Bitcoin has put in a positive performance in the past 24 hours on comments by Tesla CEO Elon Musk that the electric car maker would accept crypto transactions on the condition of reasonable clean energy use by miners.

Still, the move to 2.5-week highs above $39,000 has failed to calm market fears. That’s evident from a chart pattern known as the “options smile,” which shows relatively higher implied volatility or demand for options at strikes below bitcoin’s current market price than the implied volatility for higher strikes options.

The unique structure speaks of extreme fears and continued demand for downside hedges, as tweeted by trader and analyst Alex Kruger. In plain English, investors continue to buy puts in anticipation of a more profound price decline.

Options smile, a U-shaped graph resembling a smiley emoticon, is created by plotting implied volatilities against options at various strike prices expiring on the same date. Implied volatility is investors’ expectations of price turbulence over a specific period. A higher implied volatility results from greater demand for options and vice versa.

Options are hedging instruments that give the purchaser the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specific date. A call option represents the right to buy and put the right to sell.

Bitcoin options implied volatility (IV) smile

Source: Genesis Volatility

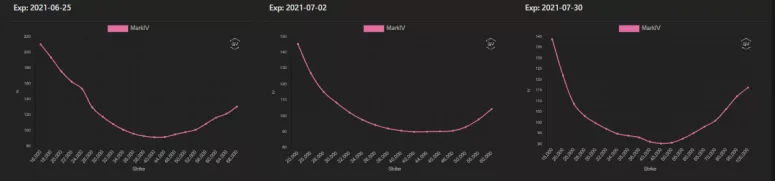

Options smile for the June 15 and June 18 expiries charted by analytics platform Genesis Volatility is quite steep at strikes well below bitcoin’s current price and relatively flat on the higher side. The subsequent expiries due on June 25, July 2 and July 30 exhibit similar structures.

Bitcoin options implied volatility (IV) smile

Source: Genesis Volatility

The steeper slope at lower strikes reflects fears of a sell-off and the flatter slope at the right end shows market participants expect rallies, if any, to be gradual.

One may argue that the steeper slope at lower strikes could be stemming from increased demand for call options or bullish bets than for protective puts. However, put-call skews, which measure the cost of puts relative to calls, suggest otherwise.

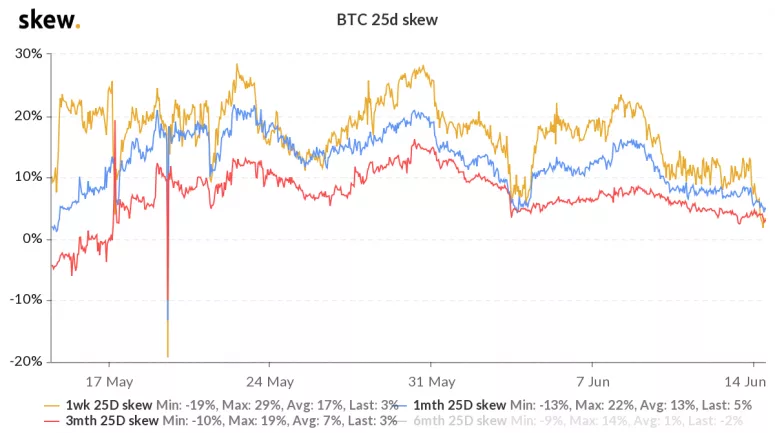

Bitcoin put-call skews

Source: Skew

The one-week, one- and three-month put-call skews remain entrenched in the positive territory, implying stronger demand for short- and near-term puts. Had the market participants been buying in-the-money calls, or even higher strike (out-of-the-money) calls in large numbers, the put-call skews would have been negative.

Deep-in-the-money calls – ones at strikes well below the spot – are relatively costly and eliminate the low risk-high reward advantage provided by calls at higher strikes. As such, in calls, hedging/trading activity is almost always concentrated at strikes just below the spot price, near the spot price and above the spot price, while in the case of puts, activity is mostly seen in strikes near and below the spot price. That seems to be the case with bitcoin as well.

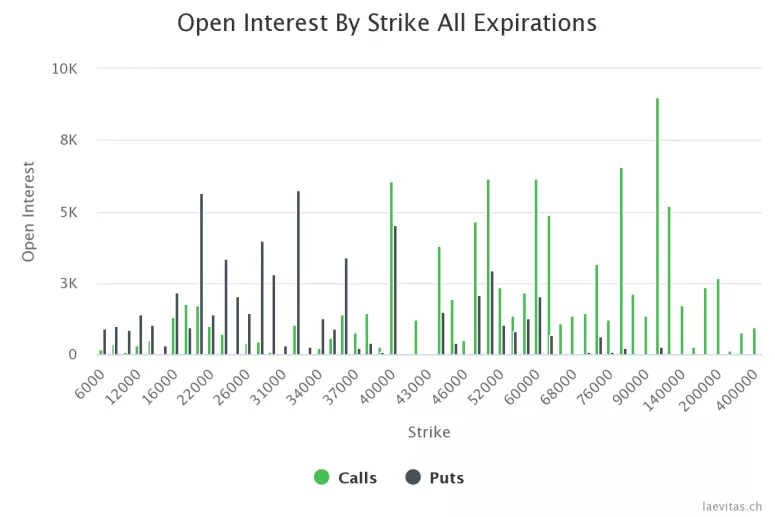

Data from dominant exchange Deribit tracked by the Swiss-based Laevitas platform shows a relatively high concentration of open interest (number of open positions) in out-of-the-money and at-the-money calls and lower strike puts.

Open interest in bitcoin calls and puts

Source: Laevitas, Deribit

While the market remains cautious for the short term, the longer-term bias looks bullish. The volatility smile for the Dec. 31 expiry options carries a steep slope for higher strikes.

Volatility smile for bitcoin options expiring on Dec. 31

Source: Genesis Volatility

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

MANTA suffers 4% pullback after unlocking tokens worth $40 million

Manta Network (MANTA) unlocked over 8% of its circulating supply on Thursday. The unlocked tokens were airdropped and distributed in public sale, according to data from Tokenunlocks.

XRP struggles to recover as lingering Ripple lawsuit could reach Supreme Court, former SEC litigator says

The SEC vs. Ripple potential showdown at the Supreme Court is likely, says former SEC litigator Ladan Stewart. XRP Ledger calls developers, businesses and investors to build on the blockchain, extending Apex 2024 registration until April 30.

Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

Merlin chain’s TVL added 20% this week, and crossed $800 million on Thursday. Bitcoin Layer 2 assets noted double-digit losses in the past week. Stacks, Elastos, SatoshiVM, BVM are hit by a correction as Bitcoin hovers around $61,000.

If Bitcoin restarts bull run, these altcoins are likely to explode Premium

If Bitcoin’s consolidation ends and the bull run resumes, altcoins are likely going to trigger a massive rally. Last cycle’s hot tokens like SOL, AVAX, WIF, ONDO, etc., could see renewed enthusiasm.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.