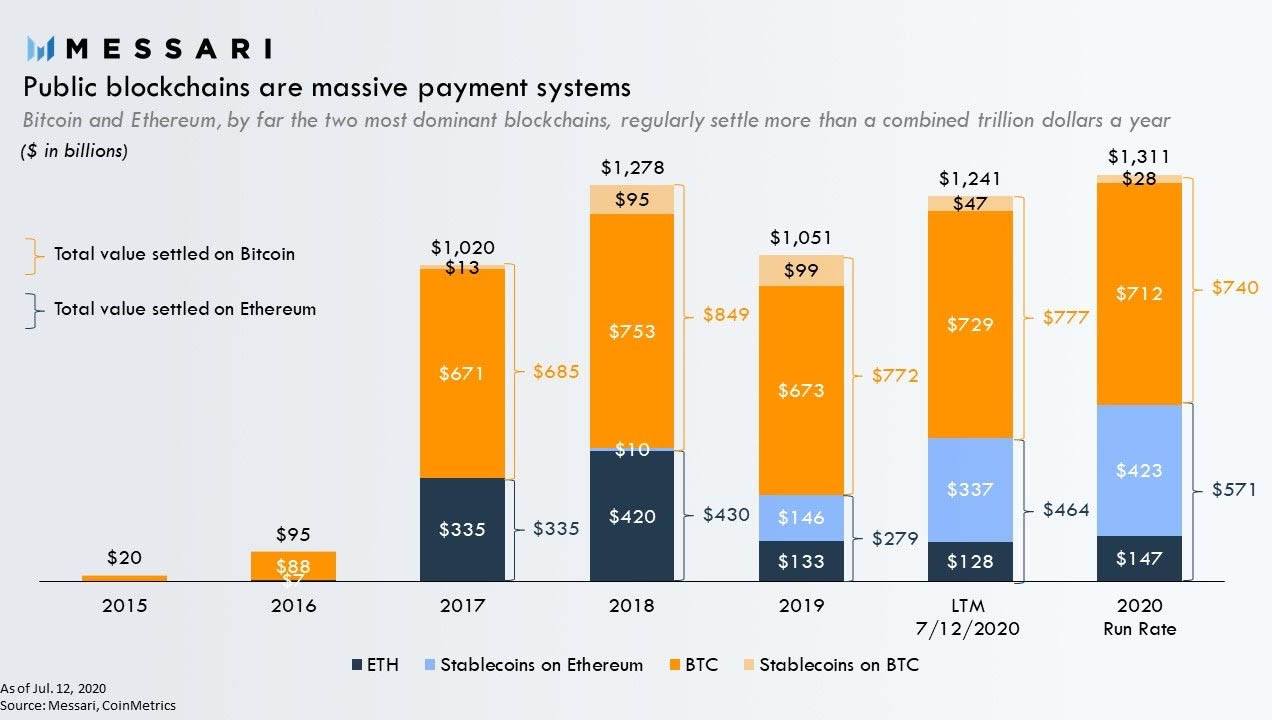

Bitcoin has settled $712 billion already in 2020, while stablecoins have already seen their biggest year ever.

Cryptocurrency public blockchains will settle more in 2020 than ever before and have already topped $1.3 trillion, data shows.

Compiled by analytics firm Messari on July 21, the figures reveal that Bitcoin (BTC) has settled $712 billion so far this year, while Ether (ETH) is on $147 billion.

Messari: Blockchains have not “failed” as payment systems

The Ethereum network, which supports stablecoins including market cap leader Tether (USDT), has added another $423 billion to the total. Growth in combined stablecoin transaction value is conspicuous, with the first seven months of 2020 topping last year’s total of $337 billion and 2018’s $146 billion.

For Messari, the overall record for settlement is a firm rejection of the concept that cryptocurrencies cannot compete with legacy systems as a means of payment.

“Many people think blockchains have failed as payment systems. The typical argument goes something like, ‘you can’t buy a cup of coffee with Bitcoin, therefore it has failed as a payment system,’” it summarized.

“Along this line of argument cryptocurrencies like Bitcoin and Ether also suffer from extreme volatility making them unable to serve as payments mediums. Both premises aren’t entirely inaccurate, but the conclusion definitely is. In fact it is about $1.3 trillion wrong.”

Public blockchain settlement comparison. Source: Messari/ Twitter

Continuing, researcher Ryan Watkins argued that it was unsuitable comparing blockchains to payment networks such as Visa.

A better comparison would be the umbrella settlement systems of the fiat realm, such as Fedwire.

“The purpose of these systems is to fully guarantee payments so that they cannot be repudiated, reversed, or charged back without agreement of the recipient, and they’re meant to settle immediately,” he wrote on Twitter.

Removing fiat ties

Cryptocurrency consumer payments are still firmly within the discovery phase. Many mainstream options represent a “bridge” to fiat, such as cryptocurrency debit cards.

These, and anything else which is dependent on the fiat economy, are also subject to disruption due to centralized control of the underlying infrastructure.

As Cointelegraph reported, the liquidation of Germany’s Wirecard earlier this month temporarily caused European cryptocurrency debit cards to stop working.

Decentralized cryptocurrencies, and specifically Bitcoin, are designed to make it impossible for a third party to control network activity.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?