- The market has dumped more than $ billion in less than 24 hours from $185 billion to the current $176 billion.

- Bitcoin continues to fight for support above $5,150.

- Ethereum reacted to a subtle double top pattern as soon as it tested $185.

- Ripple is among the biggest losers on the day with losses of more than 5%.

The market at the moment is a beehive of bear activities. Following an entire week of incredible gains across the board, the bears came in guns blazing on Thursday sending most cryptocurrencies below important support areas. The market has dumped more than $ billion in less than 24 hours from $185 billion to the current $176 billion. On the contrary, there has been an increase in the total market trading volume from $51 billion to the current $55 billion.

Bitcoin price update

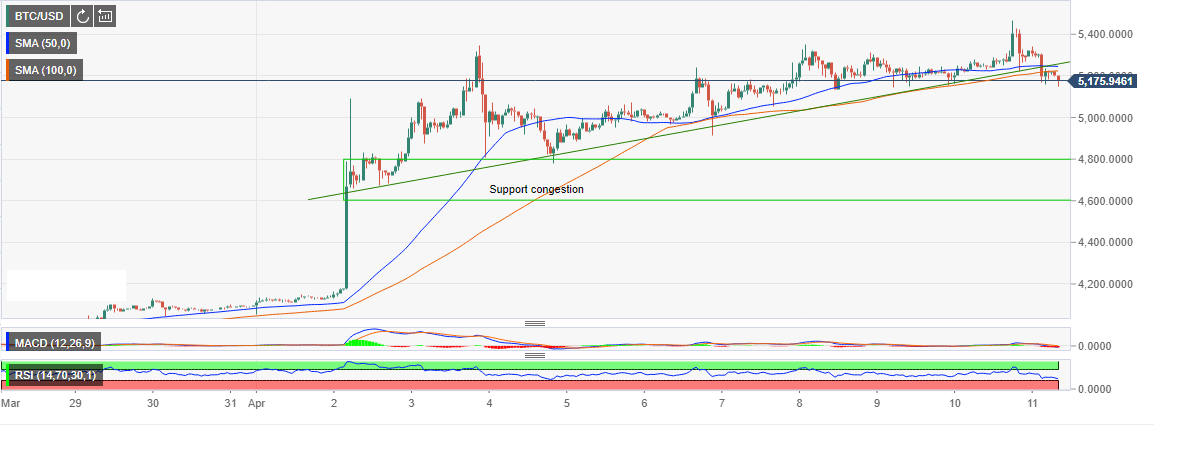

Bitcoin has dropped from the intraday high at $5,342.39 to its current market value of $5,166. This represents a 2.79% decline on the day. As predicted yesterday Bitcoin stepped above $5,400. However, the asset lacked the strength to keep the uptrend sustained. The drop could not find support at the trendline which coincides with the 50 SMA 1-hour. Neither did the 100 SMA 1-hour help slow down the flash drop. At the moment, Bitcoin continues to fight for support above $5,150. The next support target is $5,000 while $4,800 support congestion area is a definite trend reversal zone.

BTC/USD 1-hour chart

Ethereum price update

Ethereum reacted to a subtle double top pattern as soon as it tested $185 during the brief surge in the evening (GMT) session on Wednesday. The price lost its mojo resulting in a drop below $180 and extended declines below both the 50 SMA and the 100 SMA 1-hour. Further losses have slipped below $170. ETH/USD is trading at $168 and could test the support congestion zone at $155 - $160 unless a reversal takes it back above $170.

ETH/USD 1-hour chart

Ripple price update

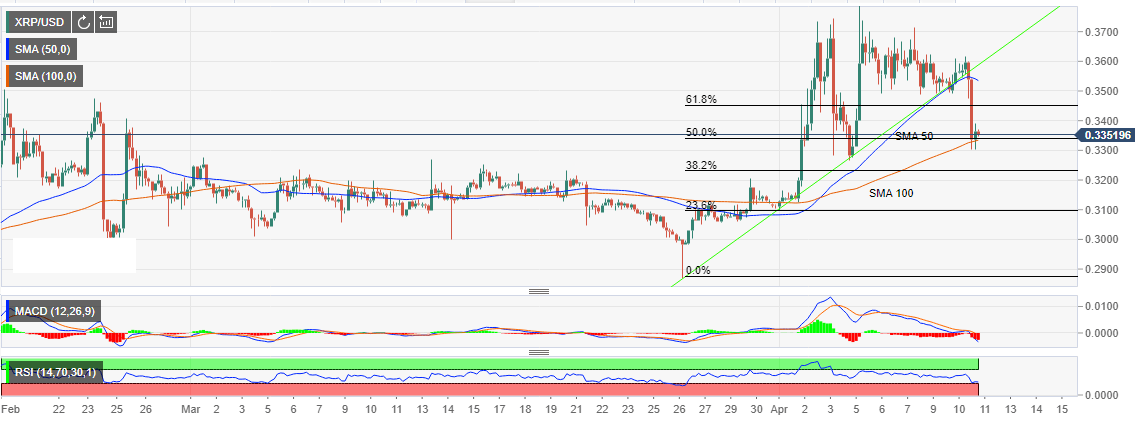

Ripple is among the biggest losers on the day with losses of more than 5%. The price has been correcting lower from the resistance congestion at $0.3700. Yesterday, the crypto attempted to break above $0.3600 but failed. A reversal ensued as bears increased their grip. XRP/USD slipped below the 50 SMA 1-hour and tested $0.3300 before a slight correction occurred. It is trading at $0.3353 at press time while supported by the 100 SMA 1-hour.

XRP/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat (WIF) price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu (BONK), WIF token’s show of strength was not just influenced by Bitcoin (BTC) price reclaiming above $63,000.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

PUPS, WZRD, and PEPE are gaining liquidity through Bitcoin Ordinals. Creator of Bitcoin’s Ordinals protocol is debuting a new fungible token standard to rival BRC-20, Runes.

Ethereum shows firm support at key level as its correlation with US indices increase

Ethereum's price continued a sideways movement on Thursday as the market still awaits a trigger. Ethereum isn't alone in this horizontal trend; several major index funds have also traded sideways.

Mango Market attacker convicted of fraud and market manipulation

Mango Market attacker Avi Eisenberg was convicted by a federal jury on Thursday for "fraudulently obtaining" funds from the Solana-based decentralized exchange (DEX). He could face up to 20 years in prison for his role in the $110 million attack.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.