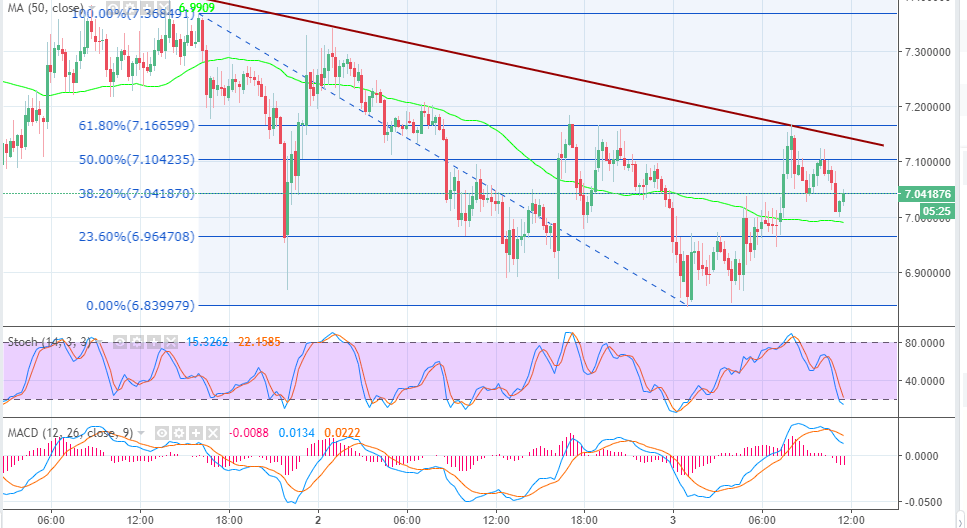

- The slide on Friday morning took the price back to the drawing board at $6.84 (intraday lows).

- EOS key resistance stands at $7.10 (50% Fib) while the intraday supply zone at $7.16.

EOS has been hammered by the rising selling pressure in the market in the last few days. However, the bulls are currently saying no more and are calling for a breather from the selling pressure. The price tanked below the pivotal $7.00 level. But the slide on Friday morning took the price back to the drawing board at $6.84 (intraday lows).

The slide was, however, short-lived and an upside movement using $6.90 as a support made a breakthrough above $7.00 and exchanged hands as high as $7.15. The recoil was limited by the 61.85 Fib level between the highs of $7.38 and the lows of $6.84. Lower corrections followed suit but the critical support at $7.00 has been holding ground for the mid-morning trading session.

EOS/USD is currently changing at $7.02 while the 38.2% Fib level is restricting upward movement at $7.042. The key resistance stands at $7.10 (50% Fib) while the intraday supply zone at $7.16 is the ultimate breakout zone towards other higher supply zones at $7.3 and $7.40. On the flip side, the 100 simple moving average on the short-term 15-minutes chart will halt declines if $7.00 support is broken. Other support areas include $6.96, $6.90 as well as the demand zone at $6.84.

In other news, EOS blockchain creator Dan Larimer has proposed a new way on how the network can make use of resources, and by so doing increase efficiency and distribution. EOS currently uses CPU time and RAM resources but the distribution has not been fully explored. This means that some users, specifically small-scale users hoard resources without knowing. Dan Larimer says that EOS owners can lend their unused tokens at a fee to other entities willing to expand their bandwidth. Larimer says:

“Token holders can lend their EOS at a fee in exchange for some loss of liquidity for the duration of the loan. There is no risk of losing capital to the lender.”

The loan, in this case, is without any financial risks because it is simply a technicality that allows an entity to utilize the specified CPU power. Dan Larimer adds:

“A EOS holder can lend their tokens to the Resource Exchange and will receive REX tokens for their EOS at the current book value of the Resource Exchange. The REX will generate fees by lending the EOS which will increase the book value. At any time the holder of REX tokens can convert REX back to EOS at book value.”

EOS/USD 15-minutes chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Lido DAO announces new phase on Ethereum with Simple DVT module

Lido DAO voted on the deployment of the Simple DVT module nearly six months ago, it is ready for mainnet as of April 17. Simple DVT helps to make Lido’s technology accessible to more users. LDO price is down nearly 3% in the past day.

New altcoins crash and burn, but this altcoin shows strength Premium

Binance Coin price shows a bullish pennant continuation pattern. BNB could range between the $600 to $526 levels until the skies clear out for Bitcoin. The altcoin could see a massive gain with the upcoming BEP-336 upgrade.

Cronos price fails to recover despite network upgrade

Cronos (CRO) is an Ethereum Virtual Machine (EVM) compatible chain in the Cosmos ecosystem. A mainnet upgrade was completed early on Wednesday and the asset’s price declined nearly 2% in the past 24 hours.

XRP tests $0.50 resistance after Ripple CLO says pretrial conference with SEC did not take place

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.