- Bitcoin settles below $9,000, consolidating the gains of the previous week.

- Break above $9,050 will provide another upside stimulus.

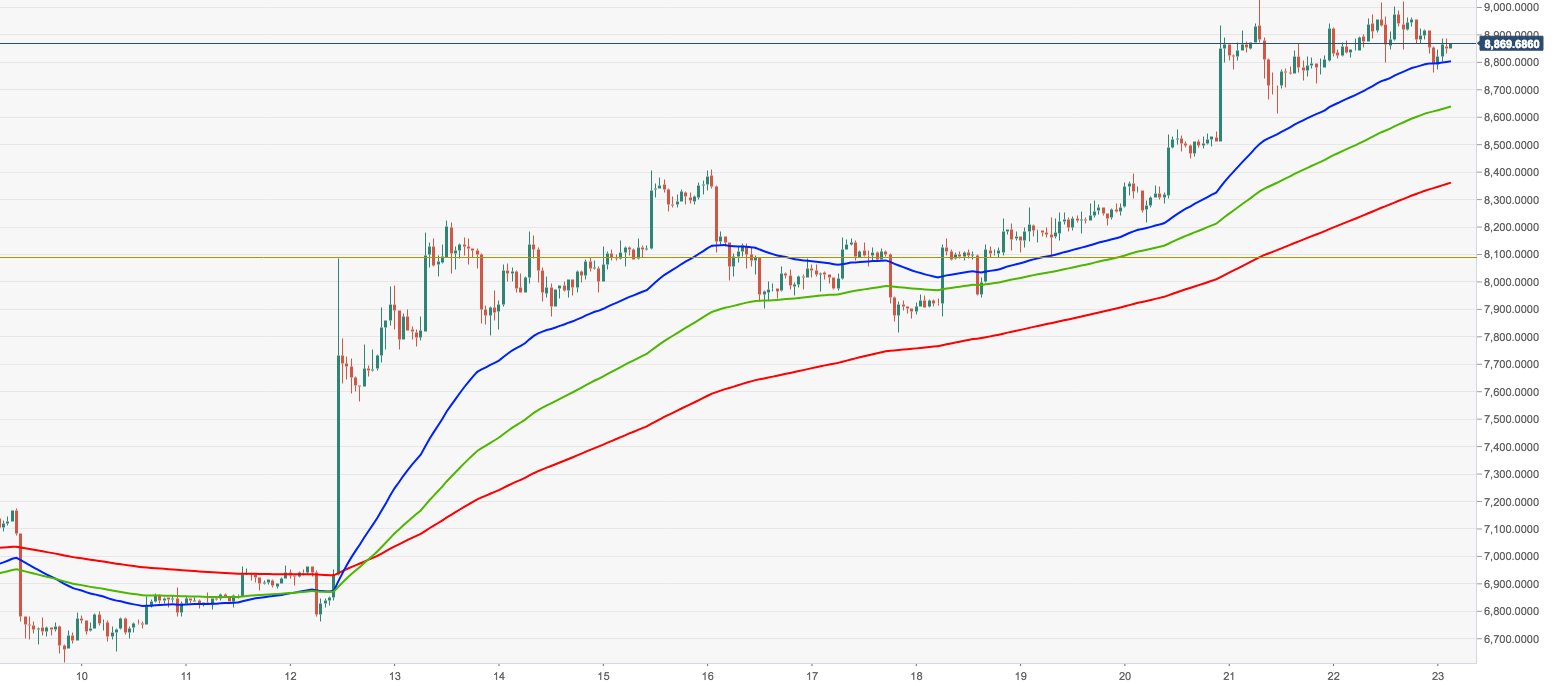

Bitcoin movements are subdued during early Asian hours on Monday. The price tested area above pivotal $9,000 during the weekend, but the breakout proved to be short-lived. BTC/USD is trading at $8,800 with mild upward bias on intraday charts.

Bitcoin had the first back-to-back green week in 2018 with cumulative gains over 28%. This rally helped to compensate the loss of over 50% since the start of the year, though, the cryptocurrency #1 is still over 37% cheaper than it was in January.

The end of tax period in the US and the positioning after an extensive sell-off, intensified by technical factors are cited as the most obvious reasons for the rally. Crypto enthusiasts believe that the worst is over and Bitcoin is ready for new highs.

“Tax selling is over, larger hedge funds have entered the market with deep pockets and strong hands, all positive signs,” John Spallanzani from Miller Value Partners said, cited by Bloomberg.

Bitcoin price technical picture

On the daily chart, BTC/USD is sandwiched between 100 and 200-EMA at $9,050 and $8,700 respectively. These are the local resistance and support areas that need to be broken for the price to gain momentum. On the intraday level, BTC/USD continues to move within clearly defined upside channel, supported by 50-EMA (hourly chart), currently at $8,800. If the price dips below $8,800 and $8,700, the next pivot at $8,400 will come into focus with 200-EMA (hourly chart) marginally below. A sustained move above $9,050 will open the way towards the ultimate near-term goal at $9,500, provided that the overall market keeps growing.

BTC/USD, the hourly chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

PancakeSwap loses nearly 3% value intraday as the DEX crosses $1 billion in trade volume

Decentralized exchange (DEX) PancakeSwap (CAKE) announced in an official tweet that it has crossed $1 billion in trade volume on the Layer 2 chain, Base. CAKE on-chain metrics support the thesis of a recovery in the DEX token’s price.

Shiba Inu hits new milestone, over $9 billion worth of SHIB tokens burnt

Shiba Inu (SHIB), the second-largest meme coin in the crypto ecosystem, recently hit a milestone in the volume of tokens burned. Shiba Inu has burnt over 410.72 trillion SHIB tokens since the inception of the burn mechanism in the project, worth over $9 billion.

Dogwifhat crashes 60%, but here's why you should not buy WIF yet Premium

Dogwifhat (WIF) price shows a slowdown in the bearish momentum as it sets up a potential range. This development could lead to a good buying opportunity from a long-term perspective.

XRP struggles to overcome $0.50 resistance, SEC vs. Ripple could enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.