Bitcoin (BTC) has a maximum 15% chance of falling below $3,800 if current price levels continue, says trader Tone Vays as BTC nears $7,000.

In a YouTube update on March 24, an increasingly bullish Vays updated his outlook for BTC/USD. He argued that at around $6,750, the pair was sitting at resistance.

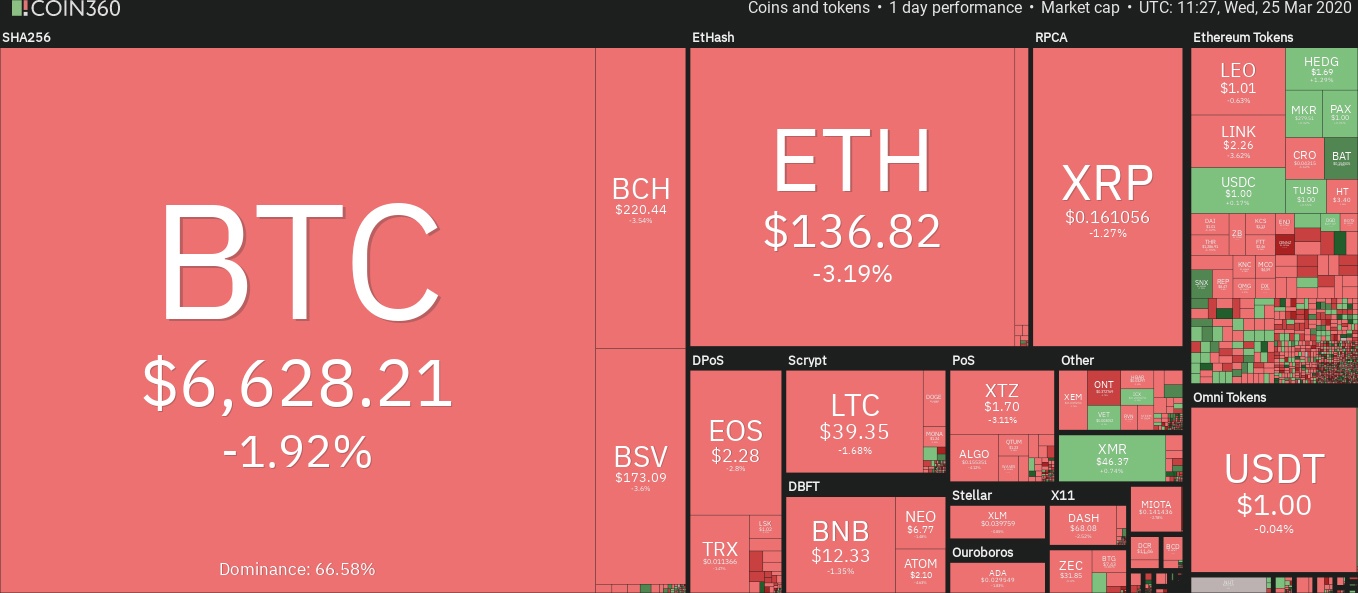

Cryptocurrency market daily overview. Source: Coin360

Vays: Don’t wait for the dip

Break above $6,800 and Bitcoin would all but eliminate the likelihood of dipping to new lows under $3,800 — only a 15% chance would remain.

“Going above $6,800 would maybe give me 85% confidence we’re not going to go below this — and we’re almost there, we’ve almost broken it; we’re sitting at resistance,” he said.

“Right now, I believe there’s a 20-25% chance we’re going to go below $3,800.”

At press time, BTC/USD was gaining momentum towards $7,000, passing the $6,800 threshold to hit $6,920.

As Cointelegraph reported, Vays had previously sounded the alarm about a potential Bitcoin collapse to as low as $2,000 before May’s block reward halving.

Now, however, he told traders that it was foolish to avoid entering the market in the hope of catching the next dip. He continued:

“That still means that you can’t wait; you can’t wait for another pullback to $3,500 — you should be in Bitcoin by now.”

Fed’s “unlimited money” facilitates $100K BTC price

Vays was speaking as United States lawmakers agreed on a giant stimulus package to bail out consumers and businesses over coronavirus. The package, worth an estimated $6 trillion, followed the Federal Reserve embarking “unlimited” money printing.

For multiple commentators, including Binance CEO Changpeng Zhao, fiscal trends suggest that it would be even easier for Bitcoin to hit a $2 trillion market cap.

Dan Held, director of business development at fellow exchange Kraken, added on Twitter:

“$6,000,000,000,000 stimulus package for just one country. And you don't think Bitcoin can reach a $2T market cap? ($100k/coin).”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.