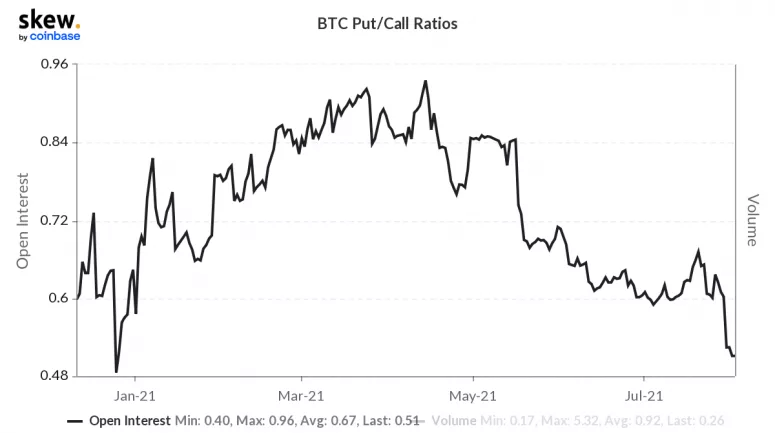

Put-call open interest ratio measures the number of open positions in put options relative to calls.

Bitcoin’s put-call open position ratio dropped to the lowest level this year on increased activity in calls or bullish bets.

The ratio slipped to 0.51 on Monday, hitting the least since Dec. 25 and extending the slide from the July high of 0.67, data provided by crypto derivatives research firm Skew show.

According to Skew’s Twitter feed, about 2,000 bitcoin call option contracts with a strike price of $140,000 and expiry date of Dec. 31 changed hands on Sunday. Similar volume was seen in the December expiry call with a strike price of $200,000.

“All this activity in calls has brought the put-call ratio to YTD lows,” Skew tweeted on Monday. A call option gives the holder the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A call buyer essentially purchases insurance against bullish moves by paying a premium to the seller. A put option gives the purchaser the right to sell.

Bitcoin put-call open interest ratio

Source: Skew

Data shared by over-the-counter desk Paradigm and analytics firm Genesis Volatility show investors bought Aug. 6 expiry calls at $44,000 and simultaneously sold calls at $50,000, a so-called bull call spread, last week, pulling the put-call open positions ratio down.

The bull call spread involves buying call options at, below or above the spot market price and selling an equal number of calls with the same expiry at a higher strike price.

It’s a limited-risk, limited-reward strategy designed to benefit from an increase in the underlying asset. The maximum profit is earned if the asset expires at or above the short call’s strike price, that is $50,000 in this case, on the settlement day. The maximum loss is limited to the net premium paid while setting the strategy. It is arrived at by subtracting the compensation received for selling the $50,000 call from the premium paid for buying the $44,000 call.

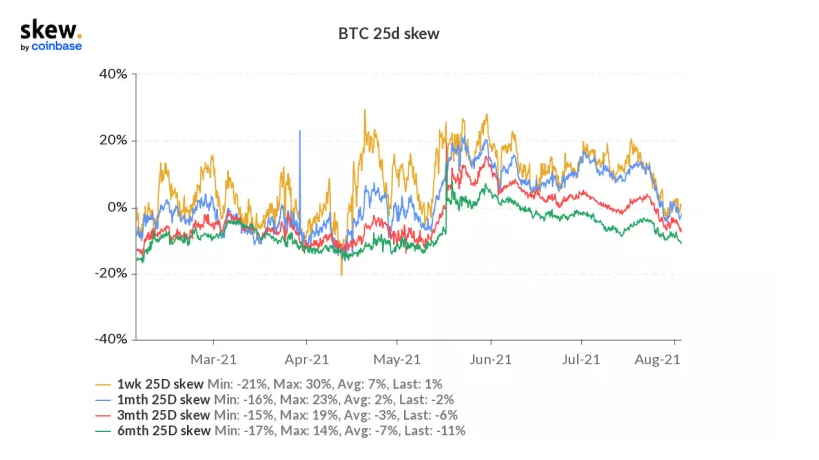

Traders also bought September expiry call spreads at $64,000-$124,000 strikes last week. Other metrics measuring the implied volatility or price differential between call and puts also paint a bullish picture.

Bitcoin put-call skews

Source: Skew

For the first time in nearly 10 weeks, short-term, medium-term, and long-term put-call skews are displaying negative values, a sign of calls drawing higher demand or prices than puts.

Bitcoin is currently trading near $38,500, representing a 1.7% drop on the day.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat (WIF) price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu (BONK), WIF token’s show of strength was not just influenced by Bitcoin (BTC) price reclaiming above $63,000.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

PUPS, WZRD, and PEPE are gaining liquidity through Bitcoin Ordinals. Creator of Bitcoin’s Ordinals protocol is debuting a new fungible token standard to rival BRC-20, Runes.

Ethereum shows firm support at key level as its correlation with US indices increase

Ethereum's price continued a sideways movement on Thursday as the market still awaits a trigger. Ethereum isn't alone in this horizontal trend; several major index funds have also traded sideways.

Mango Market attacker convicted of fraud and market manipulation

Mango Market attacker Avi Eisenberg was convicted by a federal jury on Thursday for "fraudulently obtaining" funds from the Solana-based decentralized exchange (DEX). He could face up to 20 years in prison for his role in the $110 million attack.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.