- Altcoins have been driving the market higher this week.

- Bitcoin lagged behind, vulnerable to bearish sentiments.

All major altcoins demonstrated strong growth while Bitcoin reluctuntly osclillated in a tight range and stayed vulnerable to bearish sentiments. The first digital currency spend the best part of the week hovering around $10,200 level. Though Bitcoin bull’s hearts might have missed a bit when the price dropped to $9,600 on September 18. The sell-off proved to be temporary as Bitcoin recovered above critical $10,000 pretty soon; however, the upside momentum faded away and left the coin in the old range. The total capitalization of all digital assets in circulation increased to $269 billion from $261 billion a week ago, while Bitcoin’s market share dropped to 67.7%.

What’s going on in the market

Stellar (XLM) is the best-performing altcoin out of top-20. The coin gained over 52% of its value in a couple of days and touched $0.0963, which is the highest level since the end of July. At the time of writing, XLM/USD is changing hands at $0.0755, with over 33% on a week-on-week basis. Fundamental reasons behind the Stellar growth remain unknown. Notably, on the previous week, Stellar Foundation announced the airdrop for Keybase account holders, though this event can hardly qualify for a growth trigger.

Ethereum is another big winner of the week with over 20% of gains. The second largest digital asset settled well above critical $200.00 handle and topped at $224.68. The strong upside momenty was initially trigged by geneally bullish sentiments on the cryptcurrency market. Later on, technical and speculative factors created strong bullish environment and pushed the price higher.

Ripple (XRP) has been caught in controversies this week. While the coin outperfromed the market on September 18. The coin smashed several important resistance levels and hit $0.3269 before the downside correction started. At the time of writing, ETH/USD is changing hands at $0.2930, with 15% of week-on-week gains. Notably, Ripple allegedly dumped about 30 million tokens in circulation after the price grew by 16% in a matter fo hour, One again, the community accused the company in price manipulation, though RIpple denied the accusations - nothing new here. Anyway, XRP has been doing well with the rest of altcoins.

Meanwhile, Bitcoin was not responsive to this altcoins’ rally. Moreover, the first cryptocurrency reacted negatively to the news that regulators are tightening approach towards digital assets. Also, the news that VanEck withdrew its Bitcoin ETF proposal dealt another blow to the first cryptocurrency.

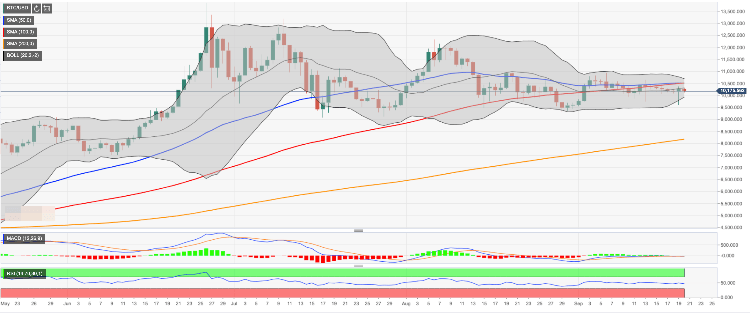

BTC/USD, 1D chart

On a daily chart, BTC/USD is sitting in a tight range capped by the middle line of daily Bollinger Band ($10,300) on the upside and $9,000 ( the lower line of daily Bollinger Band) on the downside. We will need to see a sustainable move past these barriers to escape the range and start developing a directional movement.

Considering the downward-looking RSI on a daily chart, the coin may be vulnerable to the bearish sentiments and stay close to the lower boundary of the above-said consolidation channel. Once it is out of the way, the sell-off is likely to gain traction with the next focus on $9,600 (the recent low) and psychological $9,000. This support is likely to slow down the bearish momentum, though, if it is broken, BTC/USD may retest $8,173 (SMA200 daily) and $8,000.

On the upside, a strong move above $10,300 will open up the way towards even stronger resistance created by a combination of SMA50 and SMA100 daily at $10,500. The barrier awaits the bulls on approach to $10,700 (the upper line of daily Bollinger Band). This barrier separates us from a stronger barrier at $11,000 that stopped the recovery in the beginning of September.

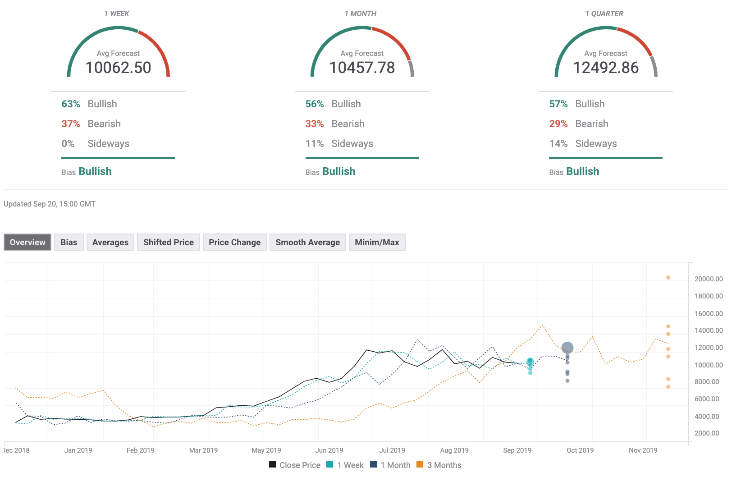

The Forecast Poll of experts improved significantly since the previous week. Expectations on all timeframes are bullish, while average price forecasts are well above 10,000. Moreover, the quarterly forecast implies that the price may move above $12,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

MANTA suffers 4% pullback after unlocking tokens worth $40 million

Manta Network (MANTA) unlocked over 8% of its circulating supply on Thursday. The unlocked tokens were airdropped and distributed in public sale, according to data from Tokenunlocks.

XRP struggles to recover as lingering Ripple lawsuit could reach Supreme Court, former SEC litigator says

The SEC vs. Ripple potential showdown at the Supreme Court is likely, says former SEC litigator Ladan Stewart. XRP Ledger calls developers, businesses and investors to build on the blockchain, extending Apex 2024 registration until April 30.

Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

Merlin chain’s TVL added 20% this week, and crossed $800 million on Thursday. Bitcoin Layer 2 assets noted double-digit losses in the past week. Stacks, Elastos, SatoshiVM, BVM are hit by a correction as Bitcoin hovers around $61,000.

If Bitcoin restarts bull run, these altcoins are likely to explode Premium

If Bitcoin’s consolidation ends and the bull run resumes, altcoins are likely going to trigger a massive rally. Last cycle’s hot tokens like SOL, AVAX, WIF, ONDO, etc., could see renewed enthusiasm.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.