Bitcoin is showing signs of exhaustion after the minutes from the Federal Reserve’s September meeting, released late Wednesday, flagged inflation concerns and revealed growing support for a faster unwinding of stimulus.

The cryptocurrency is currently trading marginally lower on the day near $57,300, having earlier touched a five-month high of $58,500. It is up 30% this month, though, buoyed by increased expectations that the U.S. Securities and Exchange Commission will soon approve a futures-based bitcoin exchange-traded fund (ETF).

The Fed minutes carried fewer references to inflation being transitory and showed policymakers are worried that price pressures might remain high for longer than previously assumed.

The shift from the long-held narrative that high inflation will be short-lived suggests the central bank may opt for a faster policy tightening than is already priced in. Several policymakers said they preferred to proceed more rapidly.

Faster tightening would be negative for bitcoin and liquidity-addicted asset markets in general. Markets have anticipated a monthly tapering of $15 billion starting in November or December. The central bank has been buying $80 billion of Treasurys and $40 billion of mortgage-backed securities every month since the onset of the coronavirus pandemic in March 2020.

Still, sentiment among some market participants remains bullish, with analysts calling for continued “HODLing” – crypto slang for buy and hold – at least till the first ETF is approved. The SEC is likely to approve at least four ETFs this month, according to Bloomberg.

Bitcoin, however, has already rallied more than 30% on ETF speculation. Further, a futures-based ETF has a downside and may not be as bullish as widely expected. So the Fed’s hawkish tilt may hurt bitcoin, especially if equity markets drop.

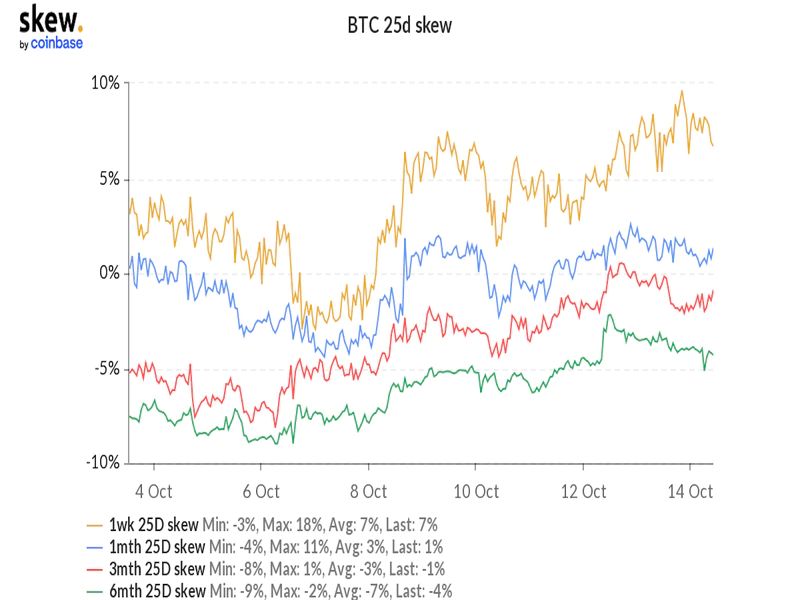

Bitcoin’s options market shows demand for downside protection in the form of put options. “Front-end risk reversals [short duration] remain skewed to the downside (i.e. puts are more expensive than calls) and the put skew has actually deepened with spot moving higher,” QCP Capital said in its Telegram channel. “A reflection of prevailing downside nervousness in the market.”

The one-week put-call skew has climbed to 7%, while the one-month gauge has crossed above zero. Positive figures indicate that put options, or bearish bets, are drawing relatively higher prices than calls, which are bullish.

The long-term sentiment remains bullish, with three- and six-month skews entrenched in the negative territory.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?