- The auditing company aims to promote Ethereum blockchain adoption by corporations.

- ETH/USD recovers from recent loss, focused on $170.00.

ETH/USD has recovered above $160.00 handle to trade at $166.80 by the time of writing. The second largest digital asset with the market value of $17.6 billion has gained over 3% since this time on Tuesday, however the further upside looks limited at this stage

What’s going on?

An auditing firm EY has created a software that will facilitate blockchain technologies adoption among its corporate customers, Coindesk reports. The Ethereum-based platform called Nightfall will be rolled out in May to promote such blockchain use cases as supply chains, food tracing, and transactions between branches of a company. EY intends to make it an open-source software, and put it n the public domain, with no license at all.

“We want to maximize adoption and community involvement, we want people to adopt it, and adapt it, and improve it. If we retain ownership, people may not invest that much time and energy in something they might not control. The cleanest way to make everybody use it is just to give it away with no strings attached,” EY’s global innovation leader for blockchain, Paul Brody, commented.

Ethereum’s technical picture

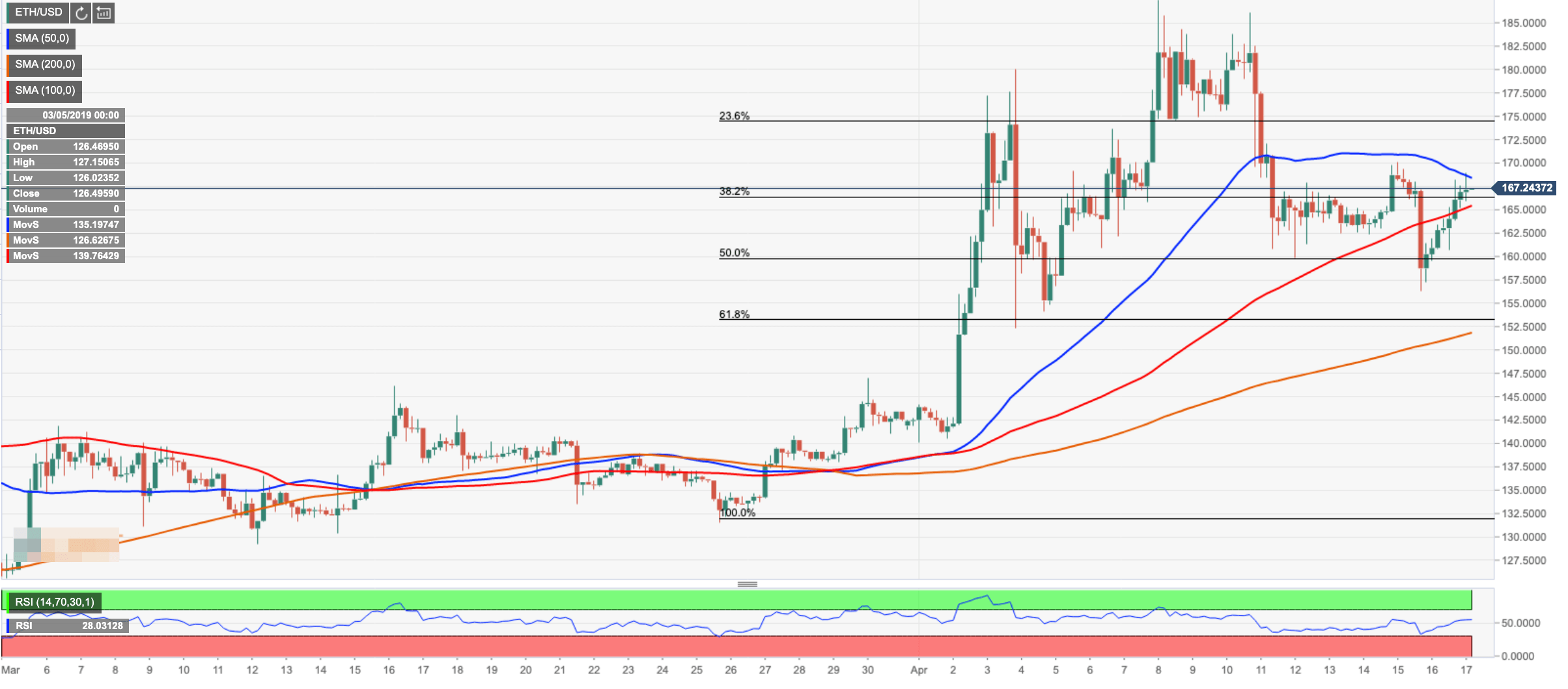

On the intraday level, ETH/USD recovery is capped by $169.00 handle with SMA100 (4-hour) located marginally below this area. Once it is cleared, the upside momentum might gain traction with the next aim at $170.00 and $174.40 (23.6% Fibo retracement).

On the downside, the first support area is created by $165.00 (SMA100, 4-hour). It is followed by psychological $160.00 and 50% Fibo retracement at $159.78.

ETH/USD, 4H chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?