- Hitbtc denies access to its services for Japanese residents.

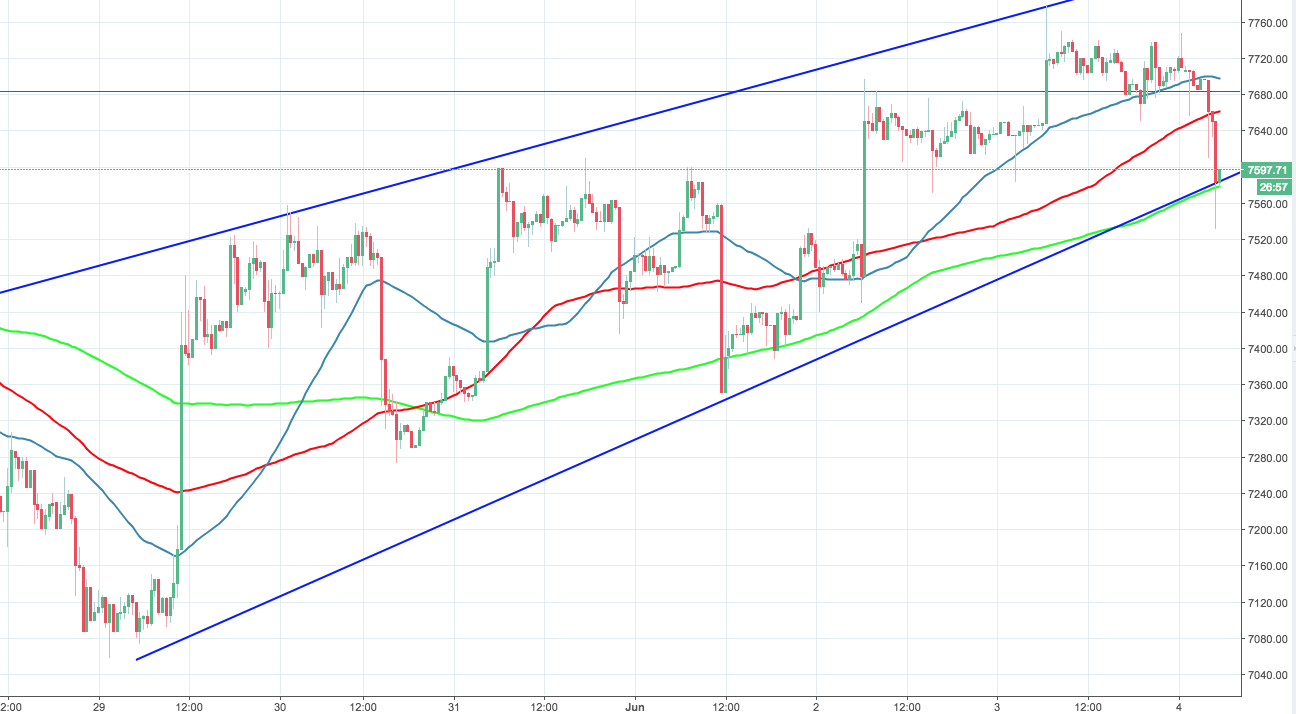

- All coins are sliding down, Bitcoin is close to critical support.

Cryptocurrency market switched back in red mode after a period of recovery during the previous week. Bitcoin is losing 2% since the start of the day, Ethereum and Ripple are down 2.5% and 4.5% respectively. IOTA and Bitcoin Gold are among the biggest losers of cryptocurrency Top-10.

Hitbtc, the Hong Kong exchange for trading digital assets with average daily volume over $278M has stopped servicing clients in Japan to avoid troubles with Japanese Financial Services Agency. The operator updated its Legal section of the website to include the information about service restrictions.

"For the avoidance of any doubt and in accordance with the Japan Payment Services Act, HitBTC has temporarily suspended providing virtual (crypto) currency exchange services to residents of Japan. In case our technology detects that you use our Services from an IP address registered in Japan, or any other services registered in Japan, you would be asked to confirm that you are not a resident of Japan by providing information on your residency within KYC procedure."

BTC/USD dropped to intraday low at $7,531 before recovering to $7,600 handle. The digital currency No.1 has returned above the upside trendline at $7,570 and above 200-SMA (30-min chart), though the coin is vulnerable to a new sell-off wave as long as it stays below $7,660 (100-SMA) and %7,700, strengthened by 50-SMA.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?