- The USDC stablecoin created by Coinbase is now available on the Algorand Blockchain.

- Algorand will also support another stablecoin thanks to OpenDAO Protocol.

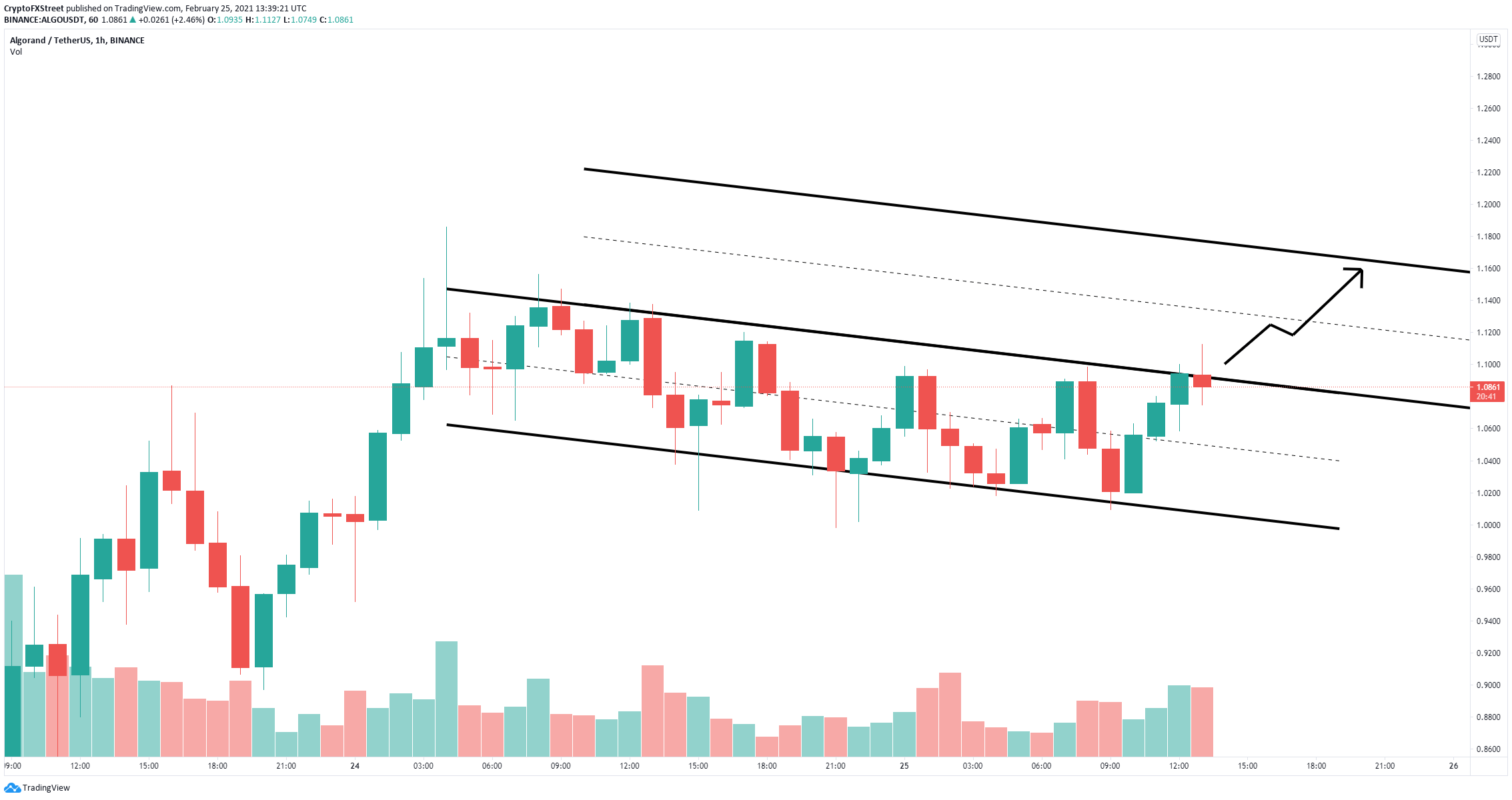

- The digital asset looks poised for a massive bullish breakout to $1.14.

In the past two months, Ethereum has seen a lot of competition as the massively high fees forced investors to look for better alternatives. Algorand has announced several positive developments and aims to become a solution by providing faster and cheaper transactions.

Algorand aims to become the better Ethereum

The first major development for Algorand happened back on February 19 when the team announced that one of the most used stablecoins, USDC, and perhaps the most trusted, will be supported on the Algorand mainnet. Using the Circle API, Algorand enables users to transfer funds between its blockchain and traditional bank accounts.

More recently, Algorand announced that it will support yet another stablecoin thanks to a partnership with OpenDAO:

OpenDAO is happy to announce that we are welcoming Algorand into our DeFi family! We’ve already begun the process for creating the $wAlgoO stable coin with wAlgo as collateral!

Algorand's efforts to build open source software for an inclusive ecosystem have created a cascade of opportunity throughout the cryptospace...

— OpenDAO (@opendaoprotocol) February 24, 2021

We're excited to be part of it!

-Sean Qian

OpenDAO Cofounder

New #stablecoin Coming Soon!@Algorand $ALGOhttps://t.co/T1Q5QYF2iq pic.twitter.com/KrJBTwmvT0

Besides supporting USDT and USDC stablecoins, among others, Algorand also allows users to buy and sell gold thanks to a partnership with Meld Gold which issues decentralized gold tokens based on the Algorand technology.

It is reported that more than 500 companies are currently developing on the Algorand platform, with an average daily transaction volume of 500,000.

According to Algorand, the Algorand Standard Asset (ASA) is better than the ERC-20 standard because it can cover all types of assets while providing users with faster transactions and lower costs.

As the asset standard on the Algorand chain, ASA assets are directly built on Algorand Layer-1, so it has unparalleled high speed and security; in addition, due to the extremely low cost of the Algorand platform itself, the operating cost of ASA assets is also very high.

Algorand price aims for $1.16 if key level cracks

On the 1-hour chart, Algorand price has established a descending parallel channel which is on the verge of a significant breakout. If the bulls can push ALGO above $1.10, the digital asset can quickly jump to $1.12 and $1.16 eventually.

ALGO/USD 1-hour chart

On the other hand, if Algorand price gets rejected from the upper trendline at $1.10, it will quickly dive towards the lower boundary of the descending channel at $1.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?