- Dash is mitigating the reversal from the intraday high at $96.61.

- Dash needs a catalytic boost to tackle the concentration of sellers at $100.

The widespread recovery staged on Thursday appears to be pre-maturely stalling. Bitcoin (BTC) seems to have spent all the batteries after tackling $10,200 resistance and its immediate retreat is once again, is dragging the crypto market down. On the contrary, Dash is coming out as a strong daily gainer after its value shot up more than 3.5% on the day.

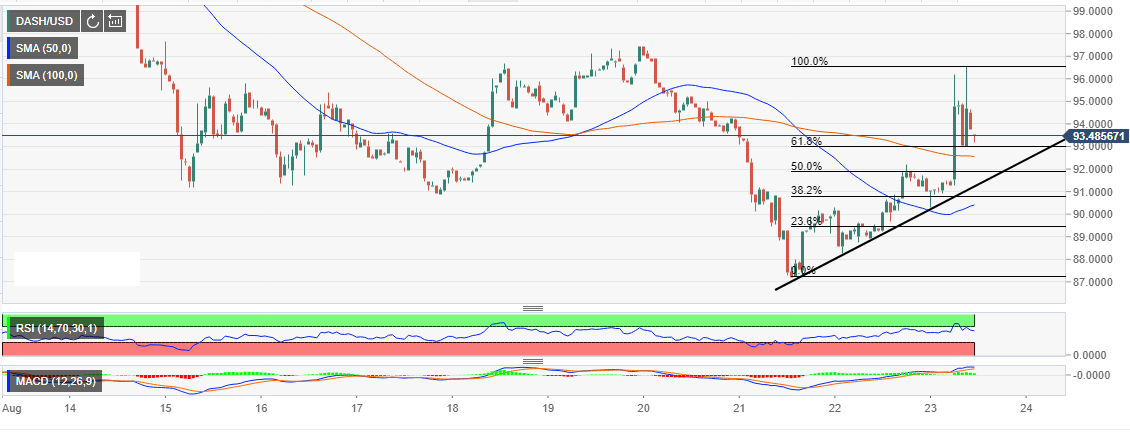

Despite the correction across the board Dash is mitigating the reversal from the intraday high at $96.61 by holding ground above the 61.8% Fibonacci level taken between the last swing high at $96.61 to a swing low of $87.26.

Dash found refuge from the recent declines at $87. The price action from this zone has been mostly bullish. On zooming above the 50 Simple Moving Average (SMA), Dash bulls grip tightened forging their way towards $100.

Unfortunately, $100 level remains unconquered while a retreat is underway. The relative strength index (RSI) retreat from the levels above 70 means that DASH was slightly overbought. On the positive note, the Moving Average Convergence Divergence (MACD) hit a high of +1.0718 after recovery from August 21 low at -1.7840. For Dash to gain the coveted ground above $100, the bulls must first ensure the price stays above the hourly moving averages. Secondly, Dash gets a catalytic boost to tackle the concentration of sellers at $100.

DASH/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?