Bitcoin (BTC) outperforms major assets such as gold, real estate and stocks if an investor holds it for just four years, popular data confirms.

Highlighting the success of Bitcoin as an investment tool on Jan. 22, veteran cryptographer Nick Szabo noted Bitcoin is so far unmatched compared to many other assets broadly considered profitable.

Szabo: BTC hodlers “have low time preference”

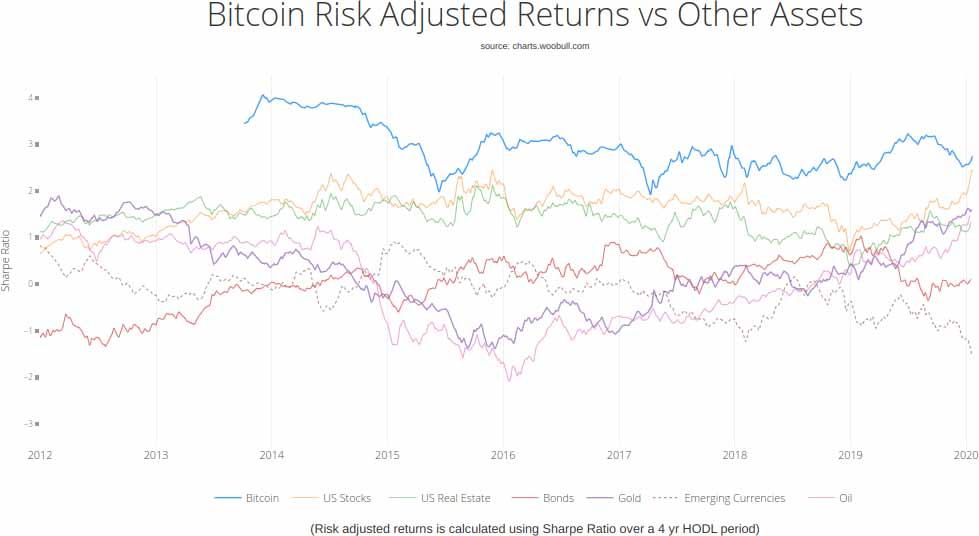

Szabo linked to a chart from statistics resource Woobull, which placed Bitcoin against United States stocks and real estate, as well as gold, bonds and emerging currencies since 2012.

Using the Sharpe ratio to calculate risk-adjusted returns, Woobull creator Willy Woo gave Bitcoin a score for every four-year “hodl” period from 2013 onwards — four years after Bitcoin’s emergence.

That timespan reflects gaps between Bitcoin block reward halvings when the supply available to miners of each block of transactions reduces by 50%.

The result is Bitcoin reigns supreme over other investments, only briefly seeing competition from stocks at intermittent points during the previous decade.

Bitcoin 4-year risk-adjusted returns since creation. Source: Woobull

For Szabo, Bitcoin’s impressive risk-adjusted returns go hand in hand with its very nature as a decentralized form of hard money which is free from manipulation by governments and central banks.

He summarized:

“Successful Bitcoin holders have low time preference & judge over extended periods, e.g. risk-adjusted return over 4-year holding periods. If an economist has not researched this strong market signal for explanations of supply & demand, they don't have a useful opinion about it.”

Time preference refers to how a person either saves money, knowing it will allow for a better life in terms of wealth in the future, or spends and borrows it out of uncertainty over its value.

Bitcoin escapes “subjective decisions”

As Cointelegraph previously reported, Bitcoin’s simple gains since its inception already made it the leading investment of the 2010s.

At nearly 9,000,000%, the cryptocurrency has more than proven itself to its earliest “hodlers” in terms of returns.

By comparison, risk in the investment options included by Woo stems from their susceptibility to react to third party meddling, Szabo meanwhile continued. For example, emerging currencies, in particular, react to the dollar, which in turn is not allowed to develop according to free-market conditions, as the Federal Reserve “manages” it.

Szabo concluded:

“Dollar prices of assets are very dependent on the subjective decisions the Fed makes about interest rates, money supply, asset financing and asset purchases, so you should ask them to predict what their own behavior would be in such a circumstance. Even they can't predict that.”

Similar arguments for a central tenet of Saifedean Ammous’ popular book, “The Bitcoin Standard,” which focuses on fiat currency’s weakness due to governments refusing to allow free markets.

At the next halving in May 2020, Bitcoin’s inflation rate is expected to drop to 1.8% — below that of both gold and the Fed’s target for the U.S. economy, further increasing its potential risk-adjusted returns.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Google, Apple could remove Binance from their app store on Philippines SEC request

The Philippines SEC has requested Google and Apple to remove applications controlled by Binance from their App stores. The exchange’s Philippines-based users are finding the exchange inaccessible to remove their funds.

XRP rallies as Ripple slams SEC for penalties, asks regulator to establish likelihood of future violations

Ripple filed its response to the SEC lawsuit on Monday, arguing that XRP institutional sales before and after the court ruling show no disregard for the law. The firm asks for a civil penalty of no more than $10 million against the $2 billion requested by the SEC.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?