- Bitcoin bulls retain control over the market.

- Geopolitical uncertainty feeds the demand for the first cryptocurrency.

- The technical picture implies that the growth may continue.

Bitcoin bulls are back from summer holidays. The first digital currency regained some ground lost during the previous week and came close to critical resistance $11,000. On Friday, the coin resumed the upside after tow days of consolidation in a tight range, while its market share jumped to $71.0, which is the highest level since March 2017. Notably, the total capitalization of all digital assets in circulation retreated to $270 billion from $272 billion a week ago. It confirms the idea that altcoin’s season is nowhere to be seen as of yet.

What’s going on in the market

Bitcoin’s recovery if often attributed to its safe-haven features. Geopolitical uncertainty and dire and macroeconomic conditions in certain countries drive the demand for “digital gold” higher as investors are unhappy with the dynamic of traditional assets and have to look for alternatives.

At the beginning of the week, Argentina established capital controls to stop the money outflow from the country. Investors took it as a signal to buy Bitcoin fiercely As a result, BTC traded with $300 premium on Argentinian cryptocurrency platforms, while the price on p2p platform LocalBitcoins was $1000 higher than an average BTC exchange rate.

Read also: Foreign currency crisis in Argentina might have triggered Bitcoin growth

Argentina might have served as an initial trigger for BTC rally, though it is not a single geopolitical reason behind the rally. Thus, Brexit developments make traders and investors nervous also. Many UK and EU companies access potential financial damage in case of no-deal Brexit, while everyday people try to protect their savings in case of a British pound lash crash. It is worth noting, that GBP crashed to the lowest level since January 2017 and touched $1.20 against USD amid this never-ending Brexit torture.

Read also: No-deal Brexit to push Bitcoin (BTC) to a new record high

Monero and Ethereum Classic are the best-performing altcoins on a week-on-week basis. Thus, XMR/UAD has gained over 16% in recent 7 days, while ETH/USD has grown by 11.5%. Ethereum Classic developers are getting ready for an Atlantis hardfork that is scheduled on September 13. The update is expected to improve stability and add new features to the network to meet the community needs.

Read also: Ethereum Classic (ETC) beats the market with 8% gains

Also, upcoming launch of institutional trading platform Bakkt is another potential reason for Bitcoin’s growth. The community believes that institutional demand will drive the price higher once investment funds and large asset managers get access to the physical Bitcoin futures market. Bakkt starts accepting deposits today, on September 6.

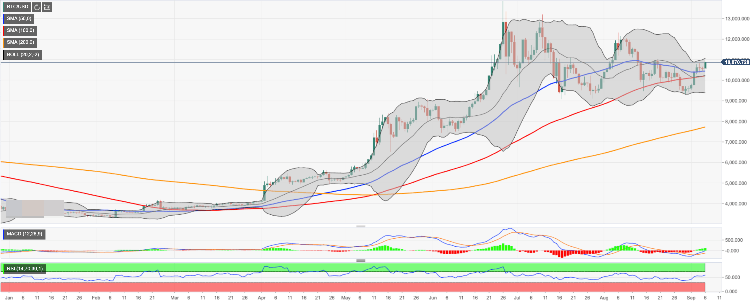

BTC/USD, 1D chart

On a daily chart, BTC/USD has been growing five days out of seven. The coin came close to $11,000 during European hours on Friday, having gained nearly 14% in recent seven days. Once this strong psychological and technical barrier is out of the way, the upside is likely to gain traction with the next focus on $12,395 (the highest level since August 8 ) and $13,000 strengthened by the upper line of weekly Bollinger Band.

Considering the upward-looking RSI on a daily chart, the bullish trend may gain traction within recent weeks, provided that the fundamental background remains supportive for the cryptocurrency market.

On the downside, the initial support is seen on approach to $10,400. It is created by SMA50 (Simple Moving Average) on a daily chart and followed by $10,400 (SMA100 and the middle line of Bollinger Bandon the same timeframe). Naturally, the critical barrier awaits us on approach to psychological $10,000. As long as the price stays above this barrier, Bitcoin is on recovery mode. However, once it is broken, the sell-off is likely to gain traction with the next focus on $9,400 (the lower line of 1-day Bollinger Band).

Vital support that comes at $9,000. This area has stopped the downside on several occasions since July. A sustainable move below this handle will worsen the technical picture and return the long-term bears to the market.

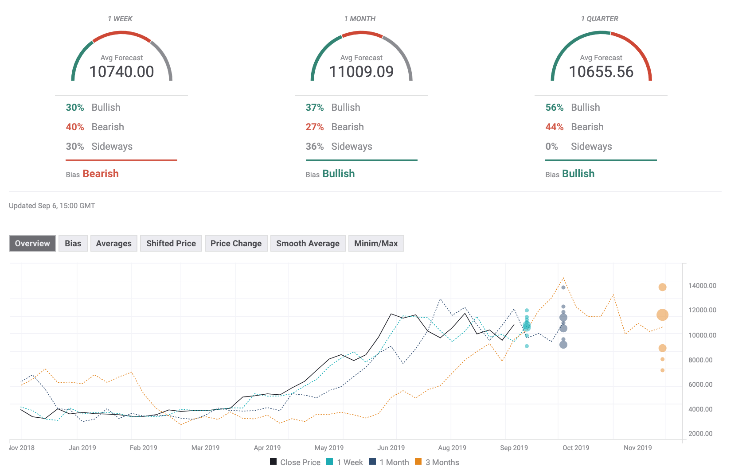

The Forecast Poll of experts improved slightly since the previous week. While the short-term expectations are bearish, the mid-term and long0term forecasts are positive as the majority of forecasts imply that the price may settle above $10,000 and move towards $11,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?