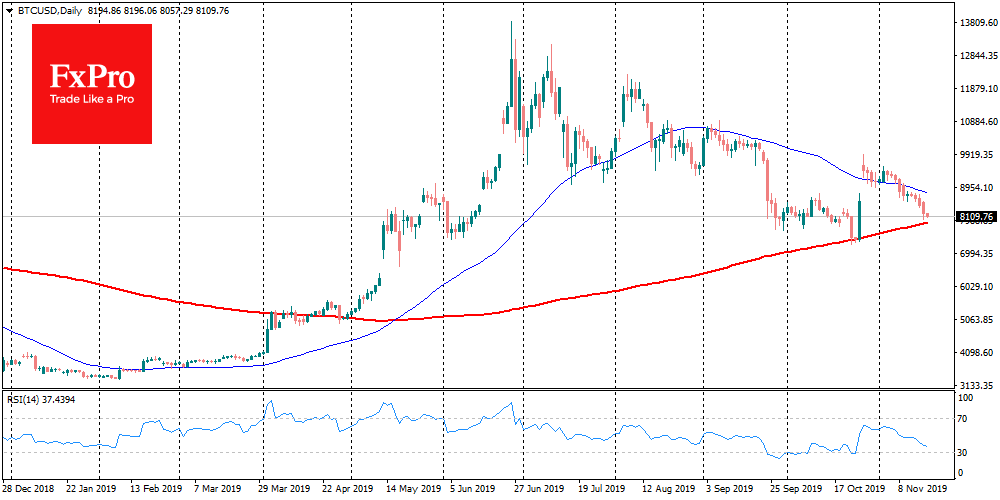

Bitcoin continues to lose ground it managed to gain due to "Chinese FOMO". At the moment, the benchmark cryptocurrency is losing 4% and trading around $8,100. This level is serious support for the benchmark cryptocurrency. The round level at $8,000 is an important psychological support factor. We saw a strengthening of buys as Bitcoin approached this mark by the end of the Monday. However, Bitcoin's position has been worsening since this morning. Almost immediately below this mark - around $7,900 - there is a 200-day simple moving average. This is an important signal level, which has stopped the sell-offs several times before. The last time we saw this was in October, and in April, when Bitcoin started its rally from 5K to 14K after almost a month of a sideways trend.

So, if Bitcoin can't withstand bear pressure at $8K, we can expect a very sharp dive with the nearest important stop at $5,000. A sharp decline of Bitcoin couldn't but pull the rest of the crypto market. Over the last day, the total capitalization slipped by $9bn. Bitcoin Cash (BCH) became the record-breaker on the decline, losing 7.5% on the previous day. Other altcoins from TOP-10 lose less. However, all are confidently in a red zone. Waves of "desperate sell-offs" of altcoins (when the investor fixes huge losses) will intensify with the further drawdown of alternative cryptocurrencies, as the current price levels for many coins are significantly lower than any psychological levels.

Some well-known analysts predict the growth of the benchmark cryptocurrency up to $25K, but we are talking about 2022, so such forecasts do not cause any excitement. What if the summer growth to $14K was a rally in the bear market? There are suggestions that the "pump" may be associated with the rise of positions before halving, and if it is true, then in the medium term BTC may be caught in a "depressive sideways trend". We are talking about successive sideways trends when almost each of them ends with a decline.

From the beginning of 2020, investors will be waiting for growth based on halving, which will support the price of Bitcoin, but if, as the event approaches, everyone begins to realize that "the best is in the past", it may lead to a new large-scale sale. This would be the worst medium-term forecast for Bitcoin, but this scenario cannot be ruled out. 2019 gave the market new hope, but judging by the fact that Litecoin was bought long before halving, and initiated a sale a few months before halving, in the case of Bitcoin, this period could be much more significant.

FxPro UK Limited is authorised and regulated by the Financial Services Authority, registration number 509956. CFDs are leveraged products that incur a high level of risk and it is possible to lose all your capital invested. Please ensure that you understand the risks involved and seek independent advice if necessary.

Disclaimer: This material is considered a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. FxPro does not take into account your personal investment objectives or financial situation. FxPro makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any employee of FxPro, a third party or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without the prior permission of FxPro. Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary. FxPro Financial Services Ltd is authorised and regulated by the CySEC (licence no. 078/07) and FxPro UK Limited is authorised and regulated by the Financial Services Authority, Number 509956.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?