- Christopher Matta reckoned that it is much safer for an investor to hold 20 altcoins as opposed to holding only Bitcoin.

- BTC/USD will continue to use the 100 SMA as a support in the medium-term.

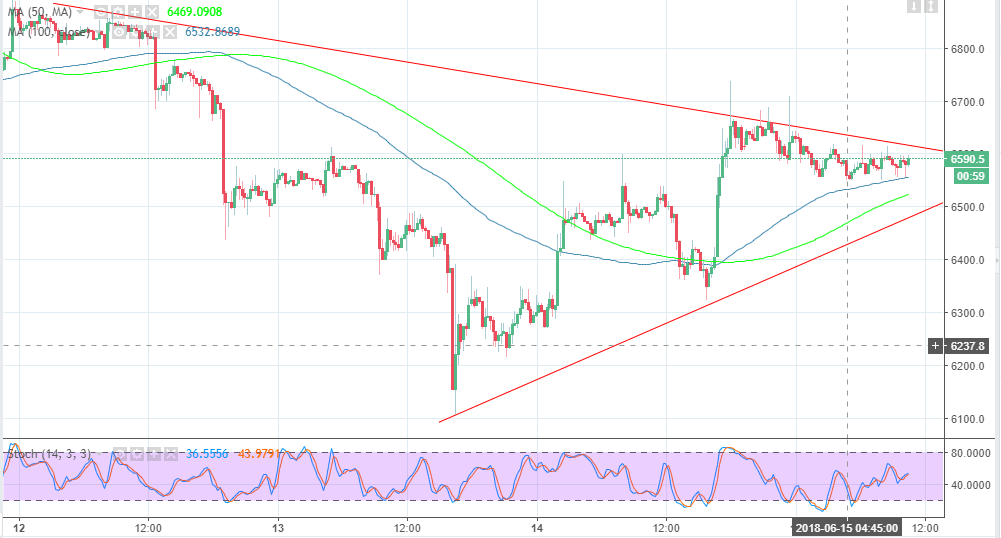

Bitcoin price is trading subtle lock-step movements slightly below $6,600. The bearish trendline is preventing gains marginally above $6,600. BTC/USD opened the session on Friday above $6,630 after which it embarked on a brief downward trend in the Asian trading hours but the support at the 100 SMA has managed to stand ground at $6,550.

While on CNBC’s Fast Money segment, the former Vice-President in the Investment Management Division at Goldman Sachs, Christopher Matta reckoned that it is much safer for an investor to hold 20 altcoins as opposed to holding only Bitcoin. The Co-founder of Crescent Crypto Asset Management said this is a better way to manage risk and adjust returns. He added that his firm chooses cryptos that have shown the ability to retain value after a surge. Crescent Crypto Asset Management largest portfolio holdings include Bitcoin, Ethereum, Ripple as we as Bitcoin Cash.

Bitcoin price technical picture

Bitcoin price has the potential to break the short-term resistance at $6,600 and the bearish trendline mentioned earlier. BTC/USD will continue to use the 100 SMA as a support in the medium-term. Moreover, the gap between the 50 SMA and the 100 SMA is narrowing which could signal more buyers to find an entry. The stochastic is facing upwards and is at 56% confirming the bullish trend. Both the ascending trendline and the zone at $6,500 will prevent declines into the $6,400 range.

BTC/USD 15-minutes chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?