- Bitcoin Cash (BCH) is still in the red after being unable to overcome the resistance at $135.

- Bitcoin Cash bulls are looking forward to pulling above $140 in the near-term.

Following the slight decline in the market on Sunday, most assets are staging recovery movements, although slight ones. Bitcoin (BTC) for instance has revamped the trend towards $3,600 after sliding below $3,500. However, Bitcoin Cash (BCH) is still in the red after being unable to overcome the resistance at $135.

The market, in general, is slightly in the green. The gains come after a $5 billion loss on Sunday. There has been a small recovery on Monday, although assets are still trading close to their recent lows.

After Bitcoin Cash failed to sustain growth above $170, it retreated in a stable range between the higher limit at $165 and the support at $ 150. The selloff midway through last week sent the asset tail spinning below several other support areas at $140 and $130. BCH/USD traded lows around $121 before a weak bounce occurred sending it slightly above $135.

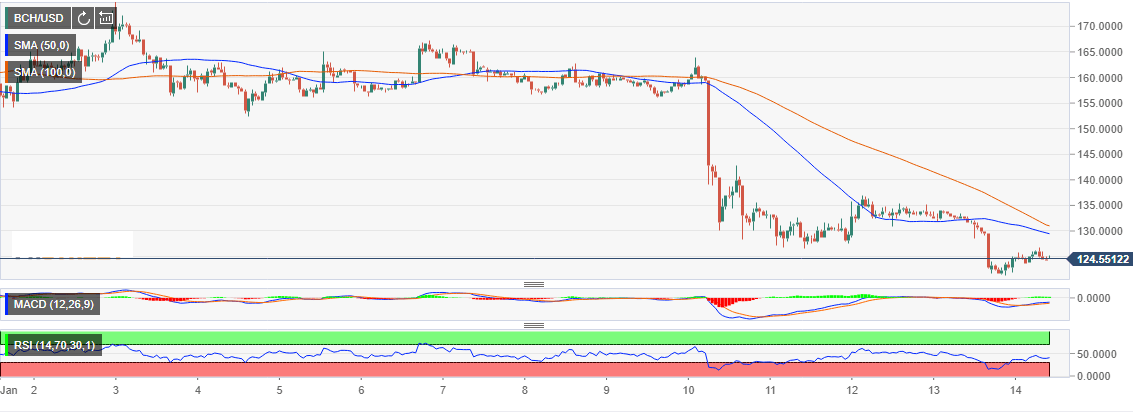

As mentioned above, the bears are in control at press time and Bitcoin Cash is trading below both the 50-day and the 100-day Simple Moving Averages (SMA). The asset is valued at $124.63 and battling to clear the initial resistance at $125. The 50-day SMA will limit growth at $130 while the 100-day SMA is a hurdle slightly above the shorter term SMA.

The key resistance rests at $135, besides this is also a breakout point for Bitcoin Cash bulls who are looking forward to pulling above $140 in the near-term and reclaiming the support at $150 in the medium-term. The ultimate resistance is at $170, meanwhile, the Relative Strength Index (RSI) shows that the sideways trading is bound to continue.

BCH/USD 1-hour chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?