Unless you have been underwater for over a year, you probably know that selling risk assets like U.S. stocks and Bitcoin (BTC) and buying the U.S. dollar against the Japanese yen (JPY) have been some of the most popular macro bets since the start of 2022.

Investors have been reassessing their commitment to these so-called hawkish Federal Reserve (Fed) trades in recent weeks and piling back into risk assets, except bitcoin, thanks to the peak inflation narrative and the central bank hinting at moderation in liquidity tightening from December.

The S&P 500, Wall Street's benchmark equity index, has gained 16% in less than two months to trade above the widely-tracked 200-day moving average for the first time since early April. The USD/JPY pair, often called a turbo bet on the Fed policy and U.S. rates, has dropped 11% to its 200-day moving average. The dollar index, which tracks the greenback's value against major fiat currencies, has also dropped below its 200-day average.

The U.S. government bond yields have come off sharply from the yearly highs, validating the peak inflation narrative and the resulting risk revival in equity and currency markets.

Bitcoin, however, appears to have decoupled from macroeconomic developments and traditional markets. At press time, the leading cryptocurrency by market value changed hands at $17,340 or traded at a discount of 22% to its 200-day moving average.

This shows that the FTX insolvency couldn't have come at a worse time for bitcoin and the broader crypto market.

"Historically, (U.S.) stocks and crypto have a strong relationship with each other. Without FTX implosion, bitcoin might have been trading at $29,000 by now – instead of $17,200 (or 69% higher)," Markus Thielen, head of research and strategy at crypto services provider Matrixport, said.

"If the market can move on from FTX, those prices could still be achieved," Thielen said.

The chart shows bitcoin trades at a discount to the 200-day moving average. The S&P 500 has topped its 200-day average amid a sharp slide in the dollar index (DXY). (TradingView/CoinDesk) (TradingView, CoinDesk)

Bitcoin slipped to a two-year low of $15,480 last month

The dollar index peaked and turned lower at the end of September, having risen nearly 20% in the first nine months of the year. Following the bearish turnaround in the greenback, the S&P 500 found a bottom in mid-October.

Waning impact of FTX's insolvency

Bitcoin's recent market activity suggests the worst from FTX's insolvency may be behind us. The leading cryptocurrency rose 4% last week, even though prominent crypto lender BlockFi filed for bankruptcy protection.

"There are signs that the overhang of bad news in recent weeks is having a less pronounced impact on crypto performance, even if the full context of the uncertainty hasn't been completely priced in," Coinbase Institutional's weekly note said, while drawing attention to the recent moderation in the negative sentiment in the options market.

Bitcoin's one-month call-put skew, which measures the premium investors pay for out-of-the-money (OTM) calls versus OTM puts, has bounced to -9% from -29% seen on Nov. 13.

Put options offer protection against price slides, while calls offer insurance against bull runs.

The skew has recovered from November lows, indicating moderation in the negative sentiment. (Amberdata) (Amberdata)

The recovery suggests that the height of the fear cycle has faded. Therefore, crypto investors may now focus on the improved macro backdrop and the risk reset in traditional markets.

One question is whether the latest risk revival in traditional markets will be long-lasting, given that the U.S. economy is heading toward a recession. The situation identified by consecutive quarterly contractions in the growth rate does not sound conducive to risk assets.

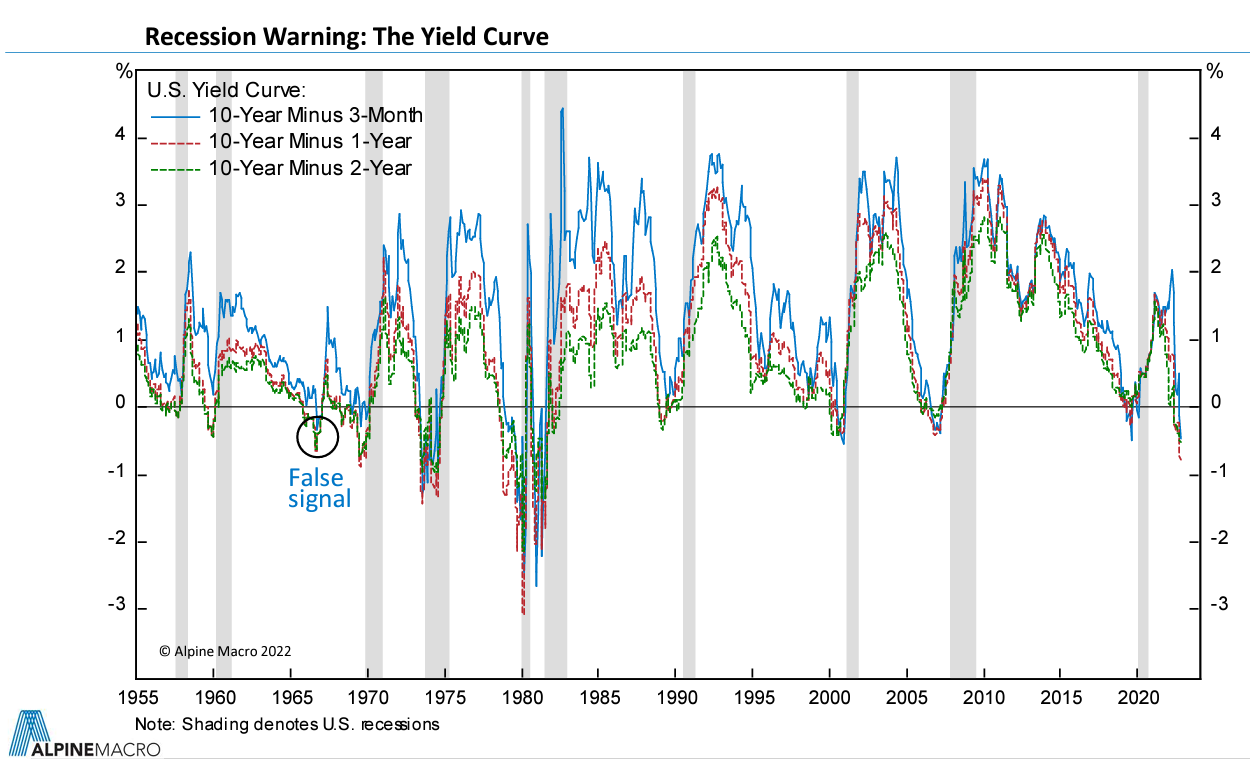

The inverted yield curve is widely considered an advance indicator of a pending economic recession. (AlpineMacro/ Geo Chen) (AlpineMacro, Geo Chen)

However, a recession could turn out to be a blessing in disguise, according to an analysis by macro trader Geo Chen.

"The Fed is over-tightening into a recession that has likely already started, and this will likely result in a downtrend in inflation that will be more persistent than many expect," Chen said in a Substack post published on Nov. 22.

"The biggest driver of asset prices this year has been yields and inflation, so a downtrend in yields should be a tailwind for asset prices and make next year look like the mirror image of this year," Chen added.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Ethereum dips slightly amid Renzo depeg, BlackRock spot ETH ETF amendment

Ethereum (ETH) suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH (ezETH) crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective (INJ) price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

US intensifies battle against crypto privacy protocols following crackdown on Samourai Wallet

CEO Keonne Rodriguez and CTO William Lonergan of Samourai Wallet were arrested by the US Department of Justice (DoJ) on Wednesday and charged with $100 million in money laundering on a count and illegal money transmitting on another count. This move could see privacy-focused cryptocurrencies take a dip.

Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27. Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery. A break and close above $7.95 would invalidate the downleg thesis.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?