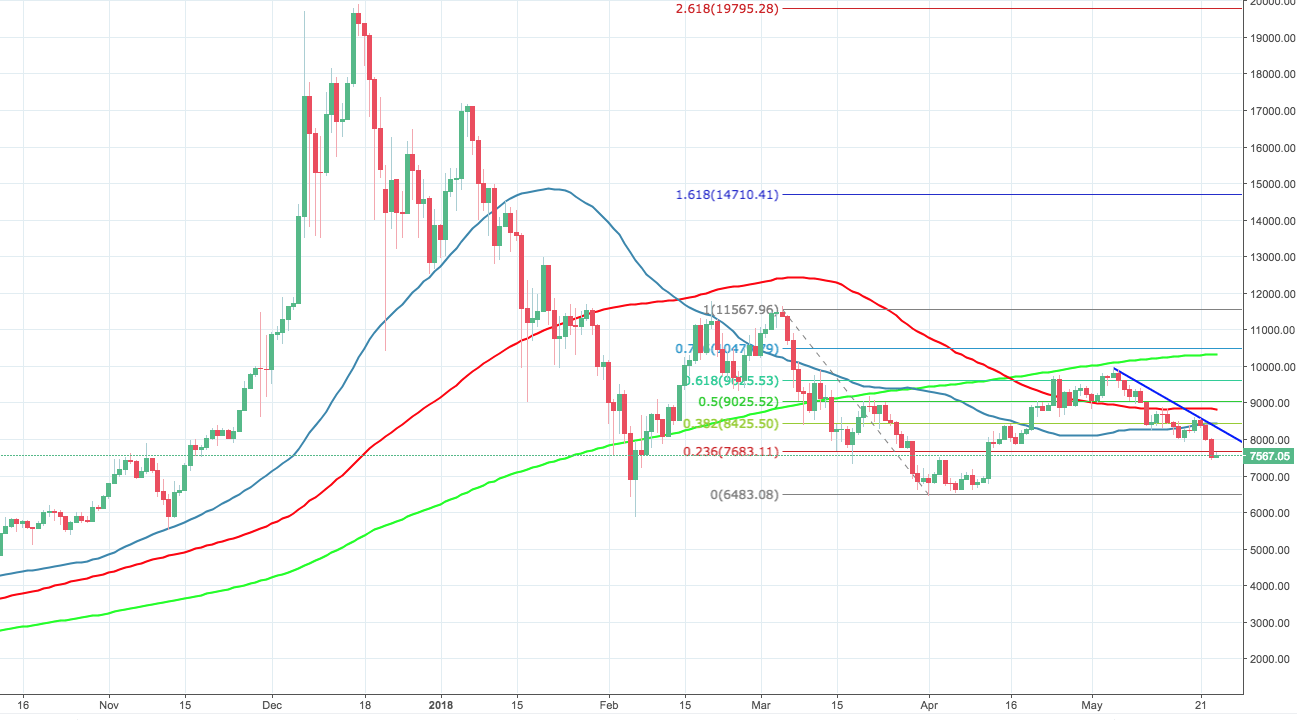

- Bitcoin crashes below 50% Fibo, worsening the technical picture.

- Market players have opposing opinions about Bitcoin's future.

Cryptocurrency market is attempting a recovery after Tuesday's sell-off. Bitcoin, the world’s biggest digital currency, is changing hands at $7,567, losing 4.5% since this time yesterday. BTC/USD reached the lowest level since April 12 and broke below $7,683 (23.6% Fibo), which makes the short-term picture really gloomy.

Bitcoin's market value dropped to $128.5B, while trading volumes jumped above $6B.

Jani Ziedins from Cracked Market says chances are that the worst isn't over yet.

"Last week’s $9k support has turned into this week’s $8k support. And thus far it is giving every indication that $7k will become next week’s support. I hope you see the trend here. Cryptocurrencies are still very much in a downtrend and we should expect lower prices. It takes most bubbles between 6 and 24 months to finish bursting. If bitcoin is like most bubbles, that means the worst is still ahead of us and we should expect lower-lows over the next few months," he wrote in his blog post on Monday. And, probably, his forecasts might come true sooner than expected.

Meanwhile, hardcore bulls are not so easily scared out of their positive forecasts. For example, Tom Lee from Fundstrat still expects that one Bitcoin will cost $25,000 by the end of the year as insitutional money starts flowing in. John McAfee shares similar opinion, urging investors to look at the price movements in perspective as Bitcoin is still over 200% higher than a year ago.

BTC/USD, the daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

HBAR price jumps 75% as BlackRock tokenizes Money Market Fund on Hedera

Archax, Ownera and The HBAR Foundation have enabled the first tokenization of BlackRock’s money market fund (MMF) on Hedera. Last year Hedera Council member abrdn’s successfully tokenized its MMFs on Hedera.

Bitcoin price holds above $66K as Morgan Stanley files prospectus to add BTC ETF exposure in two of its funds

Bitcoin (BTC) price remains range-bound, holding above the $63,000 level, while its upside is capped below $68,000, going against or delaying the assumption that the fourth halving would be a 'sell-the-news' outcome.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce reliance on the US dollar after plans for a stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?