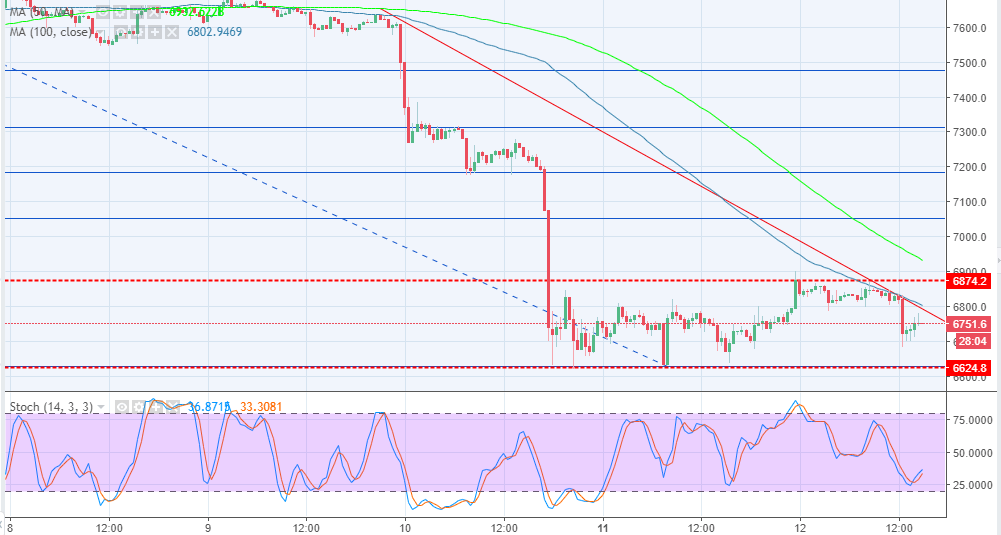

- Both the 100 SMA and the descending trendline are limiting gains at $6,800.

- BTC/USD to use the support at $6,700 in the short-term, but $6,600 will be instrumental in stopping further declines.

The recent downward movements have culminated in Bitcoin price trading within a ranging channel. The Bulls lack a fresh catalyst to shake off the bears and correct higher above $7,000. The recovery since the weekend declines has been locked below the resistance encountered at $6,900.

Attempts to break above the descending trendline were thwarted with high selling pressure on Tuesday where BTC/USD rejected a support area at $6,800. The buyers, however, stood their ground slightly above $6,700. Both the 100 SMA and the descending trendline are limiting gains at $6,800 although a bullish momentum is battling to break barriers towards $7,000.

The bear activity brought the price back to the drawing board in the session on Tuesday at $6,700. This has brought back the buyers who are pushing for retracements towards the upper supply zone above $6,800 but within the range. $6,900 is a breakout to the upside but a drop past $6,700 is a breakdown and could see BTC/USD test the demand zone close to the lows traded on Monday this week of $6,628.

The stochastic is still in the oversold region put heading upwards, besides the moving average gap sends signals for more buying entries, both indicators confirm the bullish trend in the near-term. As mentioned, $6,700 will continue to support the price until the close of the session. Failure to which, the next support target at $6,600 will be very instrumental in preventing declines towards April 2018 lows of $6,450.

BTC/USD 30 minutes chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle (PENDLE) price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Ethereum shows signs of a potential rally as suspected Justin Sun wallet buys heavily

Ethereum's (ETH) recent price movement hints at a potential rally despite ETH ETPs recording outflows. The recent price improvement follows the fourth Bitcoin halving and a suspected Justin Sun wallet purchasing large numbers of ETH.

Floki poised for growth after listing on Revolut

Floki's (FLOKI) team announced in an X post on Monday that the meme coin would be listed on the popular neobank and Fintech platform Revolut. Floki could rise further following key partnerships to boost retail usage.

Jupiter DEX second Launchpad vote concludes, JUP price rises 5%

Jupiter, a Solana-based decentralized exchange (DEX) has completed the second launchpad (LFG) vote to identify the two projects that will debut on its platform. On March 30, the aggregator network had unveiled its Core Working Group (CWG) budget proposal voting.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?