- Bitcoin breaks free from a tight range and settles above $8,000.

- The cryptocurrency market is driven by positive sentiments despite mixed fundamentals.

- The long-term Bitcoin’s bullish trend is gaining traction.

The cryptocurrency universe staged a good recovery this week. Bitcoin has settled above $8,000 as the positive sentiments returned to the market.

What’s going on

The cryptocurrency industry is bubbling with events and news; however, few of them have potential to influence the market as it is oh so typical for cryptocurrencies to live their own lives and be very picky about the things they react to.

Regulators all over the globe continue to tighten the grip over the industry on an attempt to take under control the new type of asset that is considered very risky due to volatility, high level of fraud and cybersecurity issues. Thus, the Lithuanian government approved the changes to anti-money laundering legislation to include the cryptocurrency exchange operators into the scope of the law.

Basically, the crypto-related companies are now in the same boat with traditional finance firms. They have to register with the regulator and comply with all AML procedures, including customer identity verification. This requirement applies to transactions over 1,000 euro. The deals worth over 15,000 should be reported to the dedicated authority.

Also, the ministers of finance from G20 countries requested FATF (Financial Action Task Force) to develop recommendations and guidelines for cryptocurrency companies and asked the Financial Stability Board (FSB) to monitor risks. It all boils down to the fact that the global political and economic elite wants to be on top of current developments within the industry.

Meanwhile, the business has spotted the opportunities offered by blockchain and cryptocurrency technologies. Many high-tech and financial moguls like Visa, Facebook, Amazon, Uber, and Ubisoft are joining the game to capitalize on the innovations. Thus, in the latest development, Ubisoft, the company behind such iconic games like Assassin’s Creed and Far Cry, is said to create a marketplace based on Ethereum blockchain.

Also, Amazon buyers may soon be able to purchase goods for ETH coins through the partnership with B2B platform Opporty. This development has the potential to boost ETH popularity and promote its mass adoption.

Facebook and its unconfirmed cryptocurrency project is another hot topic of the week. According to some knowledgeable but anonymous sources, Visa, Uber, Mastercard, PayPal, among others paid $10 million each to participate in the new network. The invested money will form collateral reserves of the stablecoin that will be pegged to a basket of fiat currencies.

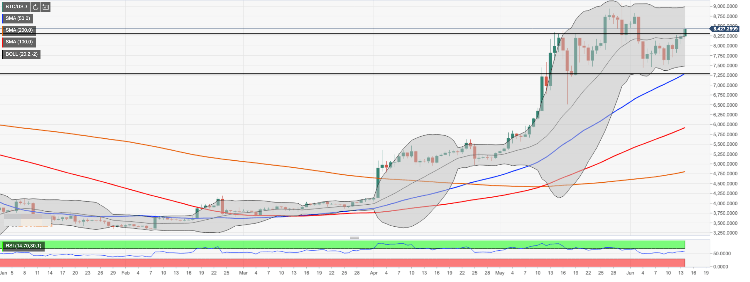

BTC/USD, 1D chart

BTC/USD has developed a steady upside trend this week with four green daily candles out of five. The coin managed to settle above $8,000, which translated into an extended recovery towards the recent high $8,449.

While the price has retreated to $8,400 by the time of writing, the upside potential remains strong with the next solid resistance as high as $9,000. Strengthened by the upper line of 1-day Bollinger Band, this area may become a hard nut to crack for the bulls. However, Once it is cleared, the upside is likely to gain traction with the next focus on $9,500 (Pivot Point 1-week Resistance 2).

On the downside, BTC/USD needs to stay above psychological $8,000 to retain positive stance. This support area is reinforced by SMA200 (Simple Moving Average) on a 4-hour timeframe. A sustainable move below this handle will open up the way towards the next bearish aim of $7,500. A confluence of strong technical indicators, including the weekly low and lower line of 1-day Bollinger Band is likely to stop the sell-off for the time being.

Once it is cleared, the sell-off is likely to gain traction with the next focus on $7,300 (the lower line of the previous consolidation channel) and $7,000 strengthened by SMA50 (Simple Moving Average) on a daily chart.

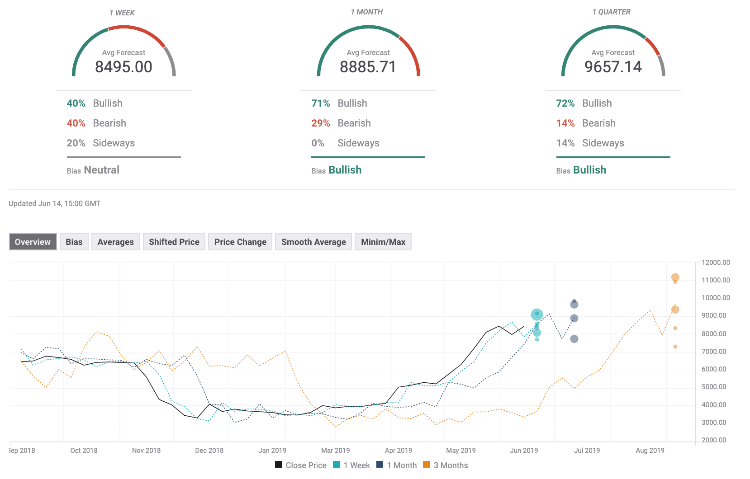

The Forecast Poll of experts improved significantly since the previous week. Expectations on all timeframes are bullish, while average price forecasts are well above $8,000. Moreover, the quarterly forecast implies that the price may move above $9,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.