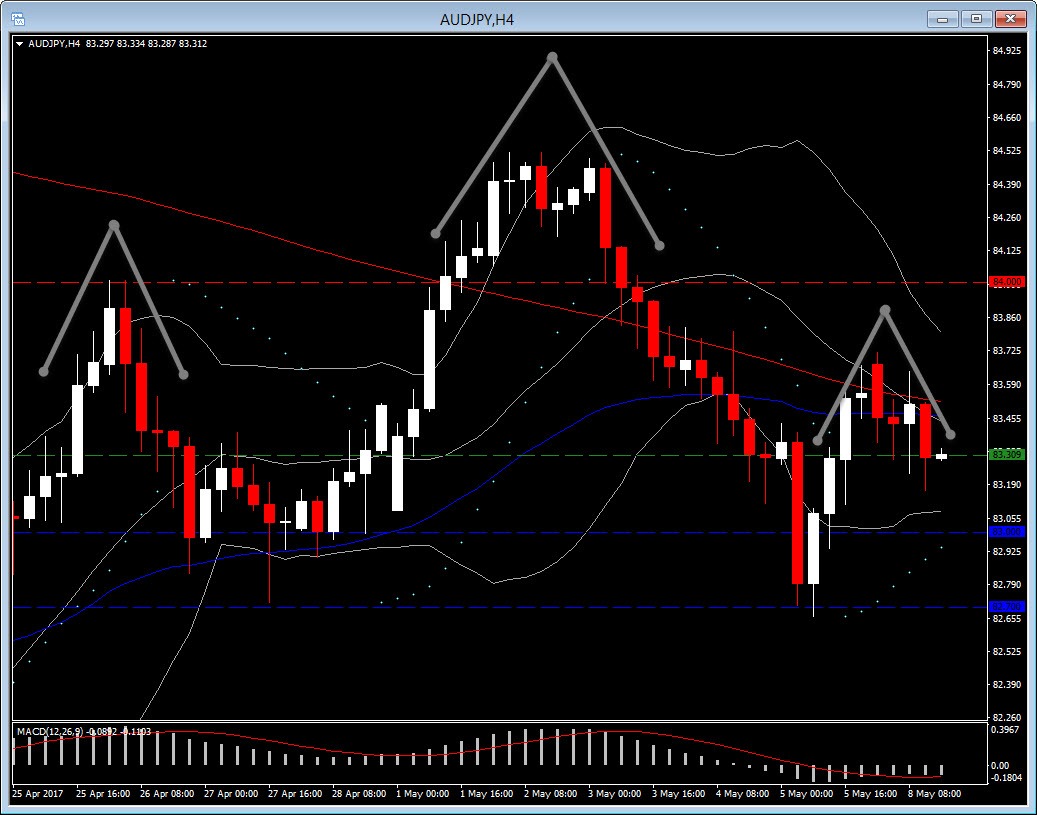

AUDJPY, H4

Today, USDJPY is lower after briefly rallied at Asia-Pacific open, leaving a peak at 112.98, seven pips shy of last week’s two-month high. The pair has since ebbed back to around 112.50. Risk appetite was high in Asian markets, though the Shanghai Composite hit a seven-month low (as a consequence of Beijing’s attempts to cool China’s property market), and European bourses headed southward. EURCHF is on the up as franc safe-haven premium unwinds following the French election, while CHFJPY is also up strongly, by 0.7%, since CHF consider be the weakest currency for the day and Yen the strongest one. The weaker franc will be joyous news for Swiss policymakers, which consider it one of the world’s most over-valued currencies in purchasing power parity terms.

Yen remained strong also against other currencies such as Australian dollar. Technically, the head and shoulders pattern noticed in the 4-hour chart of AUDJPY, peaked my interest. Consequently, I have entered a SHORT position at 83.30 with an initial target 1 at the 50.0 Fibonacci level at $83.00, which is a confluence of ATR in 4-hour chart. Target 2 is at 82.70. Support was set at 84.00.

The crossing today of 20-period EMA below 50-period EMA suggested that further downside is likely to continue, while the pair broke earlier the significant 200-period EMA earlier and moves below that level. RSI remains neutral at 42 but slopes down from the overbought high at 76 last week. In the daily chart, the parabolic SAR turn negative on Friday. MACD remains negative in both 4-hour and Daily charts.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.