BUSD’s circulating supply fell to $15.4 billion on Wednesday, paring down $1 billion over the past week and $2 billion in a month, according to cryptocurrency price tracker CoinGecko.

Crypto exchange giant Binance’s BUSD stablecoin has extended its recent declines, amid mismanagement issues involving the exchange’s pegged tokens that surfaced earlier this month, and other debacles.

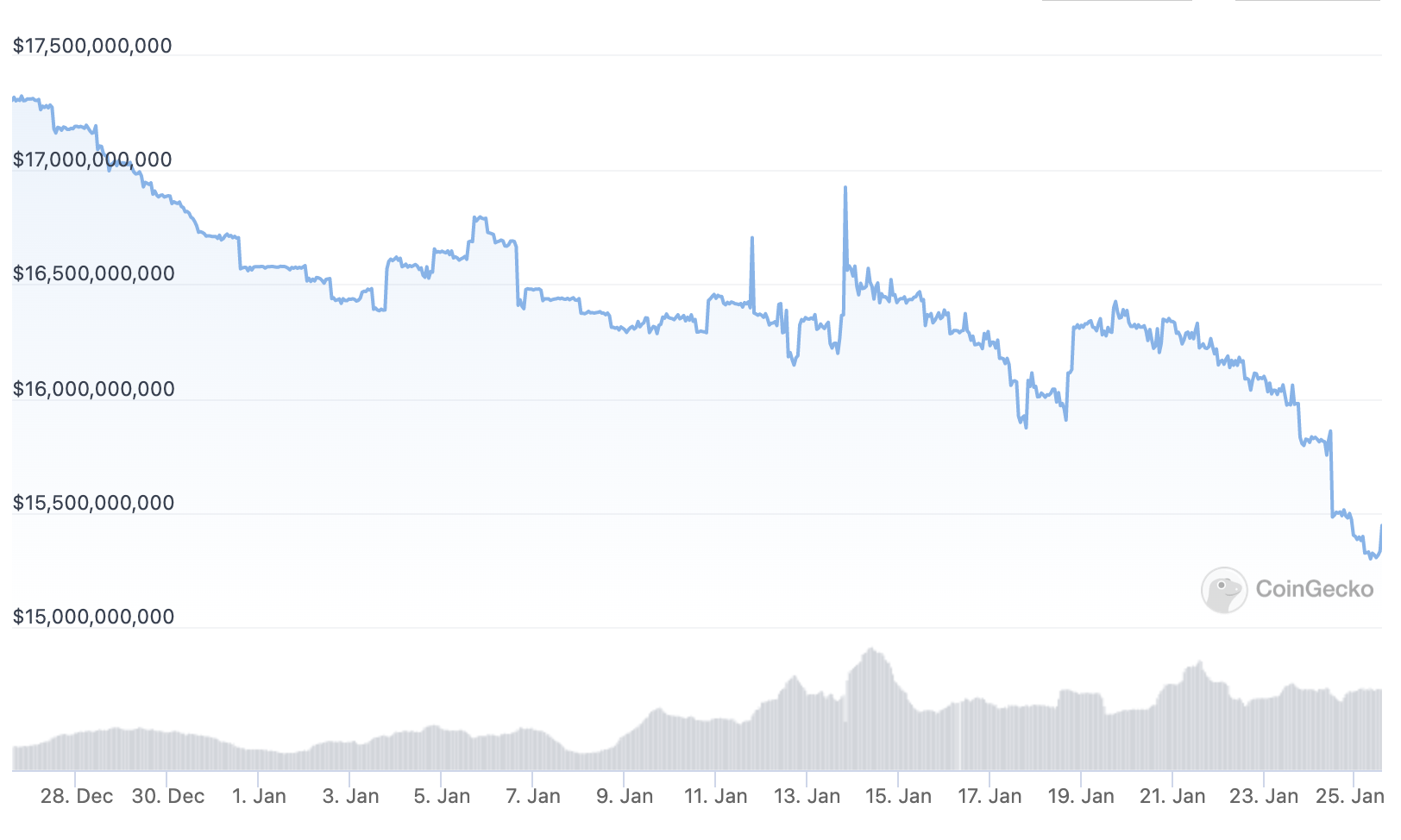

BUSD’s circulating supply fell to $15.4 billion on Wednesday, paring down $1 billion over the past week and $2 billion in a month, according to cryptocurrency price tracker CoinGecko. The latest drop extended BUSD’s decline from $22 billion in early December when anxious users scrambled to withdraw funds from Binance after it botched a report about its digital asset reserves.

BUSD lost $2 billion of its market value in 30 days, the most among its closest competitors. (CoinGecko)

BUSD is a dollar-pegged stablecoin issued by the New York-based fintech firm Paxos Trust under the Binance brand, backed by cash and U.S. Treasury bill reserves. Traders use stablecoins as an intermediary to convert traditional fiat money to digital assets and facilitate trading cryptocurrencies.

The latest decline comes amid recent reports about errors involving the exchange's wrapped token derivatives known as Binance-peg tokens.

Earlier this month, blockchain research firm ChainArgos found that Binance-peg BUSD was not always fully backed by reserves during 2020 and 2021. Binance acknowledged the breach and said it has fixed them. This week, Bloomberg reported the exchange mixed customer funds with the collateral of Binance-peg tokens.

In a blow for retail traders, Binance’s banking partner Signature Bank will halt transfers smaller than $100,000 using the SWIFT interbank messaging system, starting Feb. 1.

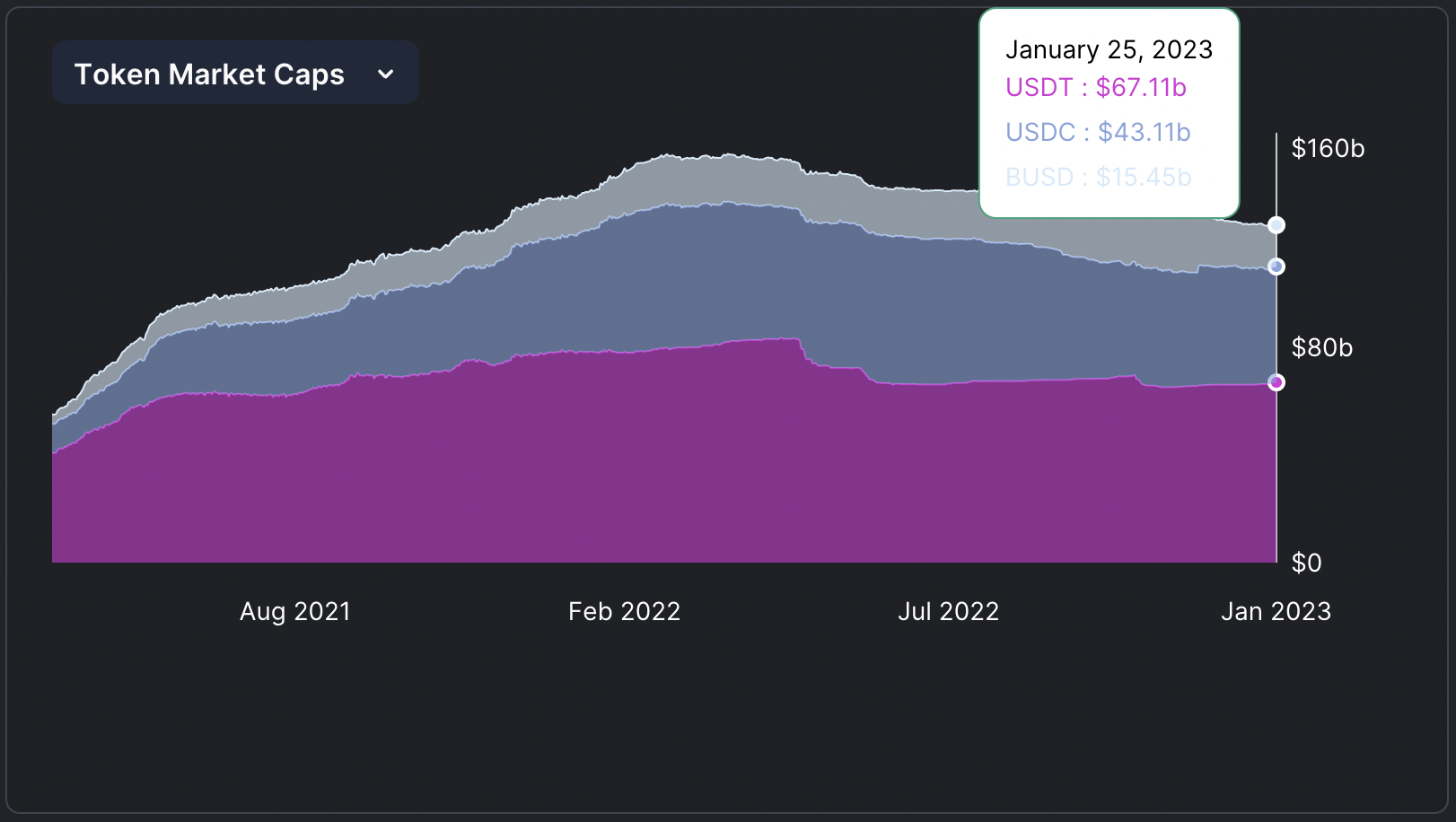

The recent issues resulted in BUSD falling further behind stablecoin rivals in what has become a fierce competition. BUSD lost 11.3% of its market capitalization in a month, while USDT gained 1.3% and USDC dropped just 1.9%, according to data by DefiLlama, which tracks digital assets' performances. Still, BUSD is the only one of the top three stablecoins that grew its market value through last year.

The overall market capitalization of stablecoins fell for a 10th consecutive month in January, to $137 billion, according to a report by research group CryptoCompare. Stablecoin dominance within the broad cryptocurrency market dropped to 12.4% from its all-time high of 16.5% in December, suggesting traders have been rotating from stablecoins into riskier assets, CryptoCompare said.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?