Overview

The cryptocurrency space has a tremendous start in 2020, with the prices of bitcoin touching the 9000 levels for the first time since October, and markets have seen some massive rallies in part of the altcoin world. However, BSV has stolen the spotlight with an enormous gain of almost 300% in just less than a week. Given that the recent price actions have already broken the major trendlines, how traders can play the post-rally BSV market? What are the likely scenarios after the rally?

Best-Performing Crypto

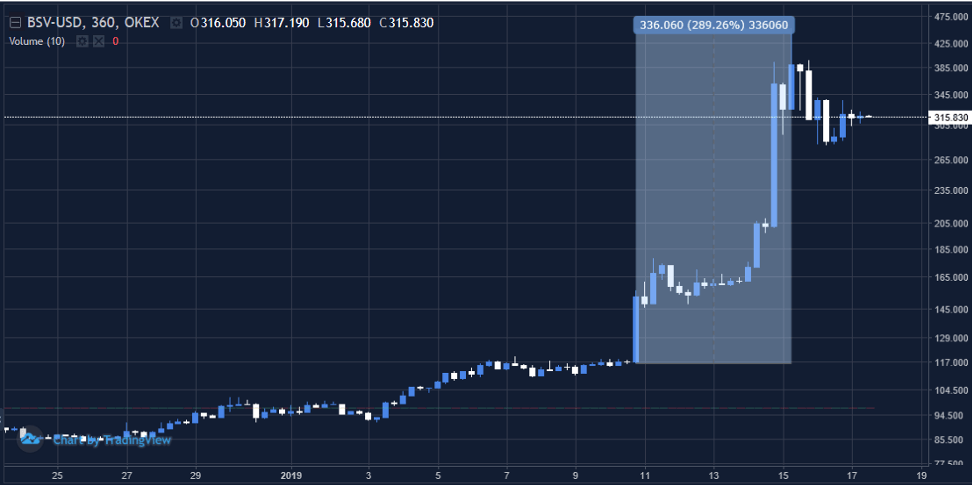

Undoubtedly BSV has been the best performing crypto so far in 2020. OKEx BSVUSD Index, which tracks the weighted average of the BSV prices in the dollar across four leading crypto exchanges, surged from 116 area to as high as 452.24 on Wednesday. At one point, the rally has made BSV briefly took over BCH as the fourth largest cryptocurrency in market cap terms, however, as BSV retreated from its all-time high, it's now sitting at the fifth place on the market cap list.

Figure 1: OKEx BSVUSD Index 6-Hour Chart (Source: OKEx; Tradingview)

While we are not going to dive deep into the reasons behind the massive BSV rally, we would like to study whether if the rally is sustainable. MVRV Ratio could be one of the ways to identify the current BSV market value is above or below its realized value.

MVRV Ratio Suggests BSV Overvalued

The Market Value/Realized Value Ratio could be another piece of the puzzle that provides more information in terms of the realized valuation of a specific crypto asset. Realized value is the total acquisition cost of all tokens in circulating supply; in this case, it would be BSV. If we divide the market cap by realized value, we get the MVRV Ratio.

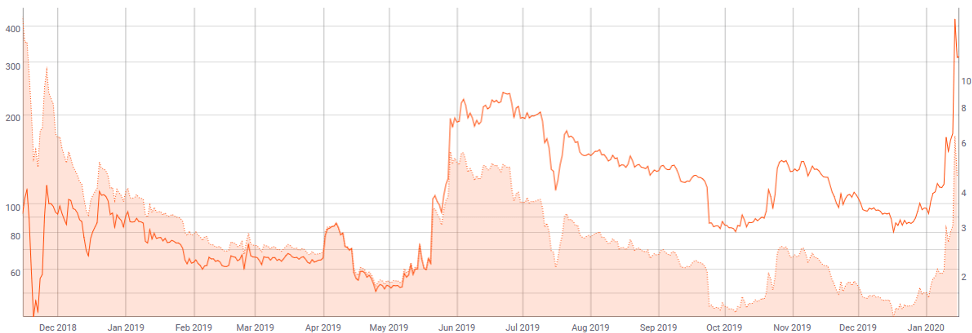

Figure 2: BSV in USD (Line) vs. MVRV Ratio (Area) (Source: Coinmetric.io)

Figure 2 shows BSV's price against its MVRT ratio. We can see that the ratio has been rising alongside the price rally. The ratio jumped to as much as 6.2 before settling down at 4.443. While the reading is not as high as in November 2018, but you can tell the number is still relatively high. Percussively, data also shows that BSV's 365-day MVRT average is 2.56, which is much lower than the current reading, and that could suggest that BSV price may not be sustainable at current levels.

Moreover, the November-December 2018 case is another example of an extreme MVRT ratio-backed price corrections, although the likelihood of repeating a similar correction pattern remains unknown. However, it won't be surprised to see if there's profit-taking activities flood into the markets after these massive rallies.

How to Play?

While traders may find difficulties and lack of instrument to gain exposure in BSV shorting, however, a BSV correction could be an underlying bull for BTC prices. That's because markets would expect some of the trades will be done via the BSVBTC pair. Chart-wise, BSVBTC has also shown a medium-term bearish formation.

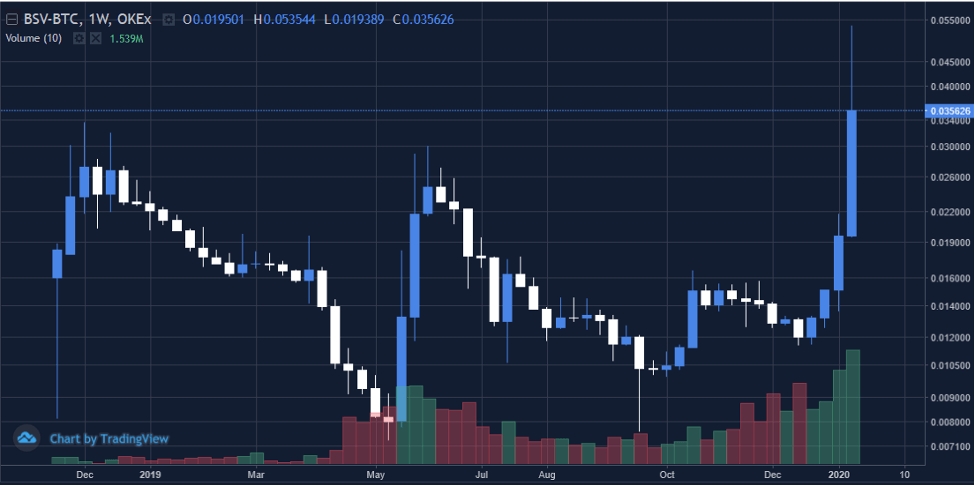

Figure 3: BSVBTC Weekly Chart (Source: OKEx; Tradingview)

Figure 3 shows the weekly chart of BSVBTC, and it seems like a triple-top pattern is in the making. If seen, it could consider as a medium-term bearish signal. While a reversal at this point is still yet to confirm, if that happens, a pullback to the 0.016 area could be possible. Besides, the current candlestick could develop into an evening star pattern, if that seen, would be another bearish signal. Also, momentum indicators (not shown here) suggested that BSVBTC has already in the overbought situation.

Final Words

The recent price actions across different crypto assets could be exciting and could trigger more FOMO trades to get into the markets. In such a situation, risk diversification and money management would be especially important when it comes to trading. On the fundamental front, BSV is expected to have its "Genesis" hard fork in early February, which could be another risk event for traders. It would be interesting to see how the market would take on this upgrade.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?