- eToro’s valuation put DASH market capitalization at $5.5 billion compared to the current cap at $3.3 billion.

- DASH/USD is correcting lower, down 1.91% on the day.

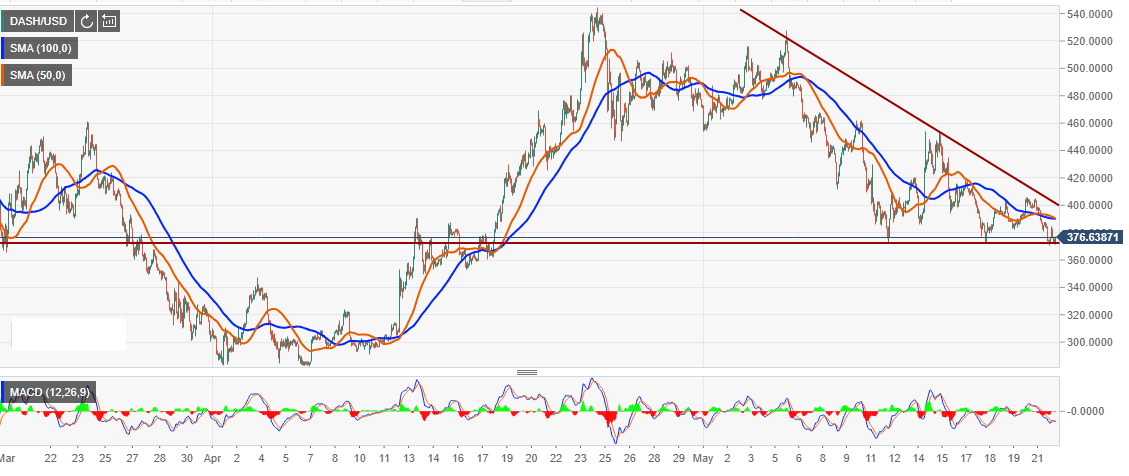

DASH price has not been spared by the downside trend in the market. It is down 1.91% on the day, besides it is trading below $400. The cryptocurrency has broken below the support level at $380 and is now trading at $376. Coincheck cryptocurrency exchange, based in Japan yesterday removed the support for four privacy-focused coins including DASH. DASH price reacted with a slide, however, it is joined by a negative wave that is sweeping across the market.

eToro’s market analyst, Matt Greenspan has recently released his analysis of DASH cryptocurrency and he is very bullish about the coin. The report after valuation places DASH’s market capitalization at approximately $5.75 billion as opposed to the current market cap of $3.3 billion. Mati wrote on Twitter today that:

“Dash is digital cash... and according to our analysis, it's also acutely undervalued compared to the rest of the cryptocurrencies.”

DASH price locked within the confines of the narrow end of the descending wedge pattern on the 1-hour timeframe chart. DASH price has been correcting lower since the first week of May after trading briefly above $500. The MACD on the same chart is at the -4 mark. DASH/USD exchanging hands below the moving averages which have crossed at $391 signalling that the crypto could consolidate higher than the current price. It is supported at $370 and $360 respectively, however, the major support rests at $300.

DASH/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?