- EOS is overbought, vulnerable to a short-term correction.

- Large EOS block producer promises to reinvest its profits back to the system development.

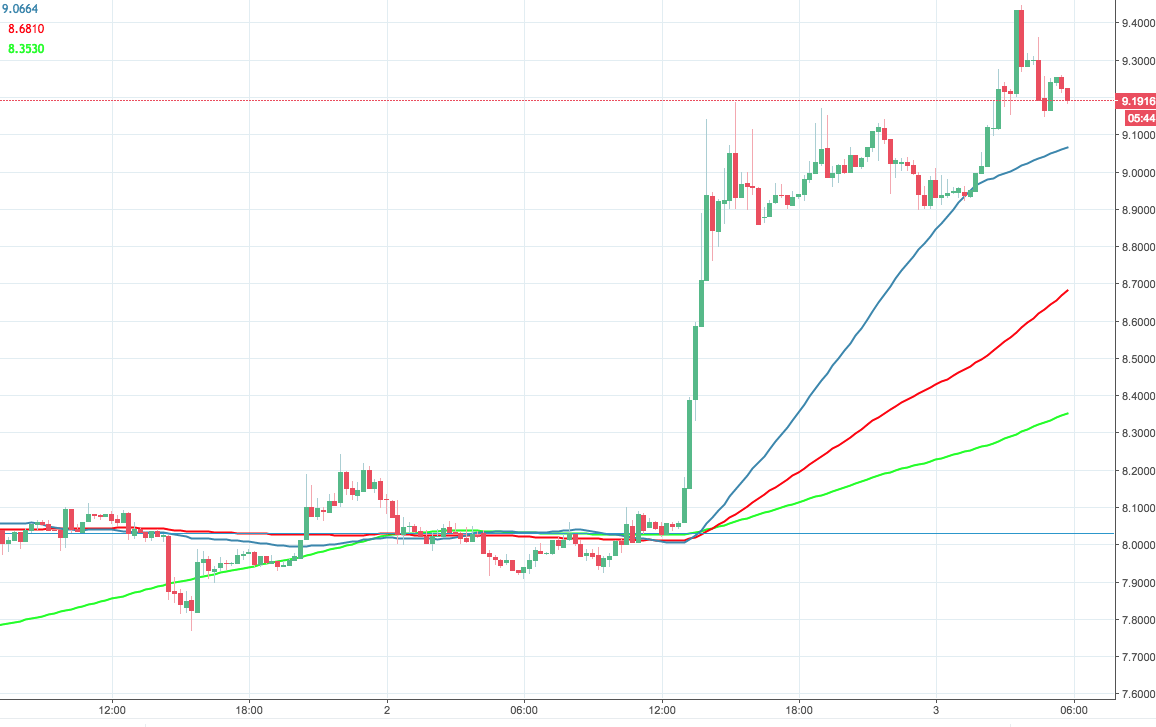

EOS/USD is one of the market leaders. The coin has gained 15% on a daily basis amid global recovery on the cryptocurrency markers. EOS is the 5th biggest coin with market value $8.2B and average daily trading volume $1.2B. The figure has doubled since Sunday and even spiked to $2.5B at some point during Asian hours. The short-term volatility subsided, but it is still elevated as the price demonstrates strong upside momentum. EOS/USD is currently changing hands at $9.22, off the intraday high at $9.44.

The market seems to have shrugged off the issues related to EOS mainnet start and a fight between Block Producers and EOS Core Arbitration Forum. High trading volumes and the price recovery show that both investors and block producers are confident with the project. Thus, the Block Producer App Coalition (BPAC) that unites EOS app developers around the globe announced the decision to reinvest the profits received from its operations into EOS ecosystem. BPAC is an elected block producer and the only member of the system committed to supporting the ecosystem development with 100% of its net proceeds.

"The top EOS block producers will generate significant profits, and we believe those profits should go back into the community," commented Reeve Collins, the founding member of BPAC and CEO of BLOCKv.

EOS technical picture

Looking technically, EOS/USD smashed $8.00 and $9.00 handles, which makes the picture look positive. However, the overbought condition might lead to a short-term correction with the local aim at $9.06, which is 50-SMA (15-min chart). Once it is broken, the downside may be extended towards $8.60 and $8.3 (100 and 200-SMA respectively). On the upside, keep an eye on $10.00 and $10.23 (200-DMA).

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

MANTA suffers 4% pullback after unlocking tokens worth $40 million

Manta Network (MANTA) unlocked over 8% of its circulating supply on Thursday. The unlocked tokens were airdropped and distributed in public sale, according to data from Tokenunlocks.

XRP struggles to recover as lingering Ripple lawsuit could reach Supreme Court, former SEC litigator says

The SEC vs. Ripple potential showdown at the Supreme Court is likely, says former SEC litigator Ladan Stewart. XRP Ledger calls developers, businesses and investors to build on the blockchain, extending Apex 2024 registration until April 30.

Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

Merlin chain’s TVL added 20% this week, and crossed $800 million on Thursday. Bitcoin Layer 2 assets noted double-digit losses in the past week. Stacks, Elastos, SatoshiVM, BVM are hit by a correction as Bitcoin hovers around $61,000.

If Bitcoin restarts bull run, these altcoins are likely to explode Premium

If Bitcoin’s consolidation ends and the bull run resumes, altcoins are likely going to trigger a massive rally. Last cycle’s hot tokens like SOL, AVAX, WIF, ONDO, etc., could see renewed enthusiasm.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.