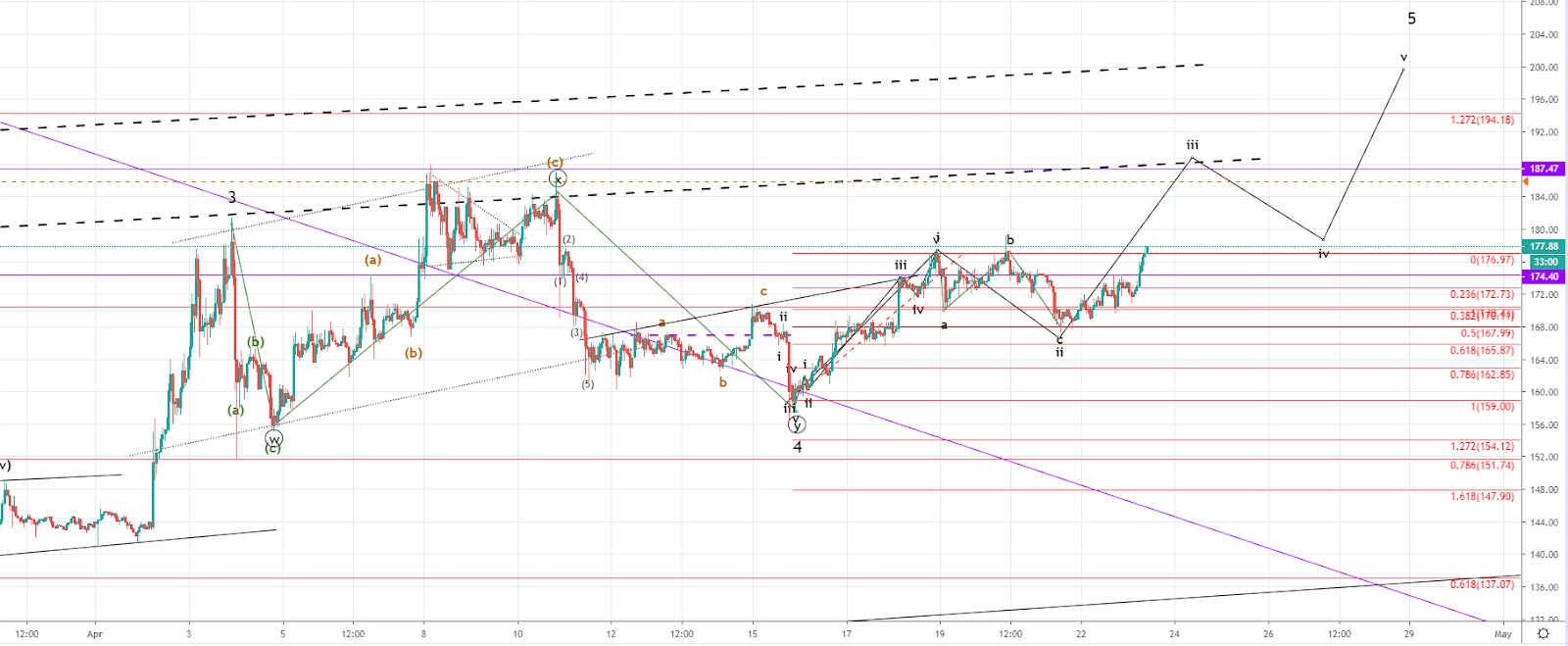

From yesterday’s low at $169 the price of Ethereum has increased by 5.36% as its currently being traded at around $178.11. The price is in an upward trajectory and has shown clear signs of impulsiveness.

On the hourly chart, we can see that the price went above the prior high level as it started increasing today from $171 area on FXOpen UK. Previously we have seen a movement to the downside which ended around the vicinity of the 0.5 Fibonacci level out of the last impulsive increase.

As a three-wave structure developed it was most likely the second wave out of the higher degree five-wave impulse wave that started after the correction of a Minute count ended. If this is true we are now seeing the development of the 3rd wave which is set to push the price of Ethereum to the horizontal resistance level around $187.7 or potentially even slightly higher to the 1.272 Fibonacci level.

This would be the final, wave 5 out of the Minor five-wave impulse of an even higher degree and is most likely to end around the vicinity of the upper interrupted ascending trendline which is the presumed resistance from the still unconfirmed ascending channel seen on the higher time-frame.

This means that when the increase ends I would be expecting the start of the higher degree downside move, but more on that in due time. For now, it is important that the price doesn’t fall below the 0.382 Fibonacci level as that would invalidate the count.

RISK WARNING: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?