Here's what you need to know on Monday

Markets:

The BTC/USD is currently trading at $8,653 (-4.6% on a day-to-day basis). The coin has been moving within a strong bearish in recent 24 hours amid decreasing volatility.

The ETH/USD pair is currently trading at $165.4 (-5.8% on a day-to-day basis). The Ethereum recovered from the intraday low of $164.44; now, it is moving within a short-term bearish trend amid low volatility.

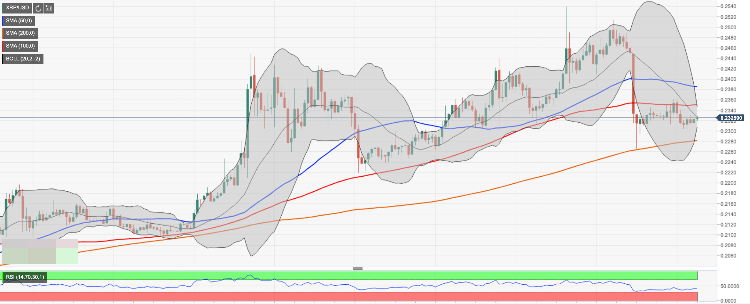

XRP/USD settled at $0.2325 after a spike to $0.2540 on January 18. The coin is down 6% in recent 24 hours.

Among the 100 most important cryptocurrencies, the best of the day are Seele (SEELE) $0.1154 (+6.5%), Bitcoin SV (BSV) $268 (+2.0%) and MaidSafeCoin (MAID) $0.0779 (+1.96%), The day's losers are, Nervos Network (CKB) $0.0049 (-18.5%), Steem (STEEM) $0.1636 (-10.42%) and Bitcoin Diamond (BCD) $0.5924 (-8.92%).

Chart of the day:

XRP/USD, 1-hour chart

Market:

Prominent economist and Bitcoin critic Peter Schiff lost access to his Bitcoin wallet. He claims that it was a program glitch; however, the crypto twitter community says he was responsible for not storing the access data properly. Schiff got the Bitcoins stored in a wallet as a gift, thus he was not too upset when they were lost.

"Since all the Bitcoin in my corrupted wallet were gifted to me, it's not that great a tragedy for me that they're lost. "Easy come, easy go," is especially true for #Bitcoin. My plan was to HODL and go down with the ship anyway. The difference is that my ship sank before Bitcoin."

Bitcoin hit a new 2020 high at $9,184 on Sunday only to crash below $8,500 in a matter of hours. The market experts blame the sharp sell-off on a massive longs liquidation on BitMEX. The cryptocurrency BitMEX is the biggest trading platform for cryptocurrency derivatives that allows trading Bitcoins on margin.

Industry:

Chinese blockchain startups raised financing to the tune of $3.5 billion in 2019, which is 50% lower from 2018, according to the recent report prepared by the investment platform Rhino Data and Xinhua Finance. The research showed that most investments had come from cryptocurrency funds, while traditional venture capitalists took a backseat.

Regulation:

The Supreme Court of India reopened the discussion of the case between the cryptocurrency industry and the Reserve Bank of India (RBI). The Court asked the central bank to explain its controversial move to ban banking services for the country's crypto-related business. During the reopened session he Court listened to Ashim Sood, the counsel for the IAMAI who discussed the basics of cryptocurrencies and blockchain technologies and pointed out that many countries had established regulation for this type of assets. While it is not clear, what the Court's verdict may look like, the Judges seemed to be open-minded about the crypto-based technologies and the economic possibilities they represent.

The South Korean government may impose 20% of tax on gains from cryptocurrency trading if it is classified as income from lottery or prize-winning. The income tax department at the Ministry of Economy and Finance in South Korea is developing a taxation scheme for gains from virtual assets transactions, according to the local media outlet.

The finance ministry is yet to finalize its direction but it surely has become more likely for the income from virtual asset trading to be labeled as other income, not as gains from transfer of capitals like real estate properties.

Quote of the day:

Many hardcore crypto ogs advocate storing your own keys. But the truth is, today most people are not able to secure a key even from themselves (losing it). A trusted centralized exchange is #SAFUer for most people. The numbers speak for themselves.

The head of Binance Changpeng Zhao

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?