- High gas fees hit the projects built on Ethereum blockchain.

- Several projects announce the migration to other blockchain or shut down.

- The launch of Ethereum 2.0 is hoped to improve the network scalability to solve the issue of expensive transactions.

The beauty of cryptocurrency is in its affordability, speed and cost-efficiency. However, the mushrooming DeFi projects built on Ethereum cause the network overload and kill all blockchain advantages over the traditional banking exchange systems.

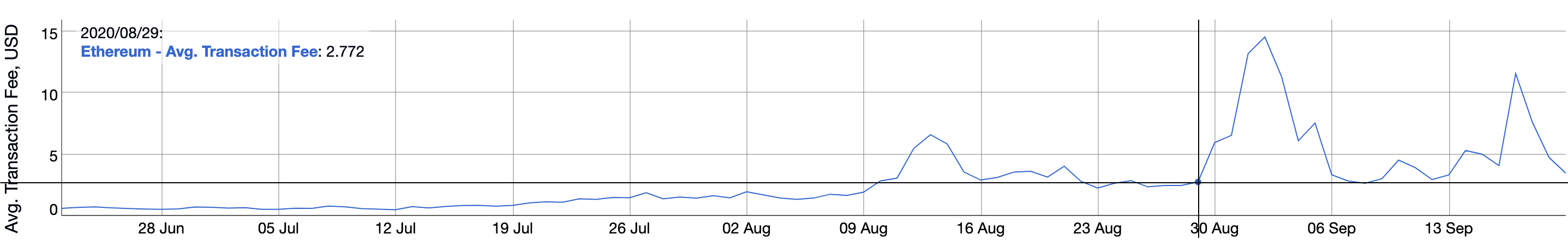

The number of daily transaction hit an all-time high at 1.4 million on Thursday, September 17. As a natural consequence, the gas prices, or the fees paid by the Ethereum network users for sending or transferring coins from one address to another, jumped above $11, close to the all-time high of $14 hit on September 2, following the $SUSHI launch.

Ethereum transaction fees

At the time of writing, the cost of sending a transaction on Ethereum retreated to $4, which is still significantly higher than the long-term average and close to the levels registered during the ICO boom of 2017-2018.

Blockchain projects in a predicament

In the early days of the cryptocurrency industry, Ethereum blockchain became home to numerous cryptocurrency startups and projects. Rolling out its blockchain and issuing a token on Ethereum was easy, convenient and fast before the place became too crowded.

However, now they find themselves trapped in the network with skyrocketing fees, delayed transactions and failed confirmations. As a result, blockchain projects are either forced to seek alternative solutions and leave the network or shut down due to high gas fees.

Biting the dust

UniLogin is the most recent causality of the high gas fees on the Ethereum blockchain. The platform that simplified users login to ETH-based applications announced on Friday, September 18, that the project was no longer viable due to the current state of the Ethereum gas market.

UniLogin is out of gas. Not necessarily out of money, but the current Ethereum gas market, the rise of DeFi, and new browser standards have changed the game significantly enough that we don't see a way forward with the project.

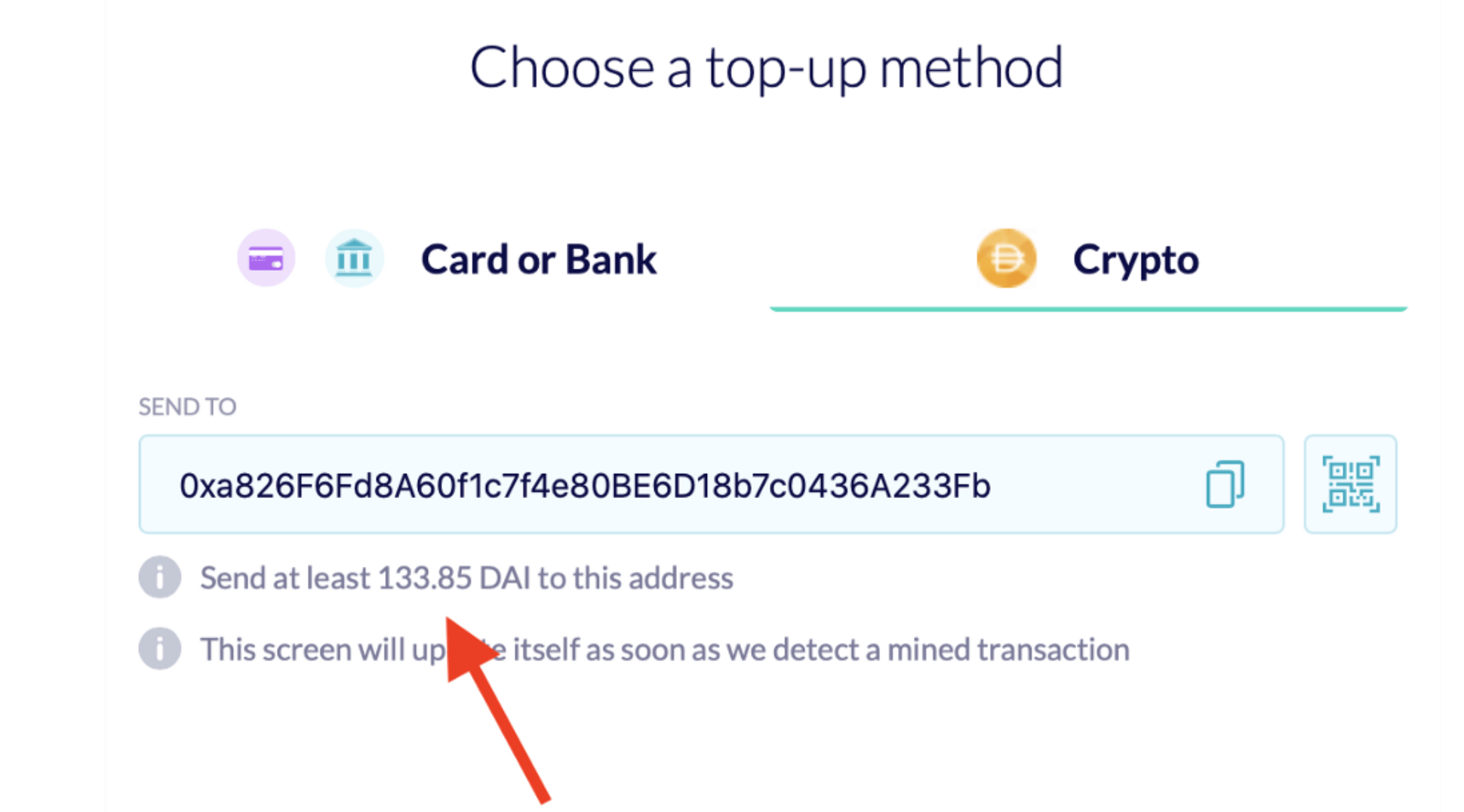

The project was launched two years ago to become a Universal Login standard for Ethereum. They onboarded new ETH users right from the browser via smart contracts and abstracted all the gas. However, at some point, the process of onboarding customers became too costly. The team believes that the problem is permanent as UniLogin is particularly sensitive to gas prices.

Some days the whole process of onboarding a new user cost over $130! Meaning you could buy a hardware wallet for the price of signing up on our app.

Source: UniLogin's blog on Medium

The developers tried to launch the second-layer solution for DeFi projects or provide xDAI support, but that would mean project total overhaul. Thus, the founders of UniLogin decided to close the project and return all the remaining cash to the investors.

Running away to survive

Meanwhile, some projects choose to migrate from Ethereum to competing blockchains that support dApps hosting and development. The trend started in 2017, after the super popular dApp for collecting virtual cats, Cryptokitties, practically paralyzed the network. The process has been gaining traction, ever since more and more competing blockchains popped in and offered developers and users more favorable conditions. TRON, EOS, Cardano, Tezos, OmiseGo, Waves are just a few options available for those who seek to decouple from Ethereum.

However, the migrations accelerated as ETH transaction fees went through the roof. Exenox, a blockchain-based smartphone ecosystem, is the most recent example of how the projects move away due to the skyrocketing gas prices on ETH. The project team announced the transition to TRX blockchain and invited its users to upgrade their software to enjoy faster and cheaper transactions and enhance scalability.

We at EXENOX have been busy developing our ecosystem, we are happy to announce that due to increased ethereum gas prices, we have moved to the tron (TRX) blockchain. Why upgrade?

— EXENOX (@exenoxmobile) September 18, 2020

-faster

-cheaper

-scalable

Let us know your thought!

Staring into the abyss

High gas fees forced some projects to delay payments to users. Thus, Publish0x, a service where users can earn coins for creating and reading content, delayed the payouts at the beginning of September, citing unreasonably high fees. Later the project switched weekly to monthly payouts as the costs appeared to be a crippling burden on the budget.

From now on, we will be paying out on every first Monday of the month. At the same time, we reserve the right to delay the payments for a few days, should gas fees be at higher levels on the first Monday of the month.

Publish0x's move is just another example of how ETH gas fees affect the Ethereum blockchain projects.

Capitalizing on ETH woes

The competing blockchains try to tempt over the dApp projects to their side. Tron's CEO Justin Sun and the CEO of Binance, Changpeng Zhao, have been especially vocal about migration benefits to their respective networks. According to Changpeng Zhao (CZ), the migration will reduce the Ethereum network's overload and reduce the fees.

However, in a separate tweet, he explained that Binance Smart Chain (BSC) was not competing with Ethereum, but instead offered users another option.

BSC never aimed to replace ETH, BSC is just ETH-compatible.

— CZ Binance (@cz_binance) September 12, 2020

Smart projects are giving their users more options. Option for cheaper fees. https://t.co/NUWvzxXMZN

At the time of writing, the Binance chain hosts numerous DeFi projects, including Cream Finance, Burger Swap, Bakery Swap, ForTube, Bounce Finance, Spartan Protocol, Stake Cow, and Peach Swap.

Ethereum 2.0 will come to rescue... or won't it?

The community sets much hope on the major Ethereum blockchain update known as Ethereum 2.0. The new version's launch will trigger the ETH transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus algorithm, meaning that validators will confirm the transactions based on how many tokens they hold.

The new algorithm is supposed to make the whole network faster and more scalable. If The transaction speed eventually increases to 100,000 per second, as promised, the problems of slowness and high gas fees plaguing the network will be solved.

Emmanuel Marchal, Managing Director and Global Head of Sales at ConsenSys, believes that Ethereum 2.0 will fix the network's scaling issues. Speaking in Coinscrum podcast, he said:

Ethereum benefits from having the largest community adoption and support, the largest amount of research around it done not by a single company but by a combination of companies and independent developers. And [this has been proven] over the last five years. It's capable of innovating yet maintaining the security and sovereignty of the ecosystem at work.

However, the industry experts are not sure that the new version will live up to the expectations. A famous economist and trader, Alex Kruger, pointed out that about 114,000 people currently participate in the DeFi industry and cause network issues. Meanwhile, Coinbase has to deal with over 32 million users, meaning that DeFi has enormous growth potential. However, it is still unclear whether the Ethereum network will be able to handle them.

The launch of Ethereum 2.0 is scheduled for November. The founder of the project, Vitalik Buterin, also confirmed recently that the update would go live in 2020. So all that is required is a little patience to wait for the update and a lot of hope that it will do the trick.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?