- Ethereum (ETH is down a subtle 0.04% on the day while hanging onto $197.

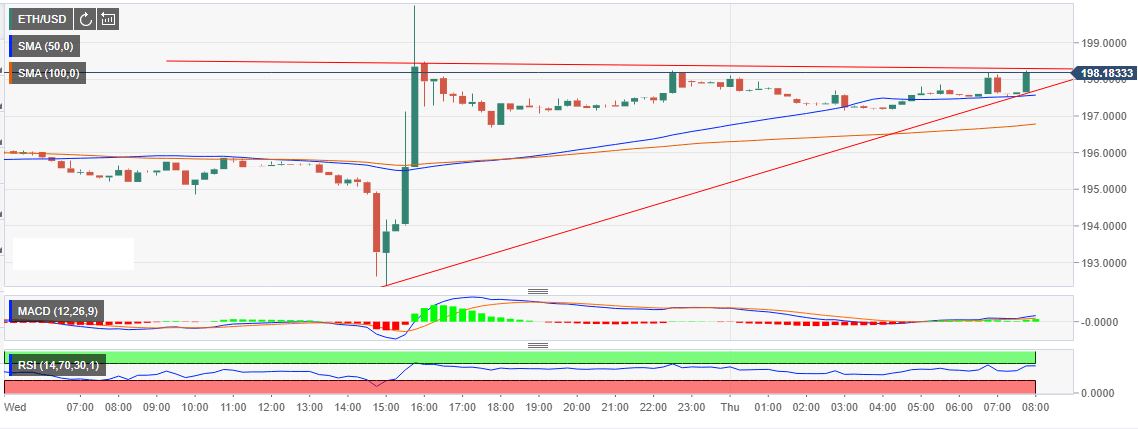

- The 50 SMA is offering support at $197.62 and the 100 SMA at $196.80.

It is yet another day in the red for the cryptocurrency market. Apart from light which is holding tight to the green line, all the other top ten digital assets are showing declines between 0.05% to 0.88%. Ethereum (ETH is down a subtle 0.04% on the day while hanging onto $197. In the analysis published by FXStreet yesterday, the asset had its upside limited at $196. As predicted, the price broke below the support at $195 only to find a support at $193.

The buyers reacted promptly to the drop ensuing an upswing in several engulfing candles. The price zoomed past the simple moving average resistance stepping above $198 before coming to an abrupt halt short of $199. Although the bears barricaded the path to $200, the buyers have managed to keep the price above $197.

The RSI at 64.00 is heading upwards, which is a significant buy signal. Moreover, the MACD has made it into the positive region (+0.12931); another solid buy signal. In addition, the short-term rising wedge pattern shows that a bullish breakout is around the corner. With this trend ETH/USD will retrace higher in the short-term to claim the broken support at $200. Meanwhile the 50 SMA is offering support at $197.62 and the 100 SMA currently at $196.80 (15-minutes).

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?