Bitcoin's value has declined by around 14% since its recent peak, and other major cryptos have followed suit, rattling a bullish run. Bitcoin's price hovered around $57,000 on Thursday, its lowest level since mid-October, after briefly falling below $56,000 a day earlier.

So far this month, BTC's value has dropped by 6%, leaving investors unsure of how deep the fall can go. My vantage point as the PR head of a big crypto exchange allows me to see the market from the inside and what is happening today is very similar to what happened in the past. In my opinion, this is just a pullback as Bitcoin gathers power before making its next leap to new highs. However, Bitcoin's price has fallen dramatically in recent weeks from the peak of nearly $69K it reached earlier this month, raising the question of why the previous correction took less time and wasn't as severe.

Source: TradingView

What has caused crypto to fall?

The plunge in crypto prices can be attributed to multiple factors. Among them is the Securities and Exchange Commission (SEC) rejecting a bitcoin ETF, which would have likely seen billions of dollars poured into the cryptocurrency market.

Furthermore, China is tightening its grip on Bitcoin mining, saying it will consider "punitive electricity prices" for some crypto mines as part of its next phase of crackdowns.

In related news, US President Joe Biden signed a $1.2 trillion infrastructure bill last week, which includes provisions that could have tax implications for crypto investors.

Additionally, I believe that rising selling pressure and profit-taking are the other contributing factors. We are experiencing crypto's natural cycle. Whenever assets reach record highs, people sell off their assets. However, large sales can result in the value’s drop.

Cryptocurrencies have also been hit by a strengthening dollar, which is always a negative factor.

Ned Segal, Twitter's CFO, also made negative remarks about cryptocurrency, which may have influenced the market. According to him, investing cash into crypto assets at this point isn't wise.

Therefore, it is no surprise that the Crypto Fear & Greed Index shows that market sentiment, which was neutral last week, is now in "fear" territory with a reading of 32/100 as of writing.

Source: www.alternative.me

However, there is no reason to be surprised by Bitcoin's volatility, bearing in mind it has shown a steady rise in value over time.

It seems like Bitcoin is on its way to bounce back to new price records. Still, even though we see some signs of recovery, it's too early to speak of a fully-fledged bullish trend.

The average directional index (ADX) which measures trend strength currently stands at 13.26, indicating a weak trend. I think the bulls are too tired and need some time to recover and consolidate.

Source: TradingView

The next level of resistance, in my opinion, is $60K. After BTC price breaks through it, we can expect accelerated growth and new heights.

What’s next for BTC?

An increasing number of people and businesses are becoming exposed to Bitcoin. Thus, according to documents filed with the U.S. Securities and Exchange Commission (SEC), Morgan Stanley added 1.5 million shares of Grayscale Bitcoin Trust (GBTC).

Several investment firms began offering crypto to clients, including Goldman Sachs, JPMorgan Chase, and Wells Fargo. With top cryptocurrency developments such as El Salvador accepting Bitcoin as legal tender, the launch of the first Bitcoin futures ETF, and Tesla and MicroStrategy adding Bitcoin reserves to their balance sheets, it seems very likely that exponential growth of crypto adoption will drive price increases for Bitcoin and other major coins.

Top monthly gainers

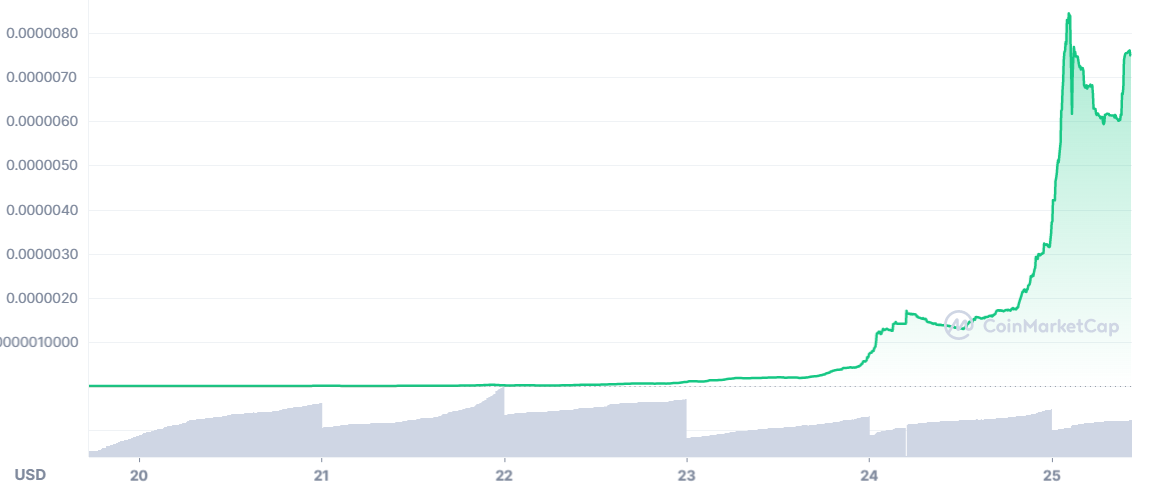

Over the past 30 days, Mars Space X (MPX) coin was the top performer making a stunning 1,447,841.08% monthly gain. At the time of writing, it traded at $0.000007489, up by 460% in a day. MPX is a cryptocurrency aimed at providing capital output to Elon Musk's Mars Project.

Source: CoinMarketCap

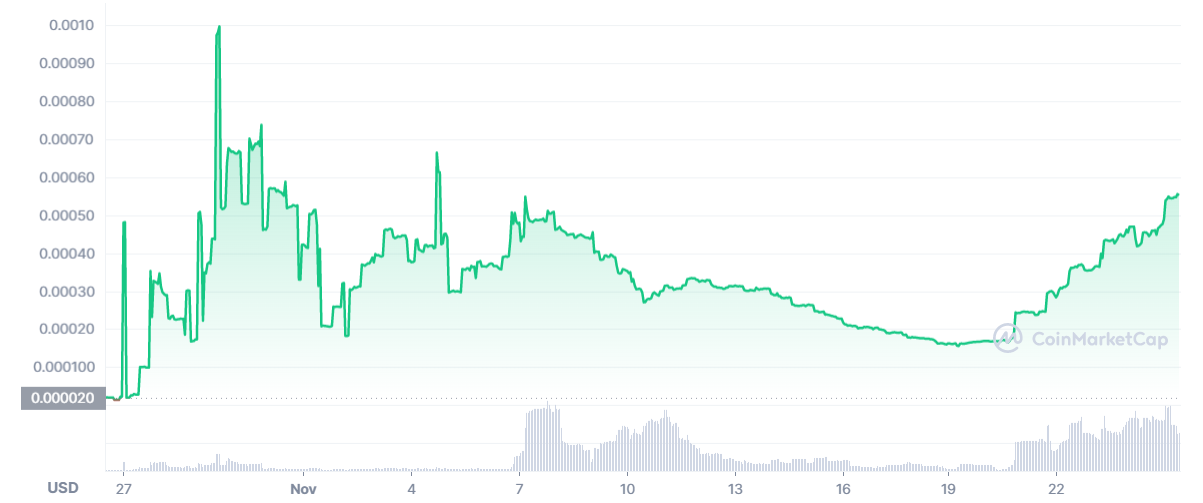

Dogebonk (DOBO), a token on Binance Smart Chain (BSC) with deflationary properties and automatic yield generation, was the second top performing altcoin, posting a 11,823.12% monthly gain. It was last traded at $0.0000003291, down by 8.7% in 24 hours.

Source: CoinMarketCap

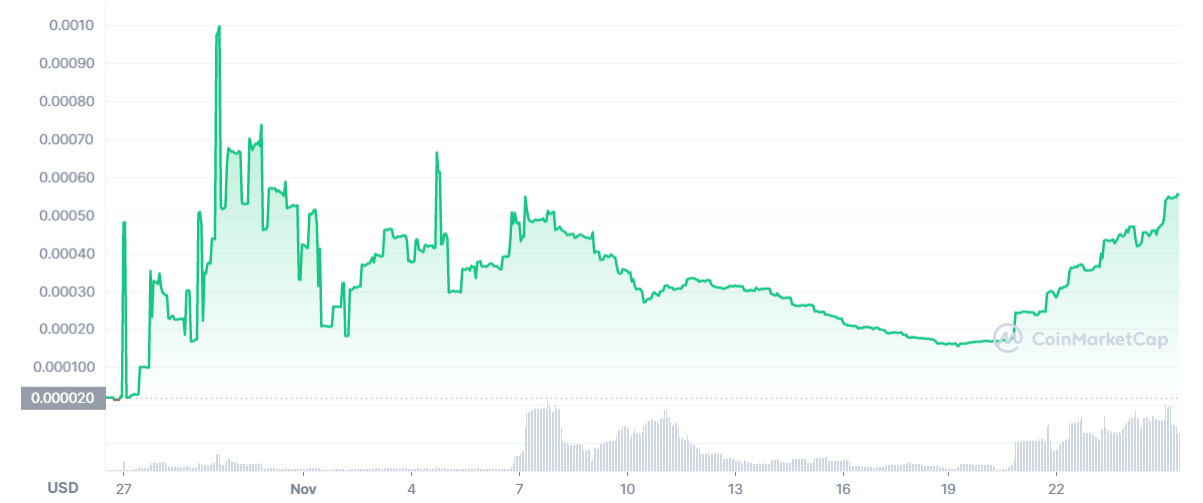

Solar Energy (SEG), a deflationary BEP20 token from Binance Smart Chain aimed at creating photovoltaic power plants in Brazil, was the third top gainer for the last 30 days, posting a monthly gain of 12,431.32%. Over the past 24 hours, it decreased by 74.70% to $0.0008315 however.

Source: CoinMarketCap

Coin To Fish (CTFT) was the fourth top gainer, marking a 9,131.47% gain month-on-month. At last check, it traded at $1.40, up by 85.70%% in 24 hours.

|

Source: CoinMarketCap The next best-performer was Arbis Finance (ARBIS) coin, making a 4,112.74% gain over the past 30 days. At the time of writing, it rose by 21.66% in the last 24 hours to $0.0005518. Source: CoinMarketCap |

|

Along with other top performers, FarmerDoge (CROP) made amazing monthly gains, rising by 3,844.38% over the past 30 days. At the time of writing, CROP traded at $0.008346, slightly down by 1.7% in the past 24 hours. Source: CoinMarketCap |

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?