- Ethereum Merge has begun, leaving proof-of-work behind for a new proof-of-stake consensus mechanism.

- Developers in the DeFi ecosystem believe Ethereum’s Merge will not lower gas fees or improve scalability, transaction costs could remain high.

- Demand for Ethereum derivatives skyrocketed with the launch of CME group’s ETH options.

Ethereum Merge will have a massive impact on the crypto ecosystem. Despite its short history, crypto has several key updates lined up, the Merge and the ETHW hard fork. The successful completion of the Merge could alter the future of the DeFi ecosystem and several dApps that rely on the Ethereum blockchain for conducting business.

Also read: Ethereum v. Bitcoin: ETH is winning despite BTC price rally to $22,000

What is the Ethereum Merge and why it matters

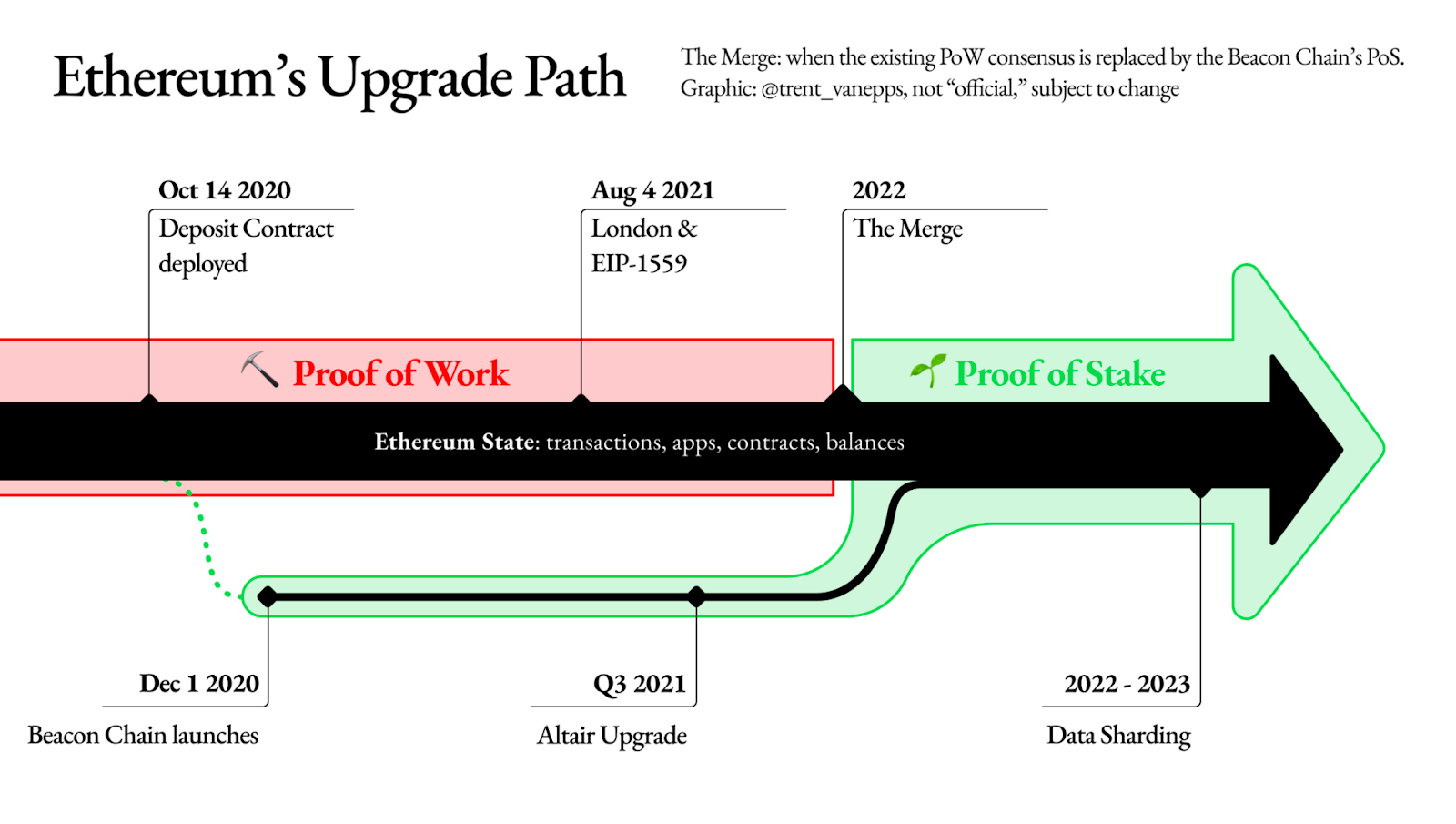

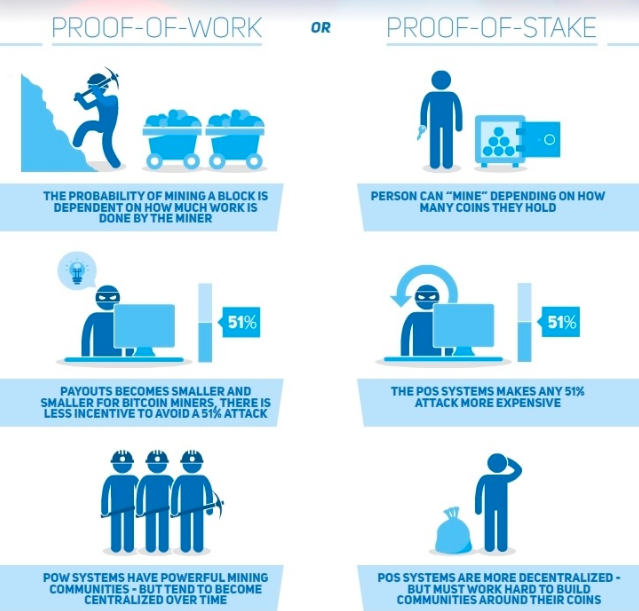

The Merge is Ethereum’s multi-year planned transition for the altcoin’s blockchain. Ethereum’s objective is to move from proof-of-work to proof-of-stake and reduce the blockchain’s carbon imprint by 99.95%. The launch of the Beacon chain in 2020 was the first step towards this transition and the completion of the last shadow fork was the pre-final one.

Ethereum Merge upgrade path

Miners and proof-of-work supporters have announced a hard fork to keep the blockchain alive for those unwilling to move to the proof-of-stake chain. Therefore, with the launch of the proof-of-stake chain, a proof-of-work chain is likely to exist in parallel and continue functioning.

The Merge represents an end of an era for Ethereum and all efforts of developers and the team are focused on scalability and lowering transaction costs post the migration. The main Ethereum blockchain, resources, key partners and institutions are likely to embrace the proof-of-stake version, driving ETH adoption higher.

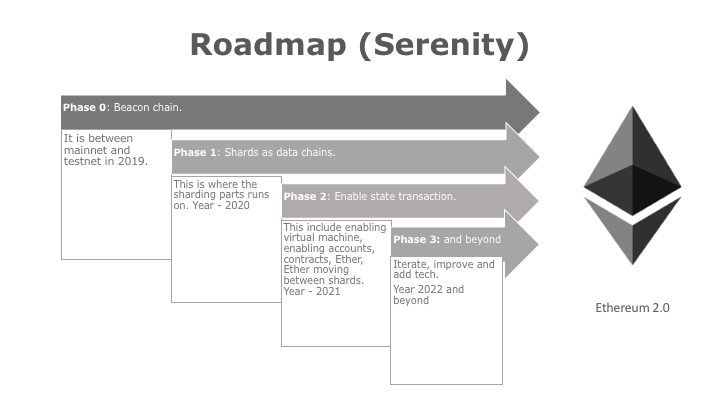

Ethereum’s transitional journey begins with the Merge. The transition to proof-of-stake marks a half-way point in Ethereum’s journey, a 55% completion as developers eye the next major goal, sharding. Sharding aims to improve scalability via segmenting the Ethereum blockchain into parallel portions.

Roadmap to Ethereum 2.0, PoS and Sharding

Ethereum Merge: Risks and challenges

Industry experts, crypto proponents and influencers have evaluated the potential risks and challenges associated with Ethereum Merge. Find the list below:

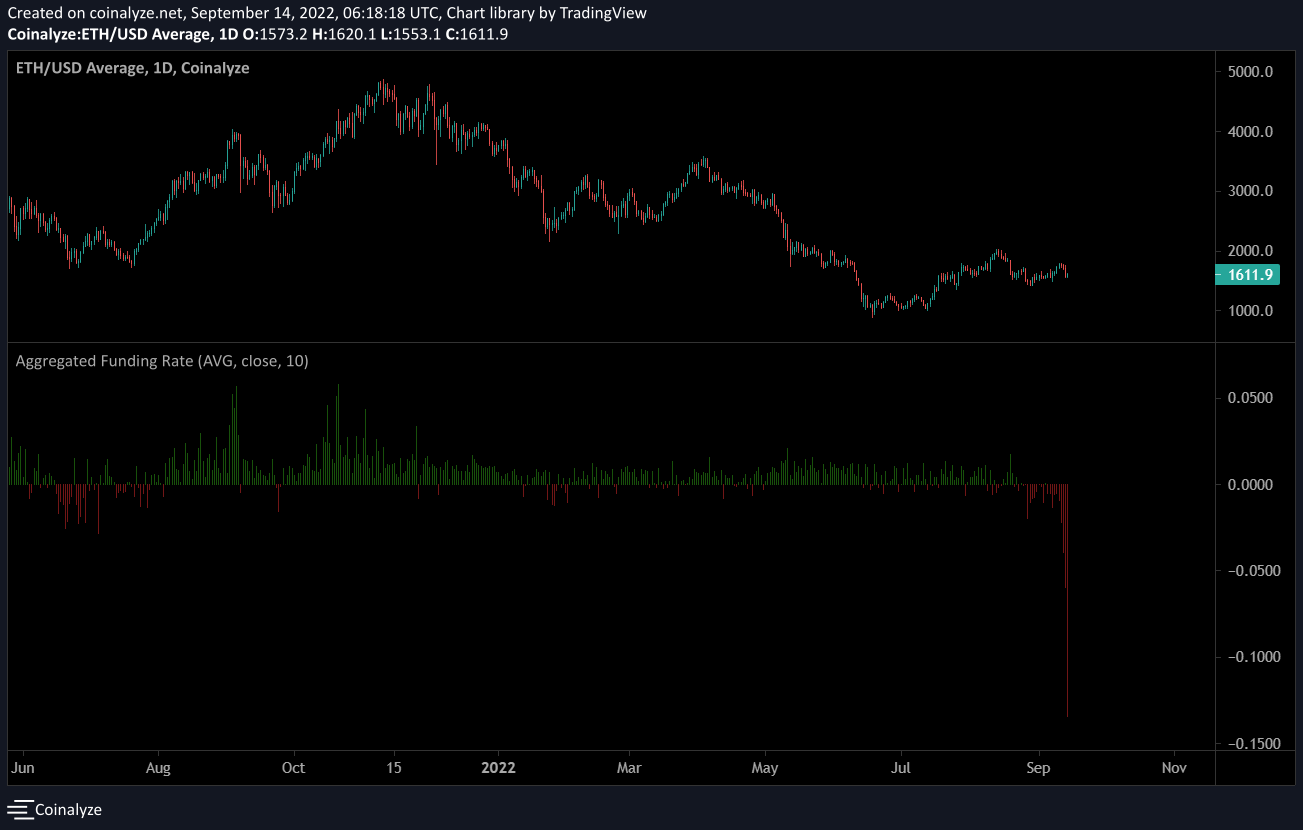

- Merge could trigger negative funding: There is rising concern among investors about negative funding. Traders with a strategy to buy Ethereum in spot markets and sell or stock and hedge in the future will receive ETHPoW tokens. These tokens will be airdropped for no additional cost and sold in open markets. Excess short positions in perpetual and futures contracts as a result of these trading strategies could result in negative funding. Negative funding implies traders are bearish, therefore it has emerged as a cause of concern. Based on data from Coinalyze, the average Ether funding rate across major exchanges- Binance, FTX, Bybit, OKEx and Deribit has dropped to its most negative ever. Holding Ethereum short positions is more expensive than it has ever been in history.

Ether funding rate across major cryptocurrency exchanges

- Minor glitches could pop up along the way: With the current difficulty, hash rate and the pressure on the successful completion of the Merge, there is a likelihood of certain minor glitches that might show up and be adjusted along the way. Proof-of-stake validators will shoulder the responsibility that miners took on, since Ethereum’s launch, therefore glitches are likely to show up.

Differences between proof-of-work and proof-of-stake

Trading strategies for Ethereum post-Merge play

The successful completion of Ethereum’s Merge could act as a catalyst, fueling bullish sentiment among holders. Traders holding “spot” Ethereum could benefit from the hike in Ethereum’s price.

Traders hedging their bag of Ethereum could consider moving a small portion of their portfolio to a short position using futures contracts. “Timing the market” is key to this move, any short-term losses experienced could be adjusted against the small percentage of holdings from the portfolio. If Ethereum price climbs post Merge, you could lose your holdings. However, hiccups during the Merge could fuel a dump and investors could shed their holdings, therefore, your position turns into a profitable one.

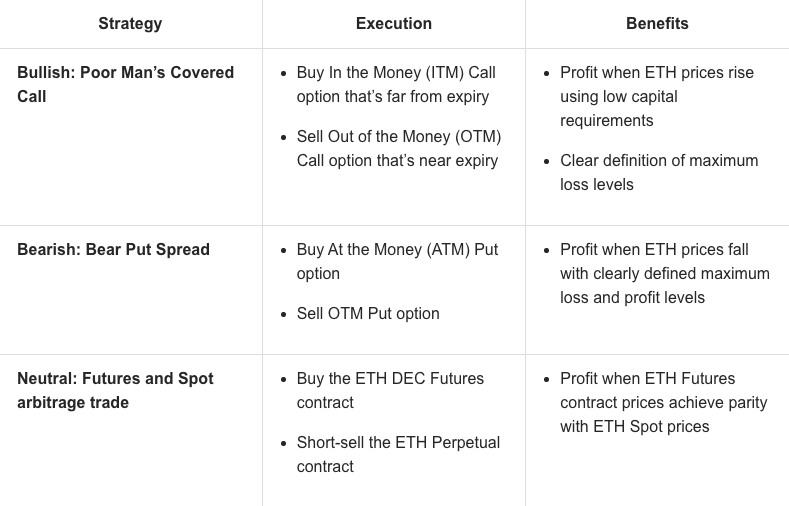

Bybit’s recommended trading strategies for Ethereum Merge play

$22 billion bet on ETH2, good or bad?

Ethereum’s Merge will decide if the $22 billion worth of Ethereum deposited to the staking contract was a good bet or a bad one. In the days leading up to the Merge, there was a massive spike in Ethereum deposited to the ETH2 contract. This has fueled anticipation and excitement in ETH holders ahead of the Merge.

ETH2.0 total value staked

It is important to dispel the myth that staked Ethereum will be unlocked post the Merge, increasing the pressure on ETH. Staked Ethereum withdrawals will be enabled through another key upgrade nearly six months post the Merge. A validator would have to exit and there is a limit on the number of validators that can exit per epoch.

CME group launched Ether options in response to Merge

CME Group, a leading derivatives marketplace, announced the launch of Ether options in response to the skyrocketing demand for Ethereum derivatives ahead of the Merge. Tim McCourt, global head of equity and FX products at CME Group told CoinDesk,

In 2022, Bitcoin and Ethereum are trading nearly the same. We look at the totality of our products, options as well as futures products and they are doing similar volume. There is a distinct enthusiasm surrounding Ethereum products. Ether has its own distinct community. Institutions…are gravitating towards the Ethereum network.

Where is Ethereum price headed post Merge?

Alex Krüger, crypto trader and analyst revealed his short-term bullish outlook on Ethereum ahead of the Merge. The analyst tweeted:

This is strictly a short-term post. I have my short term hat on at the moment. I'm very bullish on $ETH mid to long term.https://t.co/urFfYNeCZb

— Alex Krüger (@krugermacro) September 15, 2022

NFTherder warned traders in the crypto community against scams surrounding pre and post Ethereum Merge. There is a spike in fake staking pools, fake eth pow/pos airdrops, fake tweets and giveaways from vitalik, ethereum, support impersonations and “upgrade your eth, wallet, metamask scams.”

With less then 8 hours till the $eth merge it's important to remind everyone not to fall victim to any of these merge scams

— OKHotshot (@NFTherder) September 14, 2022

- fake staking pools

- fake eth pow/pos airdrops

- vitalik, ethereum, support impersonations

- upgrade your eth, wallet, metamask scams

Stay vigilant❗️

A large percentage of analysts remain bullish on Ethereum as the altcoin’s social engagements measured by crypto intelligence provider LunarCrush hit a daily all-time high of 1.88 billion.

The last run-up in Ethereum price before the Merge upgrade sets in

Akash Girimath, leading crypto analyst at FXStreet evaluated the Ethereum price trend and presented the following take.

Ethereum price is most definitely going to experience volatility as it heads into the Merge upgrade in a few minutes. The popular trade among traders has been to buy spot ETH and hedge their positions via shorting September futures.

Since holding spot ETH will allow the holders to be eligible for ETH Proof-of-Work (POW) fork, it could potentially squeeze the price higher during the final moments of the Merge. Adding credence to this run-up is investors rushing to cover their short positions, which could create a short-term surge in bullish momentum. Hence, investors can expect a move to the $2,000 psychological level that creates a double top. This move could be the perfect ending for Ethereum price before the developers upgrade the beacon chain into Proof-of-Stake (POS).

As the volatility fizzles out, market participants can expect a sell-off as investors begin to offload their spot ETH. This bearish spike could knock ETH down to the stable support level at $1,280 and depending on the intensity of the incoming selling pressure, Etheruem price could drop to $1,080.

ETH/USD 12-hour chart

Regardless of the short-term bullish outlook, investors need to be careful of the macro bearish outlook. If Bitcoin price sells off, it could steal the spotlight from Ethereum price and cause the market to go down with it.

Please find below the timeline of events leading up to the historic Ethereum Merge:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?