From yesterday’s high at $5481, the price of Bitcoin has decreased by 8.8% measure to the lowest point of $4999.3 the price has been on FXOpen UK.

The price has started falling down fast since yesterday’s high as the majority of the decrease occurred in a matter of hours and as the price is still in a downward trajectory we are yet to validate if we are seeing the start of a new downtrend or is this a minor retracement before another higher high.

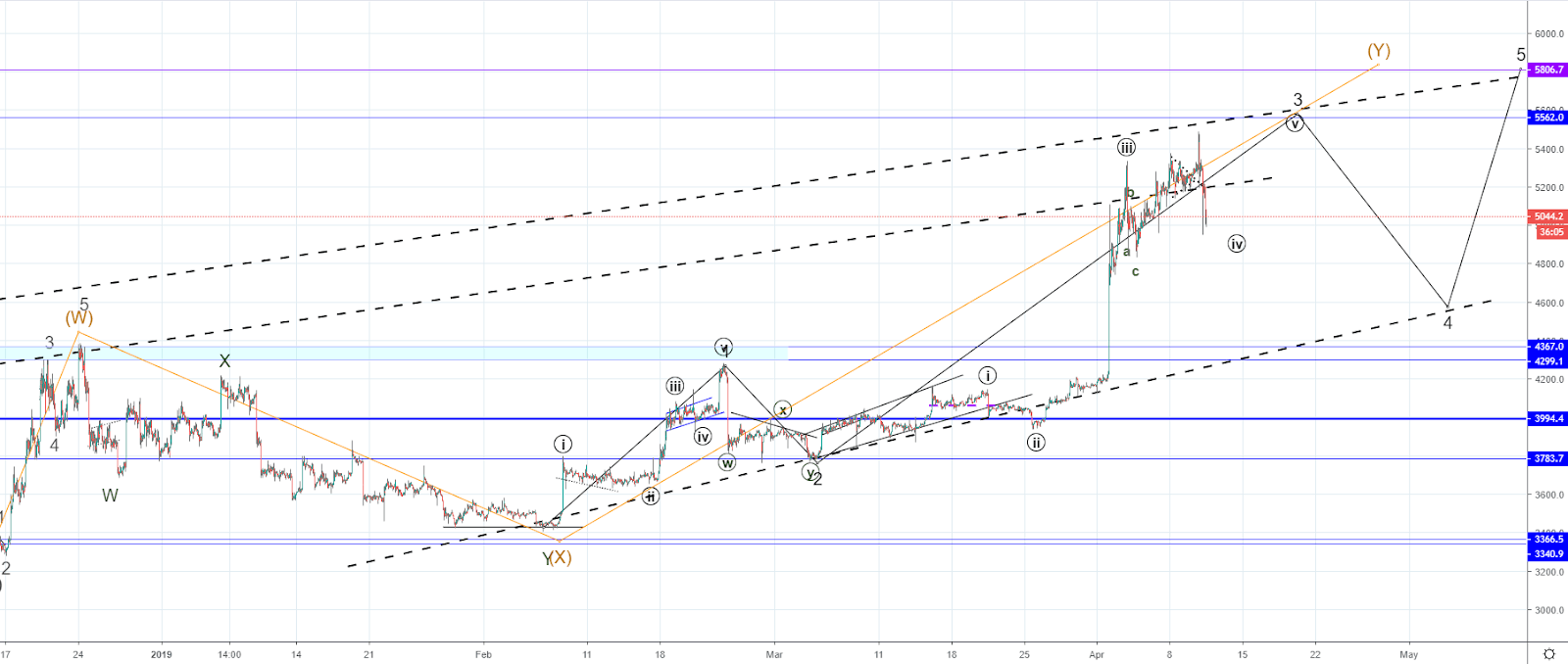

On the hourly chart, we can see that the price came up to around the upper still unconfirmed resistance level which could be confirmed as a resistance point now that the price got rejected there and started falling down.

This resistance level was outlined as a potential ascending channel in which the price has been correcting since the 15th of December when the first impulsive move to the upside started. Now that the price came up to those levels and got rejected the downside movement we are seeing could be the start of a higher degree impulse wave to the downside or could be a minor retracement before another retest which I think it’s more likely at this point in time.

As we are seeing the development of a three-wave correction to the upside from 15th of December, the increase we have seen from 8th of February is the third wave which is the five-wave impulse and as it hasn’t ended we are now more likely seeing its 4th wave developing before another increase is to occur.

RISK WARNING: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.