- BTC/USD doesn't give up, it switches to tactical retreat.

- Bitcoin bulls might have another try at $10,000 very soon.

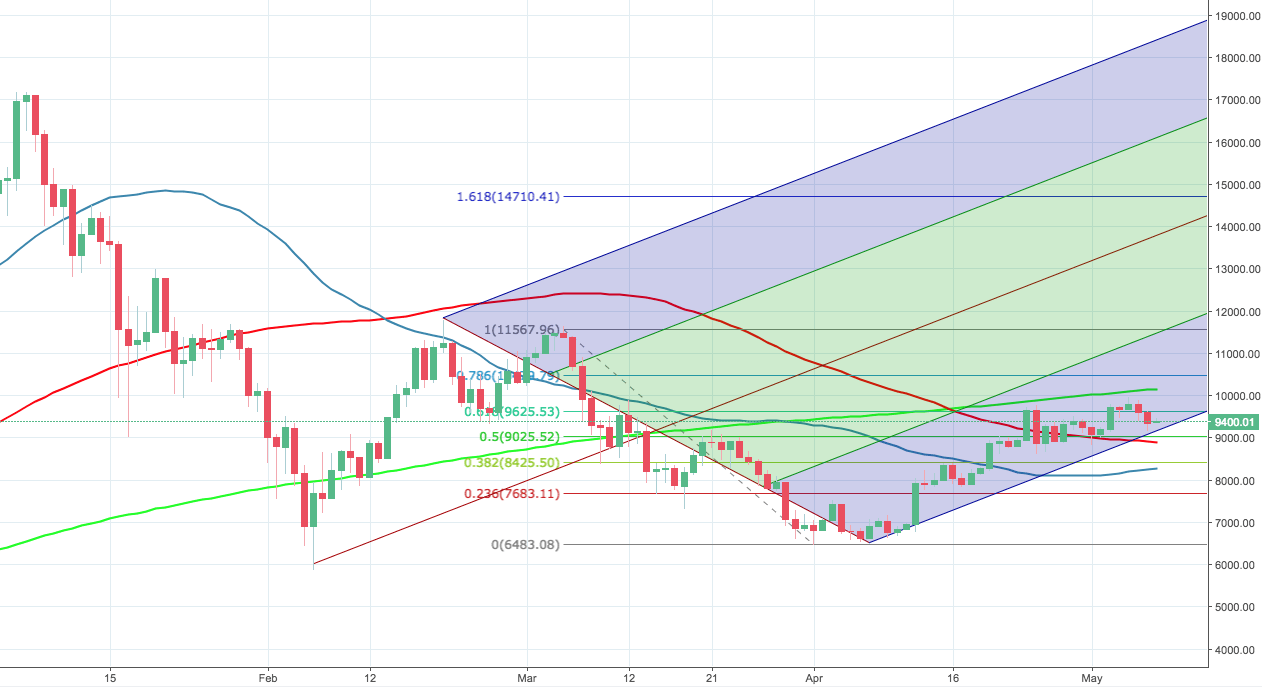

Bitcoin has stabilized after a forceful retreat from $10,000 level. The resistance is so strong that it is but natural that the market moves to and fro, test waters and gets back to mobilize energy for another attempt higher. Currently, BTC/USD is trading at $9,400, off Monday's low registered at $9,162.

Considering that the price is consequently making higher lows it stands to reason that $10,000 will be cleared out after all. Once this happens, Bitcoin will rush pretty quickly towards $10,500 (78.6% Fibo retracement) and to $11,600-$11,800 area (middle point of Andrew's pitchfork lower band).

Meanwhile, mainstream investors and financial experts continue to produce grim forecasts for cryptocurrency market: Warren Buffet, Bill Gates, Nouriel Rubini are among the latest doomsdayers. Though the crypto community seems to have hardened towards such comments from people who are involved in the traditional financial markets.

Bitcoin technical picture

From the longer-term point of view, the critical support is created by $9,000 level. As long as the price stays above, bulls have a chance to get back to $10,000, while a confirmed break lower would signal that the bullish reversal might be over and the coin is going to return to the bearish trend. Below $9,000 price will aim at $8,700 and $8,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Ethereum (ETH) suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH (ezETH) crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective (INJ) price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

US intensifies battle against crypto privacy protocols following crackdown on Samourai Wallet

CEO Keonne Rodriguez and CTO William Lonergan of Samourai Wallet were arrested by the US Department of Justice (DoJ) on Wednesday and charged with $100 million in money laundering on a count and illegal money transmitting on another count. This move could see privacy-focused cryptocurrencies take a dip.

Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27. Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery. A break and close above $7.95 would invalidate the downleg thesis.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?