relative Strength Index (RSI) indicator is trending around 63.40, next to the overbought zone.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.