- The crypto market suffers from a broad-based sell-off on Thursday.

- The Binance CEO thinks crypto traders re making a big deal out of nothing.

- USD 25 million worth of BTC longs have been liquidated from BitMEX.

- Bitcoin sales from miners spike after halving.

The crypto market suffers from a broad-based sell-off on Thursday.

Its been a bit of a bloodbath on Thursday as all of the major cryptocurrencies are trading in the red. Bitcoin dipped back below the 9K mark to hit a low of 8800.00 after a strong wave of selling entered the market. The Relative Strength Index (RSI) has moved into an oversold zone on the intraday charts and on the daily sipped below the 50 mid-line. The next major support level is just above the 8K level at 8106.70.

Ethereum is trading over 6.5% lower but at the moment the price is testing the 55 exponential moving average (EMA) on the daily chart. Unfortunately for the Ethereum bulls, the 200.00 psychological level has been broken to the downside. Although a lower high has been created the wave low is still intact. if 176.43 does break on the downside it could mean a change in the technical trend.

Litecoin has not fallen as much as the other cryptocurrencies mentioned above but the price does trade below the 55 EMA and 200 simple moving average (SMA). The market is close to the 40.00 psychological level. On the daily chart, the RSI has also moved below the 50 mid-point pointing to the fact that more bearishness could be on the way.

(Bitcoin 4-hour chart)

The Binance CEO thinks crypto traders re making a big deal out of nothing.

Feds print a few trillion, nothing happens.

— CZ Binance (@cz_binance) May 20, 2020

Someone (most likely NOT Satoshi) moves 40 early BTC, market panics.

The Binance CEO also known as CZ has commented on Twitter today. CZ is making the assumption that BTC traders are dumping their holdings in the wake of the alleged Nakamoto story from yesterday's session. It was said that one of the earliest miners moved USD 500,000 worth of BTC to a private wallet. CZ then insisted that the traders should be worried about the Fed's massive liquidity injections into the US economy rather than a movement of coins from a historic wallet.

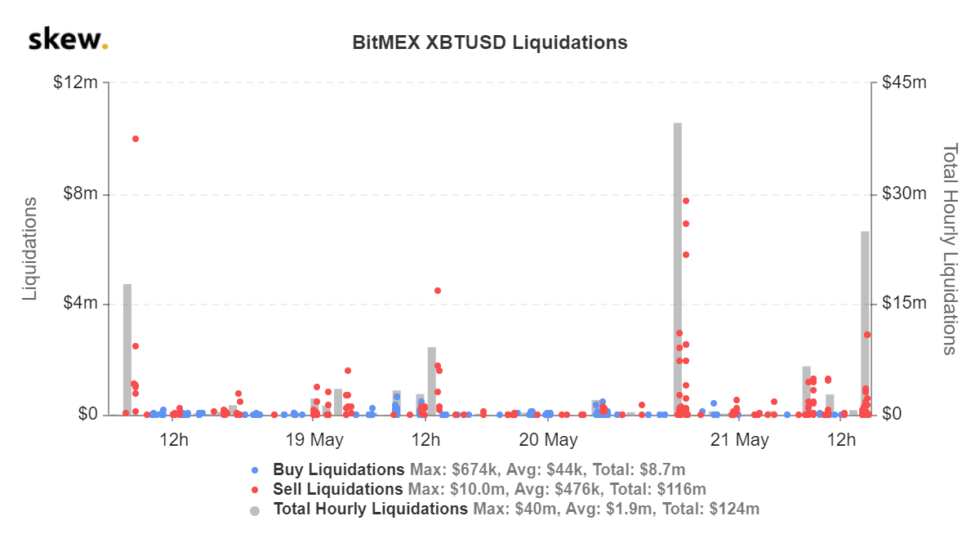

USD 25 million worth of BTC longs have been liquidated from BitMEX.

According to BTC data company Skew, approximately USD 25 million worth of long positions were liquidated by BitMEX during this drop lower. Obviously millions more would have been liquidated on other margin-enabled exchanges too, alternative crypto data sources suggest.

Bitcoin sales from miners spike after halving.

According to CryptoQuant, outflows from mining pools over the past five-sessions have hit 600%. The crypto resource company looked to combine Bitcoin sales from mining pools, and says that data analysis up to 20th May puts this week’s outflow at 7,426 bitcoins, a massive amount. In the period immediately after the halving, miners sold 1,066 bitcoins. Miner revenues have also dropped following block rewards halving, down to 6.25 from 12.5 bitcoins.

All information and content on this website, from this website or from FX daily ltd. should be viewed as educational only. Although the author, FX daily ltd. and its contributors believe the information and contents to be accurate, we neither guarantee their accuracy nor assume any liability for errors. The concepts and methods introduced should be used to stimulate intelligent trading decisions. Any mention of profits should be considered hypothetical and may not reflect slippage, liquidity and fees in live trading. Unless otherwise stated, all illustrations are made with the benefit of hindsight. There is risk of loss as well as profit in trading. It should not be presumed that the methods presented on this website or from material obtained from this website in any manner will be profitable or that they will not result in losses. Past performance is not a guarantee of future results. It is the responsibility of each trader to determine their own financial suitability. FX daily ltd. cannot be held responsible for any direct or indirect loss incurred by applying any of the information obtained here. Futures, forex, equities and options trading contains substantial risk, is not for every trader, and only risk capital should be used. Any form of trading, including forex, options, hedging and spreads, contains risk. Past performance is not indicative of future FX daily ltd. are not Registered Financial Investment Advisors, securities brokers-dealers or brokers of the U.S. Securities and Exchange Commission or with any state securities regulatory authority OR UK FCA. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest, with or without seeking advice, then any consequences resulting from your investments are your sole responsibility FX daily ltd. does not assume responsibility for any profits or losses in any stocks, options, futures or trading strategy mentioned on the website, newsletter, online trading room or trading classes. All information should be taken as educational purposes only.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

(2)-637256859577050233.png)