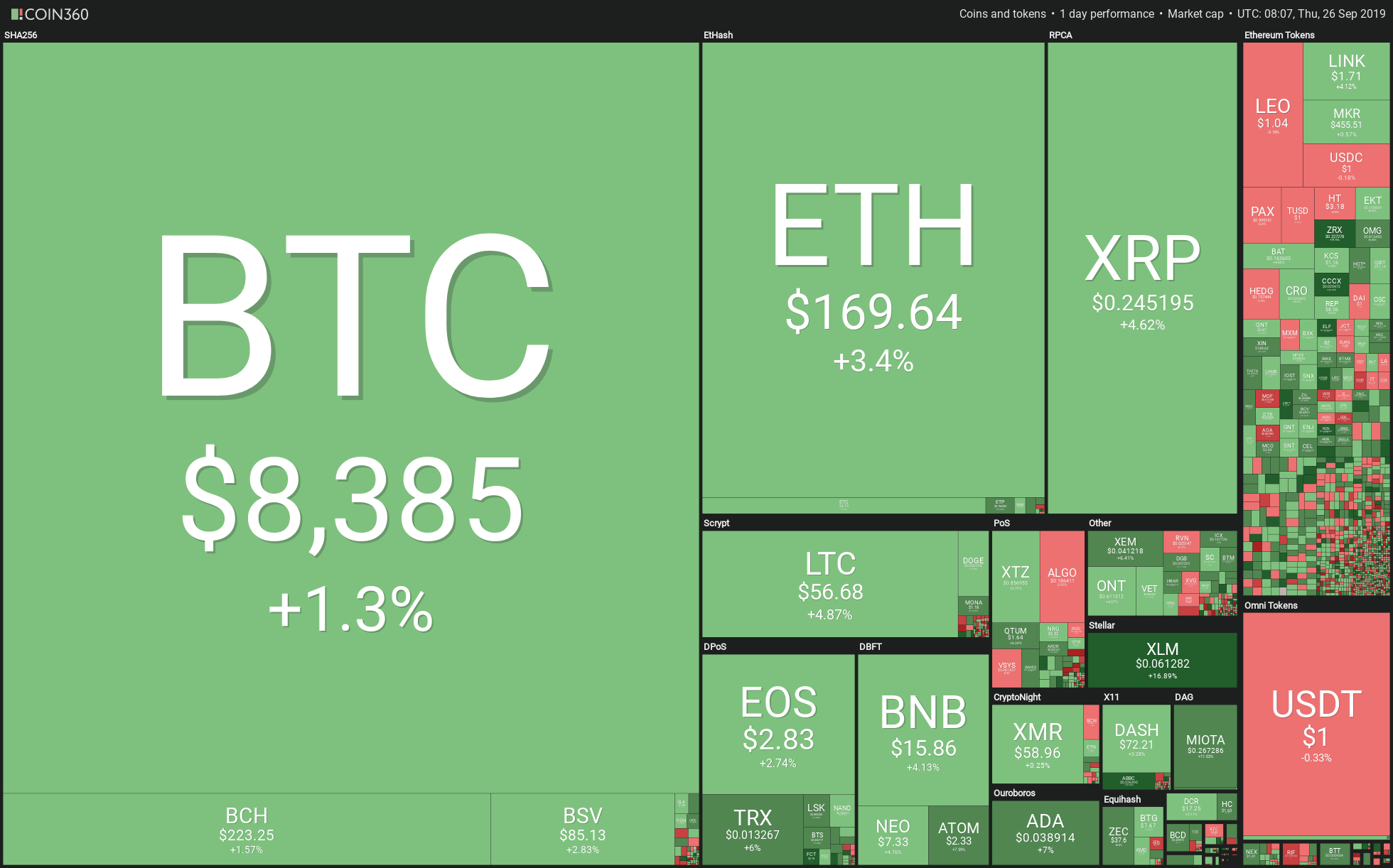

During the past 24 hours, volatility shrank, and most coins tried to create a bounce. The current situation has improved a for Ethereum (+2.77%), Ripple(+4.28%), Eos (+3.31%) and LTC (+2.1%) while Bitcoin and its variants BCH and BSV are mostly unchanged. Also, if you look at the Crypto-sector heat map below, you should observe of the significant recovery of Stellar Lumens (+16%), ATOM( +7.4%), ADA(+7.28), and Tron (+6.24%). The total market capitalization is currently $221.3 billion, and the dominance of coins, excluding stablecoins is presently:

BTC: 67.77%

ETH: 8.22%

XRP:4.76%

BCH:1.84%

LTC:1.63%

EOS:12%

OTHER:14.59%

The most relevant piece of news is, in our opinion, the comments given by Benoit Coeure, member of the Executive Board of the European Central Bank, on an introductory speech to the Committee on Digital Agenda of the Deutscher Bundestag on Sept. 25. The statement was focused on the importance of stable digital currencies in exchange and commerce. Also commented on issues such as anti-money laundering and terrorism financing as the main challenges regulators would face.

Technical Analysis

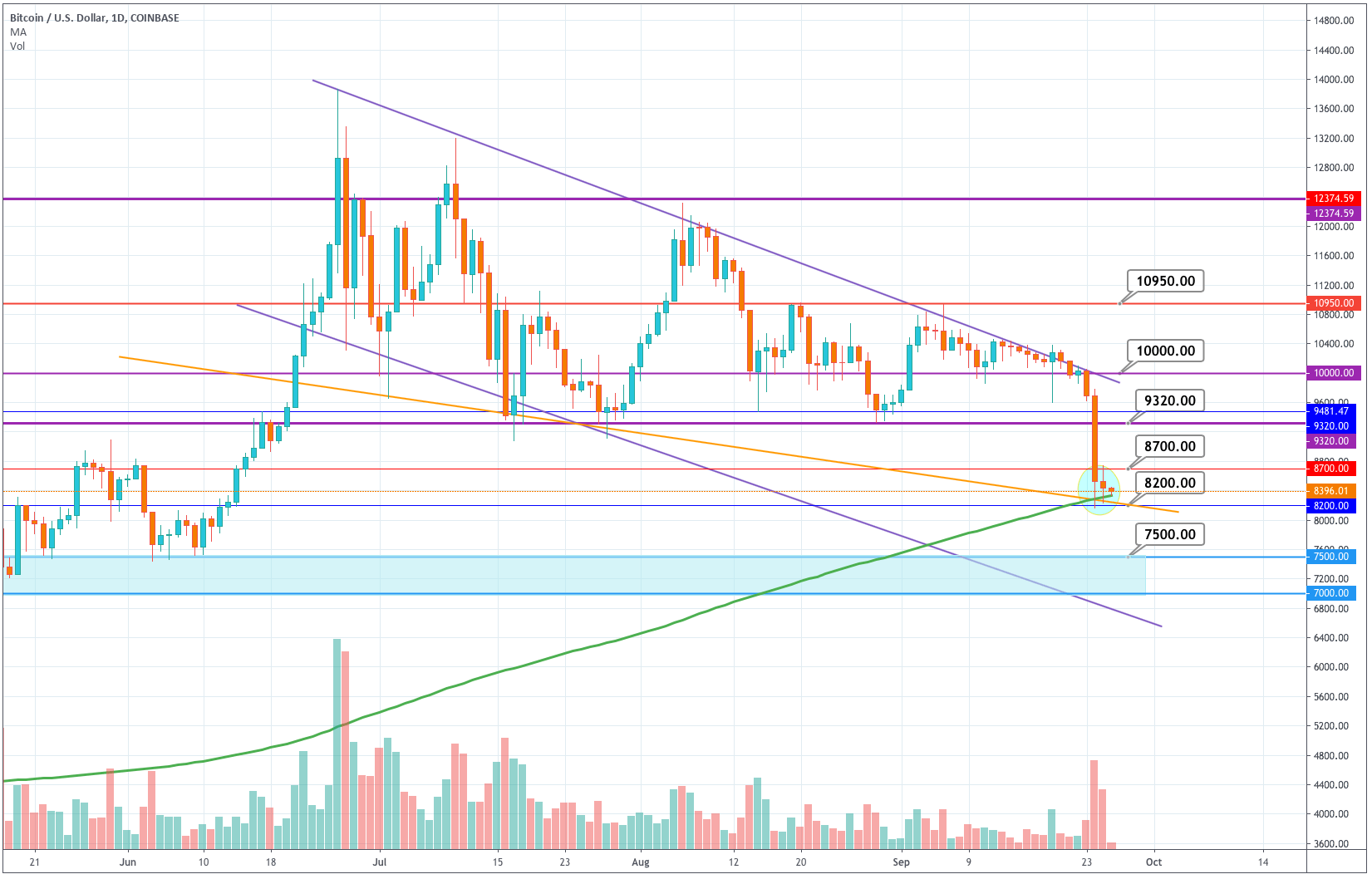

Bitcoin (BTC)

Since yesterday, Bitcoin is creating a base just above its 200-day moving average. If today the price action is maintained, it could start forming a rounding top as it did in the final days of August to, then catch the strength to create a new upward leg. The bounce off of the 200-day MA would call the buyers again, as it might confirm that the bullish trend is not over yet. Also, that would discard the parallel descending channel and establish a descending wedge instead (observe the amber trendline), which is usually resolved to the upside. A close above $8,700 would be very positive to change the short-term and long-term view of this digital asset. Also, a violation on the close of the $8,200 level would mean the price is headed towards $7500.

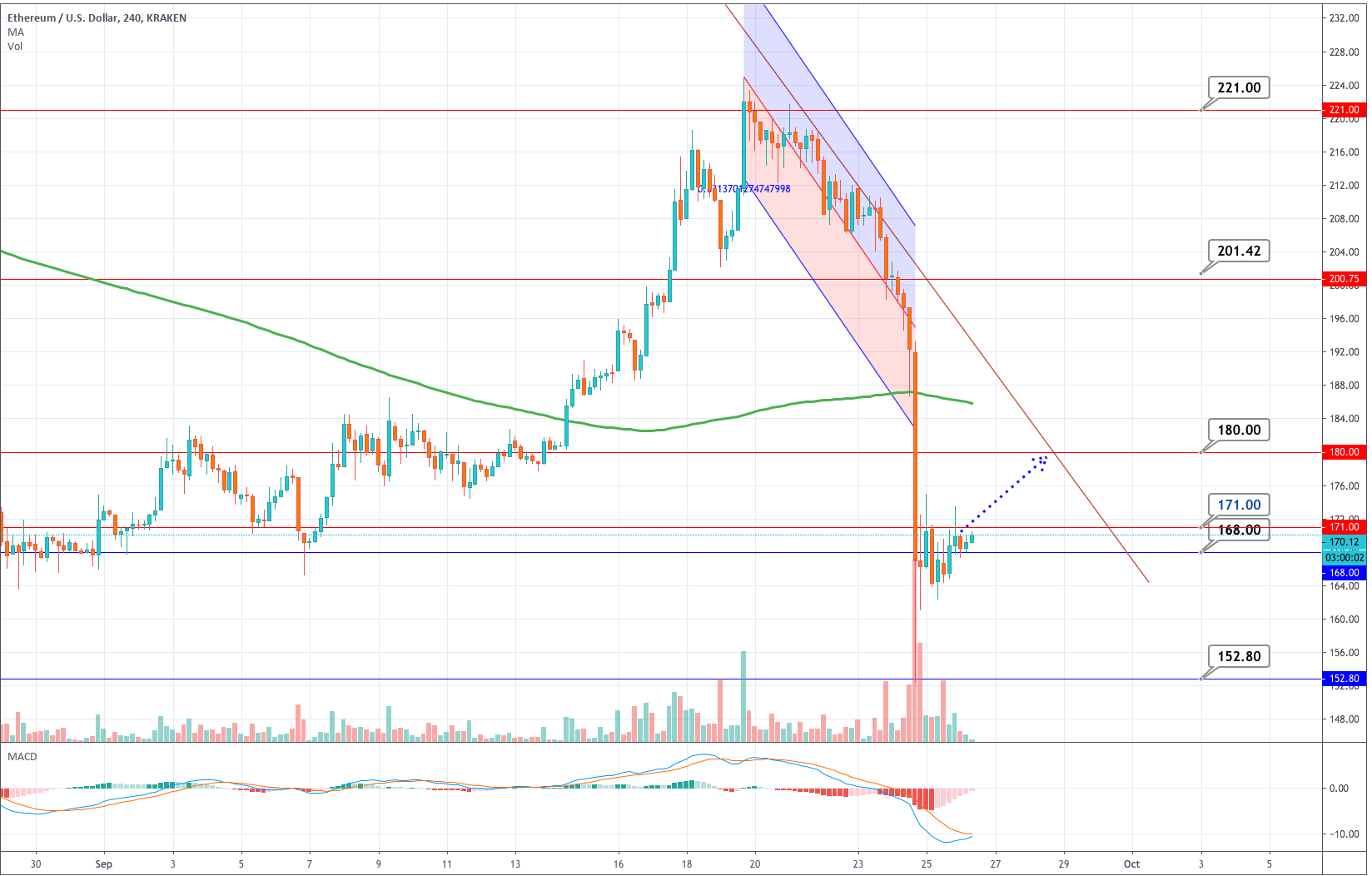

Ethereum (ETH)

We see Ethereum continue moving in a retracing movement seeking a confluence of the $180 and the descending trendline, which is a projection of the main slope of the regression channel before the selloff. The current volume is light, though, so we would like to see a healthy close above $171.

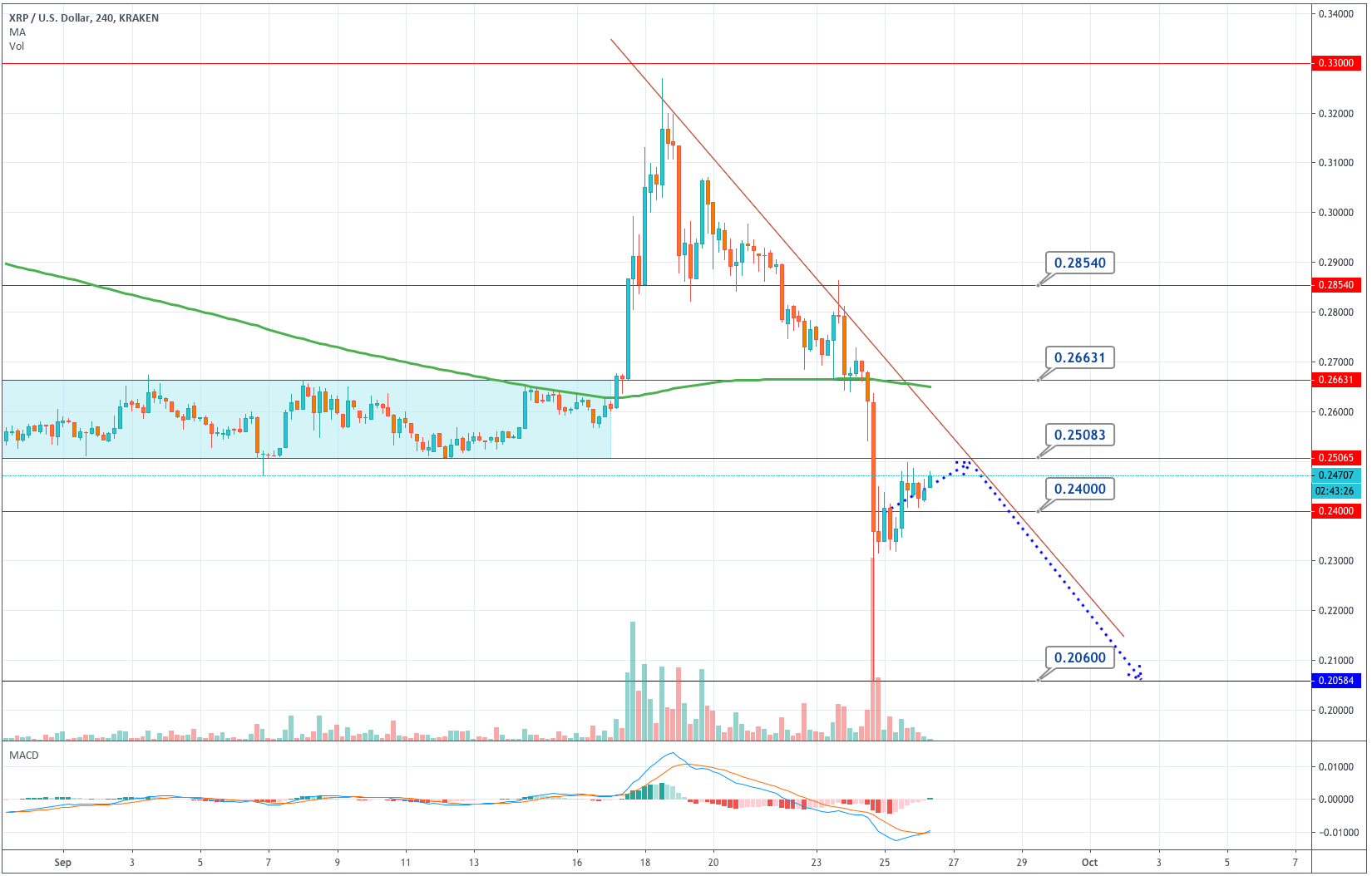

Ripple (XRP)

XRP is still moving up, although the volume is fading. The price has bounced off a bit of the 0.25 resistance level. MACD has moved to the positive side, but it needs to break this resistance level is XRP is to continue climbing to 0.266. The descending trendline is another barrier to break, though. So, overall, the outlook is still bearish, and we keep our scenario of more drops for this token. Only a sharp buying activity on the Bitcoin would change this to a more bullish view. A cross under $024 will signal that the sellers are still controlling the action.

Stellar Lumens (XLM)

Stellar has bounced sharply. The price has entered the consolidation region that was formed before the previous sharp move to the upside. Currently, the price is up more than 12% after being rejected by the 0.05177 resistance. MACD has turned up as well. That gives reasons to think the price could continue moving upwards. To confirm that scenario, we would need a close above the mentioned resistance level. A drop below the support of 0.0587 would mean this scenario failed. The volume of this bounce started strong but has faded. That is a warning, so we should ask for the mentioned confirmation before going long.

100% Anonymous Trading on EagleFX - Trade NOW!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

MANTA suffers 4% pullback after unlocking tokens worth $40 million

Manta Network (MANTA) unlocked over 8% of its circulating supply on Thursday. The unlocked tokens were airdropped and distributed in public sale, according to data from Tokenunlocks.

XRP struggles to recover as lingering Ripple lawsuit could reach Supreme Court, former SEC litigator says

The SEC vs. Ripple potential showdown at the Supreme Court is likely, says former SEC litigator Ladan Stewart. XRP Ledger calls developers, businesses and investors to build on the blockchain, extending Apex 2024 registration until April 30.

Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

Merlin chain’s TVL added 20% this week, and crossed $800 million on Thursday. Bitcoin Layer 2 assets noted double-digit losses in the past week. Stacks, Elastos, SatoshiVM, BVM are hit by a correction as Bitcoin hovers around $61,000.

If Bitcoin restarts bull run, these altcoins are likely to explode Premium

If Bitcoin’s consolidation ends and the bull run resumes, altcoins are likely going to trigger a massive rally. Last cycle’s hot tokens like SOL, AVAX, WIF, ONDO, etc., could see renewed enthusiasm.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.