Bitcoin (BTC) has in total suffered just 10% from the coronavirus outbreak which obliterated stocks and caused the United States to print $6 trillion.

That was according to the latest quarterly price data from monitoring resource Skew.com on March 31, which showed that for Q1 2020, BTC/USD is only down by around 10.7%.

Bitcoin streets ahead of macro assets in 2020

At press time, the pair remained higher after seeking new support at $6,500 on Monday.

At those levels, the pair is just $700 lower than its position at the start of 2020, and $3,800 beneath its current year-to-date all-time high of around $10,300.

Bitcoin has advanced 75% in the two weeks since hitting its quarterly low — in a volatile period, that recovery at one point reached 90% as markets peaked at over $7,000 on some exchanges.

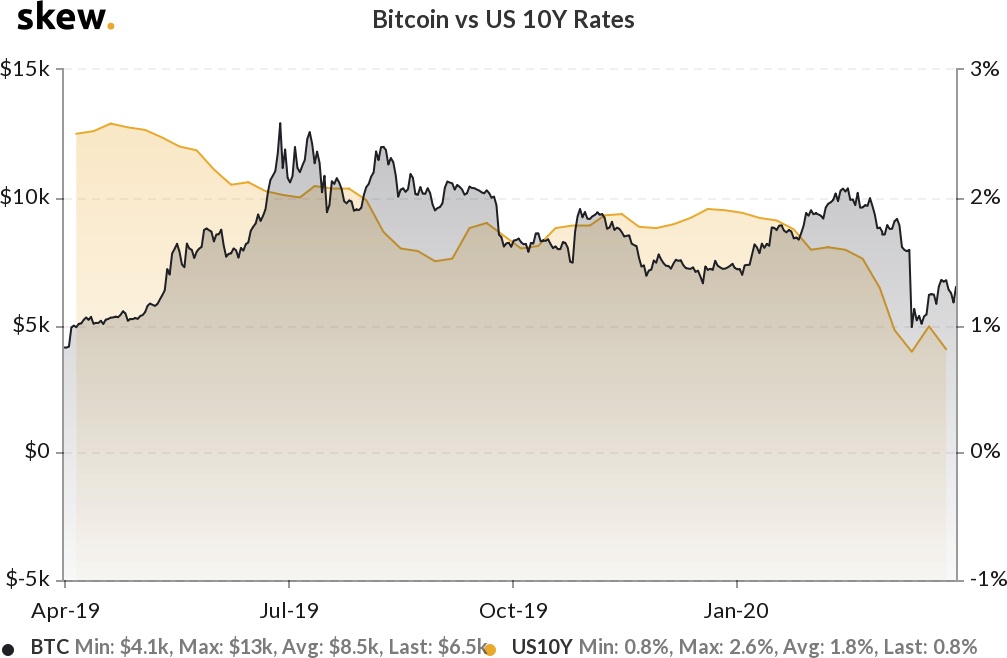

Bitcoin versus U.S. 10-year bond yields, 1-year chart. Source: Skew

As such, Bitcoin now looks increasingly resilient as an investment option versus traditional markets, which are still trailing much more as a result of coronavirus.

That was despite intervention by central banks on a scale never before seen in history — as Cointelegraph noted, the U.S. money printing exercise alone recreated the country’s entire GDP of 1990 and added it to the dollar supply.

Indicator flashes green as lucrative Q2 looms

Statistically, Q2 in a given year tends to be the most profitable for Bitcoin holders. Since 2013, just one Q2 has delivered negative returns, Skew reveals, with average gains totaling 65%.

Bitcoin quarterly returns since 2014. Source: Skew

Signs of potential are becoming visible on some indicators. As Bloomberg reported on Tuesday, the GTI Vera Convergence Divergence Indicator is giving the Bloomberg Galaxy Crypto Index its first “buy” signal in three months.

The mood among analysts is also turning more optimistic. In his latest forecast on Monday, veteran trader Tone Vays said that he no longer expected BTC/USD to find new lows of less than $3,700.

Earlier in March, he had warned that Bitcoin could plunge to as low as $2,800. Even if this were still to happen, he added, it would not pose a threat as long it was before May’s block reward halving event.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Lido DAO announces new phase on Ethereum with Simple DVT module

Lido DAO voted on the deployment of the Simple DVT module nearly six months ago, it is ready for mainnet as of April 17. Simple DVT helps to make Lido’s technology accessible to more users. LDO price is down nearly 3% in the past day.

New altcoins crash and burn, but this altcoin shows strength Premium

Binance Coin price shows a bullish pennant continuation pattern. BNB could range between the $600 to $526 levels until the skies clear out for Bitcoin. The altcoin could see a massive gain with the upcoming BEP-336 upgrade.

Cronos price fails to recover despite network upgrade

Cronos (CRO) is an Ethereum Virtual Machine (EVM) compatible chain in the Cosmos ecosystem. A mainnet upgrade was completed early on Wednesday and the asset’s price declined nearly 2% in the past 24 hours.

XRP tests $0.50 resistance after Ripple CLO says pretrial conference with SEC did not take place

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.